'Bedroom tax': are 96% of those affected "trapped" in larger houses?

"More than 19 out of 20 families hit by the bedroom tax are trapped in their larger homes because there is nowhere smaller within the local social housing stock to take them."

The Independent, 5 August 2013

Few policies have caused more controversy in the current Parliament than the Government's decision to reduce the amount of Housing Benefit available to social housing tenants who have one or more bedrooms that are unoccupied.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

Even the name of the measure - which was introduced as part of the Welfare Reform Act last year, and came into force this April - has been the source of argument in the Commons, with opponents terming it a "bedroom tax" while Ministers claim it tackles a "spare room subsidy".

Whatever we call it, today's Independent claimed that it was founded on a "big lie", as figures showed that those affected by the policy couldn't downsize due to a lack of smaller properties in the social rented sector. According to the paper, 96% of these families would have "nowhere to go".

The figures being referenced were in fact gathered by the Labour Party, whose shadow Work and Pensions team sent Freedom of Information requests to all Local Authorities in Britain asking for their estimates of the number of households in their area likely to be affected by the measures, and the number of one or two bedroom properties currently vacant in the Local Authority housing stock.

We got in touch with Labour, who kindly provided us with a copy of the figures which we've published here. From this we can see that of the 60 councils that provided data on both counts, a total of 160,688 households were thought to have been affected by the introduction of the 'bedroom tax', while there were a total of 9,025 one or two bed properties available in the local authority housing stock. If all the families hit by the measure wished to move into these one and two bedroom homes, then only 5.6% would be able to do so.

These numbers are slightly different to those used by the Independent, which appears to use data from just 38 councils. Labour's team confirmed to us that they were still receiving some responses to their initial FOI request, and the data with which we've been provided seems to be more complete.

So does this mean the Independent is correct to claim that 19 out of 20 families affected by the measure are unable to move to smaller accommodation? While the numbers might match up, there are a few reasons to be cautious about drawing that conclusion.

The first is that the sample of councils for which we have data is still relatively small. There are over 400 local authorities in the UK, meaning that as yet these numbers only cover about 14% of all councils. More importantly, there may be an element of self-selection in the sample that we do have, as those local authorities that are particularly affected by the 'bedroom tax' may be more likely to co-operate with the FOI request.

Secondly, it might not be the case that all households affected by the under occupancy charges would be chasing smaller properties. The Government's Impact Assessment noted that it was estimated that around a quarter would look to downsize, with others opting to increase the number of hours worked or look for a lodger to make up the shortfall. If this turned out to be accurate, the competition for one and two bedroom properties might not be as fierce as the Independent predicts.

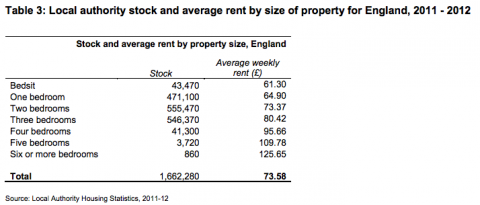

It's also worth noting that some families affected by the change might look to downsize from larger houses to properties with more than two bedrooms. This could also ease the burden, as three bedroom homes are the second most popular dwelling type in local authority control (although the Government predicts that only a third of those families affected will have children, which might be the most natural tenants for these larger homes).

Perhaps most importantly however, the data gathered by the Labour Party on vacant properties only includes those provided by the local authorities themselves, and not the social housing that's supplied by Housing Associations. The Government predicts that over a third of those likely to be affected by under occupancy charges will live in Housing Association properties, rather than local authority dwellings.

The Government has claimed that 660,000 households will be affected by the 'bedroom tax' and whether or not they will be able to relocate to a smaller property nearby should they wish to do so is clearly an important issue for this group.

The data unearthed by Labour helps to fill in some of of these gaps for some areas of the country, but we need to be cautious about extrapolating nationwide and drawing the conclusion, as the Independent has done, that 96% won't be able to downsize.

We would need a larger, representative sample of local authorities to be able to compare the number of families affected to the number of available properties in their area, and would want to factor in Housing Association stock as well as those provided by the council itself. While the data as it is certainly suggests there's a disparity in the number who might wish to move as a consequence of the policy and the number of available properties, it might be overstating the case to say that 96% would miss out.