Is the IMF lending 80 per cent of its loans to Europe?

"The IMF is now lending 80 per cent of its loans to Europe"

Today, BBC Radio 4, 11th January 2011

Yesterday, during an interview with Professor Ngaire Woods, the Today programme presenter claimed that 80 per cent of International Monetary Fund (IMF) loans go to European countries - a claim verified by the professor.

The interview followed rumours that Hungary would be the latest European country to face an economic crisis, which could eventually lead to a bailout by the IMF.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

Full Fact tracked down the figures to examine the claim.

Analysis

The 80 per cent figure appears to be based on a report by the interviewee, Professor Ngaire Woods, which lists those IMF lending arrangements approved between September 2008 and June 2009.

Of these, seven countries — Ukraine, Hungary, Latvia, Belarus, Iceland, Serbia, and Romania, accounted for 82.23 per cent of Special Drawing Rights (SDRs) approved. This figure measures the total value of all the loans rather than the number of loans provided.

Although the professor does not appear to include them, if the list were to be expanded to include Armenia and Georgia, then European countries, by the broadest definition, accounted for 83.96 per cent of approved SDRs.

However, the IMF have since released updated figures, listing all current lending arrangements dating back to March 2008. The IMF have included all mechanisms, whilst Professor Woods' calculations only include Stand-By Arrangements (SBAs) and Poverty Reduction and Growth Trusts (PRGTs).

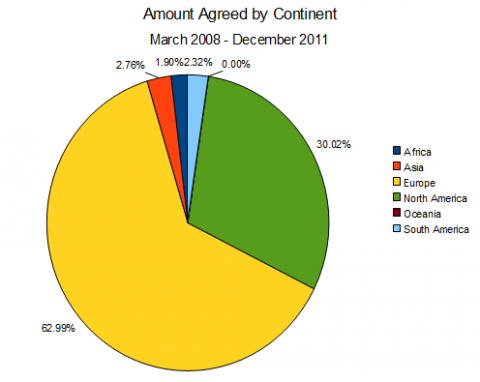

Full Fact analysed the IMF data and found that European countries account for 62.99 per cent of loans (again using the value in SDRs agreed as the measure), whilst EU member states account for 55.70 per cent. The chart below shows the proportion of loans of all types agreed by the IMF, by continent, including figures from 2010 and 2011:

If we use a similar definition of "new loans" and examine only those loans approved in 2011, there are five European countries which had lending arrangements approved (Romania, Serbia, Portugal, Macedonia and Poland), accounting for just 47.52 per cent of SDRs.

Nevertheless, European countries do account for a substantial proportion of SDRs still outstanding (i.e. the country has not yet repaid the loan). Of loans approved in 2011, the five European countries accounted for 95.33 per cent of outstanding SDRs.

It is worth noting that the figures may differ as a consequence of using more mechanisms to calculate the percentage of IMF loans which have gone to Europe. For example, our calculations include three states using the Flexible Credit Line (FCL), which provides countries with the option to draw an amount. However, none of the three countries (Columbia, Poland and Mexico) have done so.

The IMF provide a factsheet that explains the nature of each type of loan possible.

Conclusion

Whilst the 80 per cent figure seems to have grounding in the professor's report, it is important to note that these are based on data from 2008 and 2009 (specifically intended to illustrate post-financial crisis lending arrangements).

With more up-to-date data available, the actual proportion of IMF loans heading to Europe seems somewhat different, although the differences are heavily based on which time-frames are used.

If all loans since March 2008 are considered, 62.99 per cent of IMF loans go to European countries. Alternatively, if only new loans agreed in 2011 are considered, then the IMF only lends 47.52 per cent of its loans to Europe.