“We’re cutting your income tax. Saving a typical basic rate taxpayer £1,205 a year.”

Conservative party, 31 October 2018

This claim is based on the difference between the amount of income you could get tax free in 2019/20, compared to 2010/11. It has increased by £6,025. The basic rate of income tax is set at 20% so the amount of tax ‘saved’ by the taxpayer would be £1,205.

But this figure doesn’t account for the fact that prices have risen over the last ten years, meaning you can buy less with the same sum of money today than a decade ago—an effect known as inflation. Factoring that in, the amount kept by the taxpayer is the equivalent of about £940.

But for some families, these savings could be cancelled out by changes to other taxes. For example the Institute for Fiscal Studies found that when looking at the changes all taxes and benefits as a whole, rather than just income tax, there had been “significant reductions in household income” for low-income households between 2010 and 2015.

Honesty in public debate matters

You can help us take action – and get our regular free email

Where does £1,205 come from?

For most people there is a set amount of money that you can earn without having to pay any income tax—known as the personal allowance. Some very high earners don’t receive a personal allowance, or have it reduced.

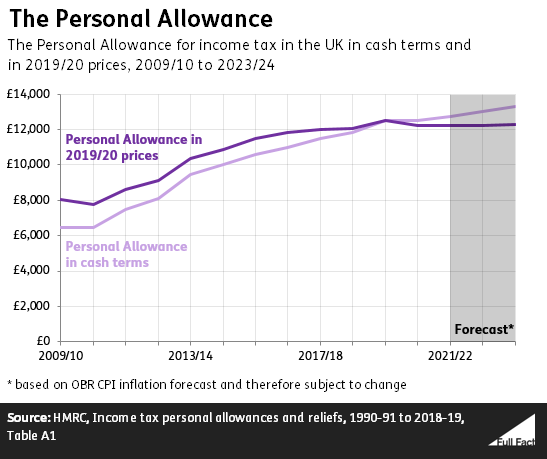

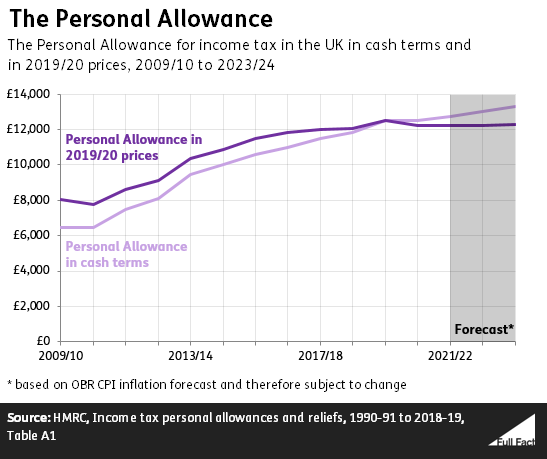

At the moment the personal allowance is £11,850 and at the Budget last week the Chancellor announced that from next April the personal allowance will increase to £12,500 and keep increasing until it’s around £13,310 in 2023/24. There are some exceptions to this—for example, you can have a different personal allowance if you’re married and over a certain age. The government says that from 2021/22 onwards the increases are based on forecasted inflation (the change in how much things cost over time), and therefore might change.

The £1,205 mentioned in the tweet is based on the difference between the amount of income you could get tax free in 2010/11 and next year in 2019/20. In 2010/11 the typical person’s personal allowance was £6,475. So the personal allowance will have increased by £6,025 by 2019/20.

That means £6,025 of additional income on which no tax is paid in 2019/20. The income tax rate that would have been applied on that income (known as the “basic rate”) is 20%, which works out at £1,205. This is what the government claims it has saved the typical basic rate taxpayer.

Prices have changed since 2010 and it now costs more to buy things, an effect known as inflation, so we need to factor that in too. What matters is how much you can buy with that £1,205, and as inflation goes up, this will go down.

Once you account for the way prices have changed over the last ten years, the difference between the personal allowance in 2010/11 and 2019/20 reduces to £4,710 in 2019/20 prices. So the amount saved by the taxpayer also changes to around £940.

And income tax isn’t the only tax that might matter to you

Of course this won’t necessarily be the experience of every taxpayer and it doesn’t factor in any other changes that have been made to the tax system over that time. Those paying less due to income tax changes might not be taking home more money overall than they were in 2010/11.

In 2017 the Institute for Fiscal Studies found that when including changes to other taxes and benefits such as VAT and child tax credits, changes have led to “significant reductions in household income” for low-income households between 2010 and 2015.