Are 13,000 millionaires getting a £100,000 tax cut?

"There are fewer than 40 days until April 6th - when 13,000 millionaires will get a £100,000 tax cut."

Labour, 'Tory millionaires day'

Back in September Ed Miliband claimed that, this April, David Cameron would be writing a cheque worth £40,000 to each and every millionaire in Britain.

As readers may remember, Full Fact and others found that this was indiscriminate. Only people with incomes over £1 million fall into Ed's category of 'millionaires', not the 322,000 people with personal wealth worth at least £1 million, who wouldn't necessarily be affected at all.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

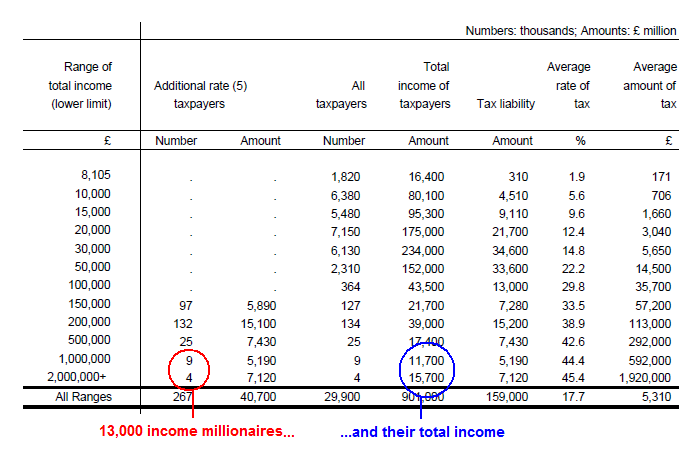

So when we're talking about a "millionaires' tax cut" we need to be clear who exactly we're talking about. At the time (figures for April 2012), HM Revenue and Customs (HMRC) projected that there were 8,000 taxpayers earning at least £1 million per year. These projections are highly sensitive to changing circumstances however, and now the same projection stands at 13,000.

So, the best estimates confirm the 13,000 income millionaires. What about the £100,000 tax cut?

Before, when Labour were claiming the cut would be £40,000, the calculation was fairly simple. Assume every income millionaire earns exactly £1 million. Take off £150,000 (the threshold for the 50p tax rate). Of the remaining 850,000, a 50p rate earns you only 425,000 after tax. Under a 45p rate, you earn £467,500. The difference: £42,500.

[Actually, you also need to factor in changes to the thresholds at which lower rates of tax start to be paid, which are lowering in April as well, but this makes only a minor difference.]

Now, Labour are claiming that it's going to be a £100,000 average tax cut. This is a little trickier to pin down, but the method is similar. This time, Labour haven't assumed every income millionaire earns £1 million. Instead, they've taken the total income earned by all 13,000 income millionaires and worked out the grand total tax deduction, divided by the 13,000 to get an average cut.

So, from the latest data we know that the total income of the 13,000 income millionaires in the UK is £27.4 billion. For all 13,000, the cut from 50p to 45p will only affect earnings above £150,000, so the total income subject to the additional rate cut is £27.4 billion less 13,000 lots of £150,000. This gives us £26.2 billion of income taxable at the additional rate.

5% (the size of the cut) of £26.2 billion is £1.31 billion, so that's the total tax cut for all 13,000 income millionaires. The average additional rate tax cut per income millionaire therefore stands at £100,769.

This isn't actually the end of the story, as again these 13,000 will also be hit by the lower thresholds at which portions of their income will be taxable at the basic and higher rates of income tax. HMRC already provide total projections of how much these 13,000 are liable to pay in tax in 2012-13. This will make the average change in tax paid lower than £100,000.

The bigger picture?

No one doubts that lowering the additional rate of tax amounts to an effective tax cut for people who paid that rate on some of their income (at least, enough to offset the changes in basic and higher rate thresholds). The Government, however, can claim (and has) that its package of tax changes for the rich need to be taken as a whole rather than in isolation.

The two changes it points to are capping unlimited tax reliefs in income tax (the 'tycoon tax') and increases to Stamp Duty. Both, the Treasury estimates, will bring in £300 million by 2016-17, far more than the reduction to 45p will cost (£110 million as originally calculated by HMRC).

So the additional rate tax cut pales in comparison to the other 'rich taxes'? Not so fast. All these numbers are estimates, some more uncertain than others. Paul Johnson, Director of the Institute for Fiscal Studies (IFS), puts it eloquently:

"We know pretty much for sure that the increase in the personal allowance will cost about £3.5 billion in 2014-15. We do not know with anything like such certainty that the cut in the 50p rate will cost only £100 million. We do not know that the proposed caps on tax reliefs will bring in the £300 million or so the Chancellor is banking on. Nor do we know that the stamp duty changes will raise the nearly £300 million that he has pencilled in."

Combined with the volatile HMRC projections of the number of income millionaires and the total income they're liable to pay, it might be fair to come to the remarkable conclusion that we don't know anything. At least, for certain.

As far as we say given the figures and their uncertainty, Labour's estimate of the effect of a 50p tax cut is well grounded, but this isn't the only tax change that will affect many of those at the upper end of the income scale. Considering all of these changes together might therefore give a fuller picture of the prognosis for the wallets of the better-off.