Ed Miliband's welfare speech: what are the facts?

Labour Leader Ed Miliband grabbed headlines today by announcing a shift in his party's approach to welfare.

You'll find the full text of the speech here, but his four key points were:

- Long-term unemployment is placing a huge burden on the public purse in out-of-work benefits and unpaid taxes;

- When jobs are well paid, the state does not face rising subsidies for low pay;

- Housing Benefit makes up a big part of social security spending. The government should build more homes, which would drive rents down.

- A future Labour government would cap social security spending.

Commentators have already been discussing the significance of the new policy announcements, but what does the data tell us about Mr Miliband's claims?

First point: Earnings are down and welfare is up

Ed Miliband says: "The biggest item of expenditure alongside the NHS, is the social security budget."

That's correct. Public spending data from HM Treasury shows that spending on social security - which includes pensions, tax credits, and benefits for sickness, disability, unemployment etc. - is in fact twice the size of the amount spent on health. Spending on social protection was £240.6 billion in 2011-12, up from £236.1 billion in the previous year.

And social protection spending has been increasing steadily over the last two decades:

(Source: HM Treasury Public Spending Statistics, February 2013)

Ed Miliband says: "Real wages have fallen £1,900 since this government came to office."

Data from a February 2013 ONS release shows average weekly earnings have indeed fallen in real terms. Labour has adjusted the data to account for inflation (CPI and RPI) and annualising the RPI-adjusted figure does show a fall of around £1,900 between May 2010 and March 2013 (the most recent data available). The graph below shows average real earnings in February 2013 constant prices, starting from May 2010 when the Coalition arrived in office.

Second point: Spending on unemployment and housing are driving up our welfare bill

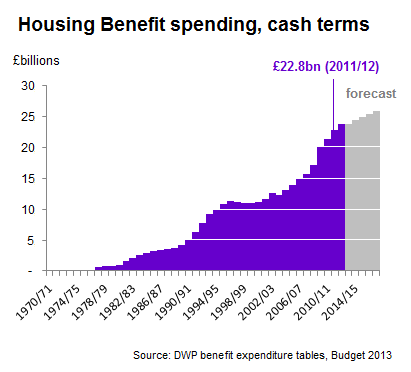

Ed Miliband says "For all the cuts this government has made to Housing Benefit, it is still rising and it is forecast to carry on rising too."

Housing Benefit spending has been on an upward curve for several years, and is indeed forecast to rise further. The growth rate is projected to be slower over the coming years, however, and in real terms will hardly grow at all:

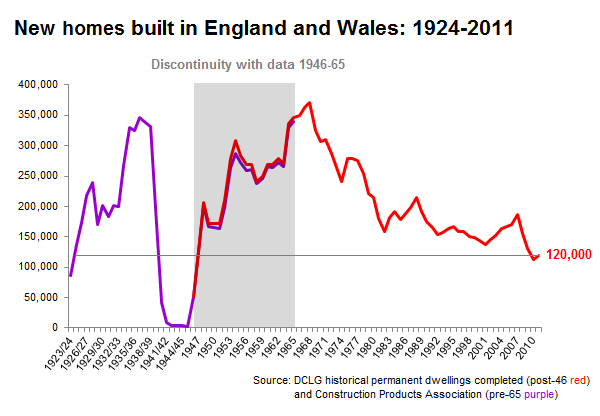

Ed Miliband says: "Currently Britain is building fewer new homes than at any time since the 1920s."

Not quite. The only reasonably comparable statistics we have going back to the 1920s are for England and Wales and they indicate this is a peacetime low - during the second world war only a few thousand homes were built in England and Wales (a low point of 1,445 in 1945/6). Excluding the war does show that 2011 saw the lowest number of new builds since the early '20s:

Third point: Worklessness and idleness - the extent of the problem

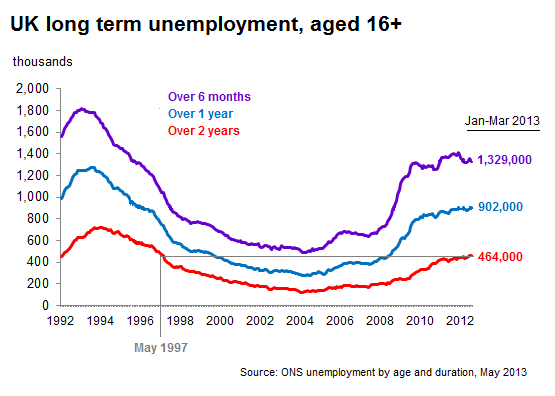

Ed Miliband says: "Long-term worklessness is now at its highest level for a generation... Today, there are more men and women - half a million - who have been out of work for over two years than at any time for sixteen years, in fact since the Labour government took office in May 1997."

This is correct. Source: ONS Labour Market Statistics May 2013.

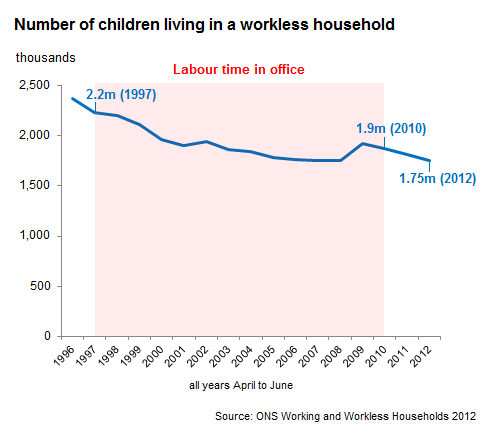

Ed Miliband says: "Too many children still live in families without work."

Data from the ONS shows that the number of children in workless households has decreased since 2010. In 2012 around 1.75 million children lived in workless households, down 60,000 from a year earlier.

Fourth point: Our economy can't afford unemployment

Ed Miliband says: "In 2012 youth unemployment alone cost Britain £5 billion."

This claim is based on research put together by ACEVO (the Association for Chief Executives of Voluntary Organisations) in a report on youth unemployment.

Research conducted by the University of Bristol on behalf of ACEVO looked at the number of 16 to 17-year-olds and 18 to 24-year-olds who claim bene?ts and found that they each, respectively, cost the exchequer an average £3,559 and £5,662 in yearly bene?ts. Multiplied by the number of claimants this figure totals £4.2 billion a year. We add to that estimates on the cost of youth unemployment at its current levels in terms of taxes foregone.

The researchers estimate this to be just over £600 million. They say this calculation is "based on the assumption that young unemployed people would earn less in work than their average currently employed peers." They also took into account the extra cost of a "minority of these young people claiming working tax credits were they in work."

It concludes:

"On this basis, 16 to 17-year-olds currently unemployed would cost the public purse £143 more per year, per person, if they moved into work (because their income would fall below tax thresholds and they might be eligible to claim working tax credits), whereas 18 to 24-year-olds would contribute a net extra £582 each per year to the exchequer through taxes."

Ed Miliband says: "This level of unemployment among young men and women means further costs of at least £3 billion per year in the long term in further worklessness and lost tax revenue."

This claim also originates from the ACEVO report.

You can find out more about the research behind these estimates here.

----

Flickr image courtesy of Cabinet Office