Turning a corner? The facts on the economy

After the slowest recovery from recession on record, George Osborne announced this week that the UK economy is "turning a corner."

According to the Chancellor, recent good news on the economy has "decisively ended the controversy" about the correct direction for economic policy in the Government's favour.

The big picture

The economic news that has grabbed most of the headlines has been the recent up-tick in the GDP figures, which showed 0.7% quarterly growth in Q2 2013. This is the joint-largest jump in output since 2010 (along with Q3 2012, which was boosted by the Olympics).

Taken on its own however, it is less clear that this marks a long-term change in economic fortunes. Similar periods of growth were recorded in 2009/10, but weren't sustained.

Employment

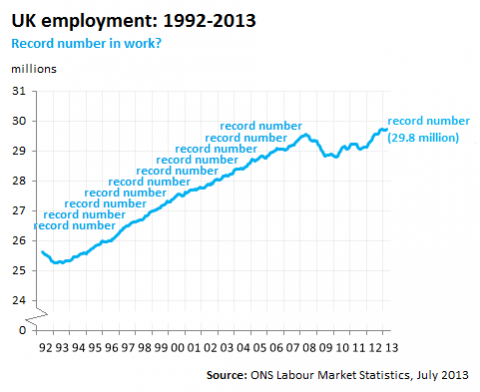

However it isn't just in GDP that the Chancellor sees improvements. When it comes to the jobs market, Mr Osborne points out that "employment is now above its pre-recession peak in the UK."

As we've seen before, in terms of the raw numbers this is accurate. The most recent figures from the ONS suggest that there are approximately 29.8 million people over 16-years-old in work in the UK, a record number. However this isn't very surprising: prior to the recession, population growth and demographic change meant more and more people were entering the labour market anyway. As a result, we've seen a new record set for the number of people in employment in every year between 1995 and 2007.

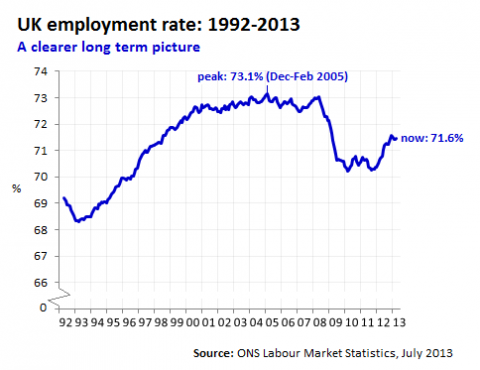

If we want to compare the relative health of the jobs market today to its "pre-recession peak" it is more helpful to look at the employment rate: the proportion of the working age and economically active population in employment. In these terms there is still some way to go before we asail the pre-recession peak. In the first quarter of 2005 the employment rate stood at 73.1%, whereas today it is 71.6%.

Household incomes and debts

Key to the Chancellor's claim that his economic medicine is working is that these economic improvements have come at a time when households and businesses are paying down their debts.

According to Mr Osborne, "total private sector debt has fallen by almost 40% of GDP since its peak in the first quarter of 2010."

While an official series on levels of private sector debt isn't available, we can get some indication of changes by looking at ONS data on the value of outstanding company and household loans, derivatives and other securities, and comparing it to GDP at market prices.

On this measure, total private sector debt (encompassing that held by both financial- and non-financial companies, as well as households) was worth around 468% of GDP in Q1 2010, and around 429% of GDP in the first quarter of this year. This represents a fall of approximately 39 percentage points, and takes us to a similar level seen in the years immediately preceding the recession.

(Chart produced by Neil Wilson)

When looking at the financial health of households in particular, the Chancellor suggests the improvement is even more dramatic. He said:

"The ratio of household debt to incomes has fallen too, unwinding all of the increase seen during the credit boom of 2004 to 2008."

The debt (or liabilities) to income ratio is something that the ONS publishes, which shows that the total size of the debt burden relative to household incomes has indeed shrunk to levels last seen before 2004. It is worth noting however that this downward trend began in 2007, so it isn't necessarily clear that George Osborne's economic policies have driven this fall.

How does the UK compare?

The multi-billion dollar question as far as the politics goes is: how much credit can George Osborne claim for his management of the UK economy, and how much of the improvement is down to a rosier global outlook?

The Chancellor himself seems to suggest that it's a bit of both. He said:

"Since the end of the recession the UK has grown by 4.3%, less than the US but more than the eurozone."

This is correct. According to OECD figures, since the UK exited the recession in the last quarter of 2009, the British economy has grown by 4.3%. This is slightly more than the Eurozone, which clocked growth of 2.5%, but some way behind the USA, which has recorded 8.9% over the same period. To add further context, France has seen broadly similar levels of growth (4.1%), but the UK lags behind Germany (8.6%) and - by some distance - the G20 group of nations, which has seen growth of 14.2%.

(It's worth highlighting here that the start point the Chancellor has chosen may have an impact upon the result: while the UK exited recession in Q4 2009, the countries used for comparison all exited recession earlier, and so may have grown more than the UK since they exited recession.)

When it comes to employment, Mr Osborne suggests the international comparisons are more flattering for the UK. He said:

"our employment rate is above the US and has grown more quickly."

On the comparable measure collected by the OECD, the UK's employment rate stood at 70.4% for the most recent quarter for which there is data (Q1 2013), which is above the USA (67.3%), France (64.1%) and the Eurozone (63.6%), although again Germany boasts an impressive 73.1% in work.

Similarly, in terms of employment growth the UK has outstripped the United States, France and the Eurozone (which has actually shed jobs), but lags behind our Teutonic cousins.