Will the Tobin Tax cost half a million jobs across the EU?

"The Commission itself points out that a European FTT would have a serious impact on European growth, it would hit the UK economies, it could reduce European GDP by up to 3.5 % but the commission take the central view that it's only going to reduce European GDP by 1.76%... That is going to cost half a million jobs across the European Continent." Chancellor George Osborne, ECOFIN, in The Daily Telegraph, 8 November 2011.

With Eurozone troubles hogging the headlines of late, the prospect of a European Financial Transaction Tax has been proposed in some circles as one way of making a dent in sovereign debt crises.

Today German Chancellor Angela Merkel has criticised the British Government's rejection of the so called 'Tobin Tax', suggesting the state of the EU economy as a whole needs to be prioritised over fears of the potential impact on Britain individually.

However UK Chancellor George Osborne has questioned whether Europe would benefit from the tax at all. Speaking at last week's meeting of European Finance Ministers, he claimed that not only would the FTT hit growth, but would also see the loss of some 500,000 jobs across the continent. So what's the evidence for this claim?

Reduction of European GDP by up to 3.5 per cent?

The Impact Assessment (IA) published by the European Commission for a potential European Financial Transaction Tax acknowledged that, "both taxes [FTT and the Financial Activities Tax] are also expected to have small effects on GDP and employment, with the negative effects of the FTT probably being slightly higher than those of a FAT."

This is because taxes are likely to be passed on to clients by the institutions taxed, and therefore this could have a negative impact on investment.

As Mr Osborne pointed out, the Commission estimated in its IA that applying a 0.1 per cent transaction tax on securities could, "without the application of mitigating effects", reduce GDP long term growth by 1.76 per cent of GDP.

However the report also calculated that to raise revenue equivalent to 0.16 per cent of EU GDP (which is the sum some studies have suggested should be generated by a FTT) may require the tax to operate at a 0.2 per cent rate. In this scenario, GDP may reduce by as much as 3.43 per cent.

Impact on Jobs?

Mr Osborne claimed that a FTT could also result in a loss of 500,000 jobs across the European Continent. The Telegraph meanwhile put this at 995,000. According to the Chancellor this was based upon the work of "the Commission itself".

We contacted the Treasury to clarify exactly what Mr Osborne meant by this. They assured us the figure was contained in the European Commission's Impact Analysis on the tax proposal, and that the exact figure was 478,000 jobs.

Full Fact was unable to find either this 478,000 figure or any other for the potential job loss as a result of the tax in the IA. However the summary does state that employment could decrease by 0.2 per cent if the tax was introduced.

It said "the negative employment effect should be limited, and presumably mainly be located in the investment banking arm of the sector, while the retail-banking arm should not be affected at all".

When the European Scrutiny Committee looked into the FTT, it pointed out that, using the Commission's estimate of a 0.2 per cent decrease in employment, "in real economic impacts it can be estimated that...a fall in employment of 0.2 per cent equates to a loss of 478,000 jobs".

We then contacted the European Commission directly to clarify whether they agreed with this assessment.

In contradiction to what we were told by the Treasury, the EC said: "This figure does not come from our impact assessment, and it is not one that we agree with".

They assured us that powerful mitigating measures were included in the design of the tax to avoid an increase in the cost of capital (which would have a negative impact on employment) and therefore there should not be a negative impact on employment.

As an example, the EC said transactions on primary markets for securities and currencies would not be included in the scope of an FTT. Furthermore, lending and borrowing by private households, enterprises and financial institutions would not be taxed. Furthermore, they noted that increased government revenues could be used to stimulate labour market growth.

Given that the Commission estimated a loss of 0.2 per cent of jobs, we can assume that this figure was arrived at by applying this loss percentage to the total number of jobs in Europe.

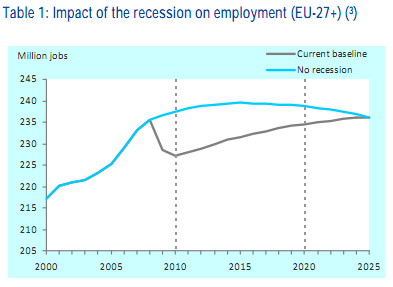

A report from the European Centre for the Development of Vocational Training provide figures for the total number of jobs in the European Union, shown in the graph below.

Taking the baseline figure for 2010, there were approximately 227,000,000 jobs in the EU, and of these, applying the loss of 0.2 per cent, approximately 454,000 might be lost as a result of the tax.

Alternatively, using a figure of approximately 235,000,000 jobs in 2008 before the two lines diverge, some 470,000 jobs would be lost.

This therefore comes very close to the Treasury estimate of 478,000.

This is still lower than the statistic mentioned in the Telegraph article, which put job loss at 995,000.

Conclusion

While it isn't strictly accurate that the European Commission itself estimated that half a million jobs would be lost if a FTT was brought in, the figure does seem to be calculated using the raw numbers contained in the Impact Assessment.

However it is important to note the Commission has now indicated that it "does not agree with" the figure, and points to the fact that the tax could actually help stimulate growth in the labour market.

The Chancellor seems to be on firmer ground with his GDP figures, which do take their provenance directly from the IA.