Would a "marriage tax break" benefit the poor more than raising the income tax threshold?

"Tax breaks for married couples would do more to fight poverty than Liberal Democrat plans to increase the income tax threshold, a report claims"

Daily Mail, 19 February 2012

After Shadow Chancellor Ed Balls suggested over the weekend that his opposite number George Osborne "could look at personal allowances" in the budget, proposals for various changes to the tax system came under scrutiny in this morning's newspapers

One report from the Centre for Social Justice (CSJ) that featured in the Daily Mail called for the Governemnt to look again at the transferable tax allowance proposed by the Conservatives at the last general election (also known as the "marriage tax break").

Under this proposal, a spouse would be able to transfer all or part of their personal allowance for income tax to their partner. In the report, the CSJ conclude that "a transferable tax allowance to support marriage, as part of wider reform to champion its value, would be more beneficial to the poorest than plans to increase the income tax threshold to £10,000."

So what is the evidence behind this claim?

Analysis

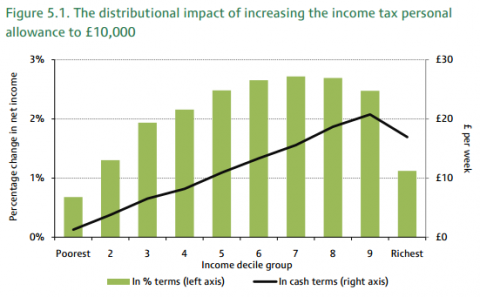

The CSJ cite a briefing note by the Institute for Fiscal Studies, which suggests that the poorest households would not benefit the most from increasing the threshold. Full Fact has referred to this data before after it apparently showed a different distributional impact of the proposed tax change to another chart put together by the Taxpayers' Alliance.

On that occassion the difference lay in whether we measured the impact of the change on households or individuals.

In this instance, it would seem reasonable to use households affected rather than individuals since most of those that would be eligible for the transferable allowance would ive in a single household. The IFS provides the following two graphs to meausre the changes to household income of the two tax proposals:

The CSJ note that "a fully transferable tax allowance would still favour poorer families to a greater extent than raising the income tax threshold". As the IFS data shows, the veracity of this claim depends upon how you understand the term 'favour'.

The IFS remark in their briefing note that as a proportion distributed, poorer household gain more from the transferable tax allowance "because gains are withdrawn from higher-rate taxpayers, and couples where both have incomes above the personal allowance cannot benefit."

According to the CSJ, higher-earning households are more likely to have two earners who would both benefit from an increased income tax threshold, whilst poorer households are more likely to have just one earner.

However it is worth noting the scales used on each graph. According to the IFS graphs provided, the sume distributed to all income deciles would be much greater if an increased income tax threshold were enacted rather than a transferable allowance. In this respect therefore, poorer households benefit 'to a greater extent' from this change.

The CSJ do acknowledge this in their report, stating that "in absolute terms raising the tax threshold does give poorer families more money than the limited Conservative manifesto commitment to allow couples to transfer only £750 of their personal allowance."

However, there are two important caveats to this. Firstly, the graphs produced by the IFS were published before the general election, and so refer to an increase on the threshold of 2010. Since then the personal allowance has been raised from £6,475 to £7,475, and is due to be increased again to £8,105 this year. This will inevitably lessen the impact of any immediate increase in the threshold to £10,000.

Additionally, the IFS only considered the Conservative proposal to allow a transferable tax allowance of up to £750. The CSJ recommend that measures be taken to allow "the entirety of one person's personal allowance to be transferred", which would have a more significant impact. However, figures for this scenario are not provided by the IFS or the CSJ.

Conclusion

While the IFS graphs do show that a transferable tax allowance would target the poor to a greater extent than raising the income tax threshold, it is less accurate to suggest this would be of a greater benefit to poorer households.

The IFS data only refers to a Conservative manifesto policy of a transferable allowance of £750, and suggests that this would result in a much smaller net increase in income. However, the data is not available for how this would be affected if the whole of the personal allowance were transferable.