Are spouses living abroad pocketing millions in UK pensions?

Daily Telegraph: "Taxpayers are funding state pensions for hundreds of thousands of people who live abroad and have never paid tax in this country, a minister has disclosed."

Daily Mail: "Pensions loophole lets 220,000 people living abroad claim a state pension despite NEVER having worked in the UK."

Daily Star: "SHAME OF £410M OVERSEAS PENSIONS."

As this year's pomp and ceremony in Parliament comes to an end and the usual day-to-day politics resumes, talk over the coming days is set to focus on the Coalition's priorities for the year ahead.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

Among the changes set to take centre stage are the Coalition's pensions reforms, which pensions minister Steve Webb has likened to the reforms of William Beveridge from 70 years ago.

But are we shedding £410 million on overseas pensions, as news outlets have claimed this week, and will the reforms stop it?

What's going on?

Currently, the pensions system has two 'tiers': the first comprises a flat-rate Basic State Pension which can be topped up with the means-tested Pension Credit; the second is the Additional State Pension which is based on earnings. Entitlement to this builds up over a lifetime, as the State Earnings Related Pensions Scheme (SERPS) before 2002 and since then as the State Second Pension.

There are also a number of categories of state pension. Most people just receive the standard 'category A' pension, which depends on a person's own National Insurance (NI) contributions. However nearly 2 million people get either a category 'ABL' or 'BL' pension. The former is paid based on someone's own NI contributions and those of their spouse, while the latter is paid solely because a married person isn't entitled to a standard pension but their spouse is.

In other words, both are based wholly or partly on the contributions of someone's partner.

The Government wants to replace this with a single tier flat rate for all future pensioners (those reaching the state pension age after the policy is introduced). Crucially, this is aimed at being an "individual" pension:

"based solely on an individual's own National Insurance records — it will not be possible to derive or inherit single-tier pension from a spouse or civil partner...

"There will, however, be transitional arrangements to recognise shared or inheritable additional State Pension in the current system, and for certain women who have paid reduced rate National Insurance contributions."

£410 million 'blown' on the 220,000?

It's possible to work out where these numbers come from by using the Department for Work and Pensions' (DWP's) Tabulation Tool, which tracks the caseloads and payments for the State Pension and other benefits. It's worth summarising the figures that are available here.

As of August 2012 (the latest period for which figures are available), there are 12.8 million people claiming at least the Basic State Pension. Of these, 1.2 million people claim from abroad, or don't have a known location.

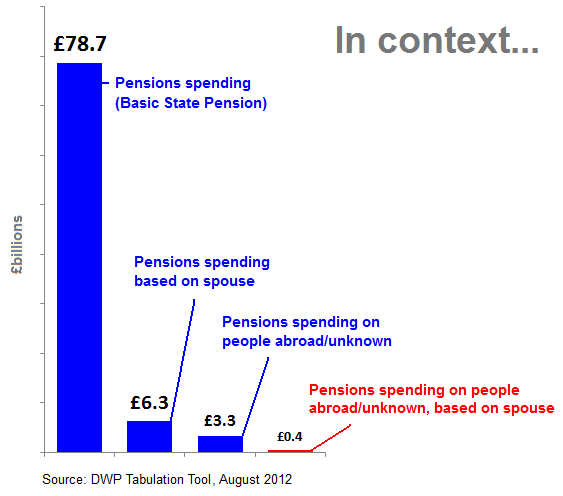

Overall the average person takes the equivalent of around £6,150 a year in the basic state pension alone, which cost the Treasury £74 billion in 2011/12 (and around £79 billion in August 2012). The cost of pensions sent out to those living abroad or those 'unknown' amounts to around £3.3 billion.

Looking at all 1.9 million people receiving category ABL or BL pensions (based wholly or partly on a spouse's contributions), 220,000 live abroad (again, some don't have a known location). Factoring in their average claims gives a total spend of £6.3 billion and a spend for those abroad of £0.4 billion (£409 million).

There are several interesting points here: the £410 million, while a considerable amount of money, comprises a small fraction of pensions spending, and the amount spent on people claiming pensions based on their spouse's NI contributions is actually far more considerable for people resident in the UK rather than those living abroad or with an unknown location.

So why are overseas pensioners being singled out, if more is actually spent on pensions claimed through a spouse's contributions in this country? The pensions minister was quoted in the Telegraph as saying:

"Steve Webb, the pensions minister, said that those receiving British pensions overseas include many foreign citizens who have 'never set foot in Britain at all'."

However the statistics from the DWP don't provide any information on the residence histories of the 220,000, so it's not possible at this stage to understand the scale of the 'problem' highlighted by the minister.

But it is striking that this claim is different to the Government's previously stated aim to remove "the facility to inherit or derive rights to the state pension from a spouse or civil partner", regardless of where they live. Based on the figures we've seen, this represents a much larger area of spending from which savings could be made.