What is an average public sector pension?

The planned rise in the state age of retirement announced by the Government yesterday has prompted widespread speculation over the future of state pensions, with many commentators expecting the pensionable age to further rise in the coming years.

Whilst the call for evidence released by the Department for Work and Pensions on raising the retirement age does not yet represent concrete legislation, it is clear that the move is the latest in a raft of measures announced by the coalition to reduce the Government's pension bill. Full Fact has previously probed the exact cost to the taxpayer of public sector pensions in a previous article.

The claim:

Some in the commentariat have blamed the rise in the state retirement age on overly-generous public sector pensions. This was an opinion echoed by one audience member on the BBC's Question Time last night, who argued that the move was being engineered to "pay for gold-plated public sector pensions".

Rebutting these accusations, panel member and Labour leadership contender Ed Balls made some claims that merit further investigation.

Addressing the issue of 'gold-plated' public sector pensions, the Shadow Education Secretary said: "The average public sector pension is between five and six thousand pounds … it is not a big pension."

Is the Government as frugal towards retired state employees as Mr Balls suggests?

Analysis:

At first glance, the average pension range of £5,000-£6,000 given by Mr Balls does seem to be out of kilter with the available evidence.

Even the Trades Union Congress (TUC), a stringent defender of public sector workers, has placed the average pension received by former public servants at £7,000.

This estimate in turn is based upon a National Audit Office (NAO) report into public sector pensions, which calculated the average annual payment to be even higher, at £7,388.

However the TUC's Nigel Stanley argues that this comparison isn't as straight forward as this might suggest.

"The true figure really depends on what you include; the NAO data only includes the unfunded pensions, and not the local government scheme," he told Full Fact.

According to Mr Stanley, the data for the local government pension scheme is difficult to integrate with the NAO figures. However he did add that "we are very confident that if this is taken into consideration, the average pension across the public sector would fall within the range outlined by Ed Balls."

According to Local Government Association (LGA) figures, the average pension under the local government scheme is £4,044, and is paid to 1.16 million pensioners.

However whether or not it is right to include the local government data in any estimates of public sector pensions is an extremely thorny issue. Unlike the rest of the public sector, the local government scheme is funded, meaning that it relies upon earnings from investments to pay its claimants.

Speaking to Full Fact, a spokesperson for the LGA was keen to stress the fundamental differences between pensions in local government and the rest of the public sector.

He said: "Although the scheme operates on rules set by central government, it acts much more like a private sector pension scheme."

"The liability for pensions is not a direct burden upon the taxpayer, as it makes use of investments whose income exceeds the benefits it receives from the public sector," he added.

But Mr Balls' claim doesn't necessarily rest solely on the basis of the inclusion of the local government data.

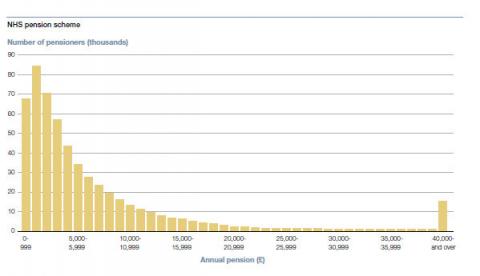

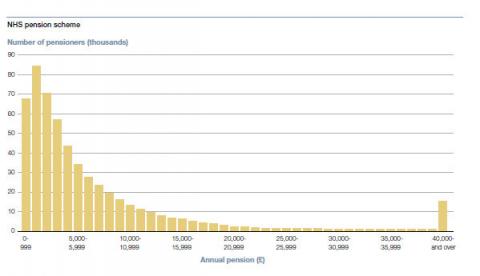

As the NAO report shows, the distribution of public sector pensions by size is very uneven, with a large number of people receiving small amounts, especially in the NHS (see table below). This is due to the high numbers of those who don't work all their lives or work part-time in the public sector.

The mean average of £7,388 is perhaps not the most revealing figure given that it is skewed by those receiving over £40,000, a point on which Nigel Stanley expanded.

He told Full Fact: "The majority in the public sector receive pensions of less than £5,000. The data here is incomplete, but we'd certainly expect a median analysis of the average pension to be below £6,000."

Conclusion:

The complexity involved in estimating public sector pensions can be eye-watering, making the comments made by Ed Balls difficult to evaluate.

If the average public sector pension is calculated by the median, or includes the sort of funded scheme run in local government, then it is certainly possible to justify the Shadow Education Secretary's remark. However, whether or not there is a basis for doing this is a topic of some contention.

Full Fact contacted Mr Balls' office for clarification, and we have been told that they are investigating the basis of his claim.