Income tax: are the top 1% really paying more?

Ed Miliband: "... can he tell us how much lower the taxes of someone earning more than £1 million a year are this year compared with last year?"

David Cameron: "The top rate of tax under this Government is higher than it ever was under the right honorable gentleman's Government. The fact is that the highest 1% of earners are paying a greater percentage of income tax than they did when he was sitting in the Cabinet."

Prime Minister's Questions, 18 December 2013

The government's decision last year to cut the top rate of income tax from 50 to 45p in the pound has proved to be one of its most controversial changes to date. Labour has made much in the past of the boon it will give to the richest earners in the UK, and today's Prime Minister's Questions was no different.

Millionaires are paying less in income tax

So what's changed for millionaires? It's still early days, the 50p rate was only removed in April this year. On the latest estimates, people earning in excess of £1 million last year (2012/13) coughed up 45% of their earnings in income tax, similar to the previous year. By the end of this financial year, they're expected to pay 41%.

If that plays out, Labour will have a point that the highest earners will be paying less, as we might expect from a top-rate cut.

Then again, the Prime Minister is right that the current top rate of 45% is higher than throughout most of the previous Labour government. It was 40% since 1988 right up until 2010 when the Brown government introduced the 50p rate.

The top 1% are still contributing more

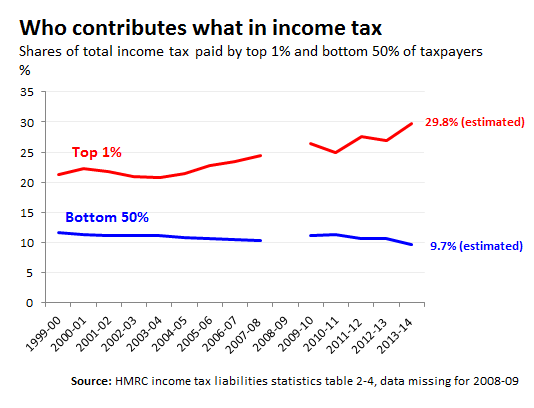

The top 1% of earners are expected this year to contribute 30% of all the government's takings from income tax, compared to 27% last year. This is in fact a long term trend, back in 1999 the top 1% contributed 21% of total income.

Similarly, the bottom 50% are contributing less in proportion to the highest earners. They gave the Treasury 12% of its takings from income tax in 1999 and are only expected to put in 10% this year.

But the highest earners aren't paying back any more of their own income

Knowing what each income group contributes to the government's income tax take doesn't tell us very much about how much people are coughing up from their own pockets. Looking at the effects of taxes on household income tells a different story.

Back in 1980 the top 10% of earners paid 19% of their earnings in income tax. In 2011/12, they also paid 19% of their earnings in income tax. There has been barely any change for the last 35 years.

People are also affected by far more than just income tax. The Office for National Statistics are able to measure the effects of benefits and pensions, as well as other 'direct' taxes such as National Insurance and Council Tax.

Even once these are factored in however, the lot of the highest earners hasn't changed a great deal. After earnings, minus taxes and plus benefits, the top 10% currently walk away with 70% of their original income (their 'disposable income'). Back in 1980, they took home 69% of their original earnings.