Are house prices up or down? Depends which paper you read...

The Daily Express is noted for its long-standing interest in the movements of the housing market although, as Full Fact has shown, it hasn't always reported them accurately.

Today the paper relayed some good news for homeowners: according to a headline: 'house prices are on the rise at last'.

The Express's claims - that according to the Office for National Statistics house prices in April were up 1.1 per cent on March and 1.4 per cent on the previous year - are this time fairly uncontroversial, given that they are taken directly from the ONS report.

And while the paper's claim that "Britain's housing market is surging upward again" may be more optimistic than the ONS's own verdict that "there was relatively little growth in house prices in the UK", the Express's numbers seem to match up, even if the commentary doesn't.

However those readers who are also partial to flicking through the Daily Telegraph might nonetheless have been left confused, given that they reported earlier this month that:

"House prices fell by more than £3,000 in April — more than most owners earned that month."

The two papers are referring to the same month - April 2012 - but whereas one paper saw a 'surge' the other has reported a fall. How can we account for this?

Regular readers will know that this is a problem that we've encountered before, and the varying accounts of the fortunes of homeowners can be traced to the multitude of indices that purport to measure house prices.

The Express references the ONS house price index, previously compiled by the Department for Communities and Local Government (DCLG), which is one of two 'official' measures of house prices, the other being that produced by the Land Registry. Whereas the ONS uses mortgage completion data provided by the Council of Mortgage Lenders to inform its prices, the Land Registry uses actual sales data recorded in its register.

The Telegraph meanwhile references the Halifax house price index, which is compiled using the bank's own mortgage approval data. Several lenders similarly produce house price figures, with the Nationwide's index also widely used.

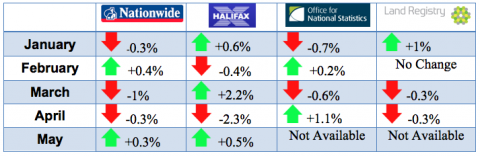

This confusing array of sources for house price data makes for some confusing newspaper reports. As we can see from the table below, journalists could have chosen to report either upward or downward moves in the market for any month this year, depending upon their index of choice:

(Table shows month-on-month changes.)

As we can see from this table, the 'surge' being reported by the Express is based upon ONS data which is the outlier for April. All three of the other main indices pointed to a decline in house prices in this month. In fact, the four measures frequently disagree over the direction of the market.

As it stands, none of the indices offer a perfect measure of movements in the housing market, and while this dearth in quality house price data persists, homeowners might be advised to take each individual reported change in the value of their home with a pinch of salt.

It is only by comparing the complete picture over time that we can get a clear and reliable measure of movements in the market, and this perspective is rarely found in newspaper articles.