Has £1 billion been lost through fraud and error in Council Tax benefits?

"Council chiefs were last night urged to get to grips with council tax benefit as figures revealed £200million a year is being lost to fraud and error."

"Council tax benefit cheats have bled £290million from taxpayers in the last six years, figures show."

"More than £1billion of council tax benefit payments have been lost in six years because of fraud or mistakes, the Government will claim today."

Newspapers this week got stuck into a press release by the Department of Communities and Local Government commenting on the scale of fraud and error in the Council Tax Benefit system.

Speaking on the looming responsibility-shift of benefit from the Department of Work and Pensions (DWP) to local councils, Secretary of State Eric Pickles underlined the need for councils to crack down on waste; waste which has now accumulated to an estimated total of £1.1 billion since April 2006.

Reporting of waste in the benefit system is an old friend of Full Fact and we've become used to dealing with cases where the media has quoted figures on benefit system waste and suggested they are only due to "fraud", when in fact the statistics referred to include losses through customer error and official error as well.

Analysis

The figure of "over a billion pounds of taxpayer's money" slipping neatly off Mr Pickles' tongue can be traced to the DWP's annual "Fraud and Error in the Benefit System" estimations.

Since March 2006, the DWP publication has provided annual estimations of the total overpayments and underpayments made in the benefits system, as well as a breakdown for each type of benefit expenditure.

The key statistics for overpayments made since 2006 is summarised by a table in yesterday's release by the Department of Communities and Local Government.

|

Council Tax Benefit |

Expenditure |

Fraud and Error |

Fraud |

Customer Error |

Official Error |

||||

|

2011/12 |

£4.9bn |

4.0% |

£200m |

1.2% |

£60m |

2.4% |

£120m |

0.4% |

£20m |

|

2010/11 |

£4.9bn |

4.2% |

£210m |

1.3% |

£60m |

2.5% |

£120m |

0.4% |

£20m |

|

2009/10 |

£4.7bn |

4.2% |

£200m |

1.1% |

£50m |

2.4% |

£110m |

0.7% |

£30m |

|

2008/09 |

£4.2bn |

4.0% |

£170m |

1.2% |

£50m |

2.3% |

£100m |

0.5% |

£20m |

|

2007/08 |

£4.0bn |

4.1% |

£160m |

1.0% |

£40m |

1.9% |

£80m |

1.2% |

£50m |

|

2006/07 |

£4.1bn |

4.2% |

£170m |

0.8% |

£30m |

2.3% |

£90m |

1.1% |

£50m |

*Fraud: when a customer knowingly receives the incorrect payment.

*Customer Error: when the customer receives the incorrect payment by providing incomplete or incorrect information, or failing to update a change in circumstances, but had no fraudulent intent.

*Official Error: when benefit has been paid incorrectly due to inaction, delay or mistaken assessment by the DWP.

The table shows that the estimated total lost through fraud and error has remained relatively stable since 2006, although has crept up from £170 million to £200 million.

If we add-up the total estimated amount lost through fraud and error between 2006 and 2012, we do indeed come to about £1.1 billion, just as the Express, the Sun and the Mail report it. The total amount lost through fraud alone since 2006 has also been correctly reported at £290 million. So far, so accurate.

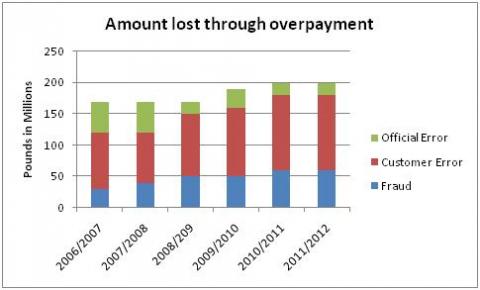

To get a sense of the proportion of the 1.1 billion lost through fraud, the graph below shows the varying sizes of the channels through which money can leave the benefit system by overpayment:

Overall, fraudulent acitivies can be blamed for around 26 percent of the estimated £1.1 billion lost over the six years.

Is £1.1 billion the best figure we have on waste?

It's worht mentioning that, although the actual amount lost has increased by about £30 million, the amount spent on the benefit has also increased. We can see from the table above, the amount fed into the system has increased by approximately £800 million since 2006.

Looking at the figures in this way, the proportion of benefit expenditure lost through overpayment has actually remained farily consistent since 2006. So even though any waste is not ideal, when viewed in proportion, there hasn't been any real change in the prevalency of fraud and error.

We should also be wary of Mr Pickles' claim that:

"It is not right that over a billion pounds of taxpayers' money has been lost through council tax benefit fraud and error".

This ignores the fact that some losses are counterbalanced by 'underpayments' - errors which result in less money than is due being paid out by the department. The amount of underpayment caused by official and customer errors amounted to £310 million over the last six years.

Additionally, some of the benefits which are overpaid are subsequently clawed back by the DWP. So, as the latest publication notes, "the net loss to the DWP is less than the overpayment figures shown in this report".

A final word of warning

It's important to bear in mind that estimations for Council Tax Benefits are based on the prevelancy of fraud and error found in the Housing Benefits system (given that the benefits are similar in terms of entitlement and administration). Even with regard to measuring Housing Benefit, the 2011/2012 Fraud and Error publication states:

"All estimates are based on reviews of random samples drawn from the benefit caseloads. In any survey sampling exercise, the estimates derived from the sample may differ from what we would see if we examined the whole caseload."

What's more, the DWP warn against drawing conclusions across multiple years.

Firstly, they point out that estimating the total amount of money lost through mistakes is difficult due to the range of value the mistakes can have. Some errors in benefits cases can involve only matters of pennies, while others can value hundreds of pounds. As the number of smaller-scale errors are more common, it is very difficult to extrapolate from the number of mistakes noted in a sample, to the amount lost by the DWP and Local Authorities nationally.

Secondly, as we know, the proportion of benefit expenditure lost through fraud and error is statistically small (around 4 percent). As the samples by which national estimates are made are relatively small and therefore any changes year on year are small — it is difficult to blow this up to a national level and note any statistically significant changes from year to year.

Conclusion

The statistics on Council Tax Benefit fraud and error are, by and large, reported correctly. However the Department's own statement doesn't allow us to draw conclusions on how much the fraud and error actually costs the taxpayer. For this, the £300 million in underpayments over six years and the overpayments clawed back by the DWP need to be recognised.

Furthermore, when looking at any estimation on Council Tax Benefit waste, eyes should be slightly narrowed. Fraud and error estimations are, by the DWP's admittance, highly difficult, and the Council Tax Benefit waste is literally an estimation of an estimation. Adding up six years' worth of overpayments only compounds this problem.