How crucial to Scottish public spending are reliable oil and gas receipts?

"Tax revenues from oil and gas in 2012-13 were £4.7 billion lower than the year before - a drop of more than 40%. While the UK's broad and diverse economy is able to absorb this volatility, this equates to more than one third of Scotland's health budget or two thirds of Scotland's spending on education."

Downing Street press release, 24 February 2014

With David Cameron and Alex Salmond both holding cabinet meetings within a few miles of each other in north east Scotland today, political and media attention has been focused on the area's largest industry: North Sea oil and gas extraction.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

The Prime Minister used the occasion to outline the reasons he felt the industry was best served by remaining in the Union, arguing that the UK economy was well-suited to sheltering the Scottish economy from the volatile tax revenues provided by oil and gas.

Mr Cameron is correct that the dip in the amount collected by the UK government in tax from oil and gas production is roughly equal to a third of the Scottish health budget and two thirds of the education and training, although how significant the impact would be in practice would depend upon how revenues from the industry were divided between the two countries in the event of a 'yes' vote.

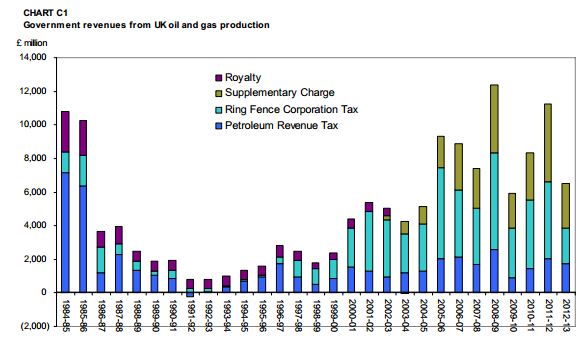

HMRC data confirms that in 2012-13, government receipts from taxes paid by companies involved in oil and gas production stood at £6.53 billion, £4.72 billion lower than the £11.25 billion collected in the previous financial year.

Recent years have been particularly volatile for the taxman when it comes to oil and gas: the amount raised more than halved between 2008/09 and 2009/10, before almost doubling again over the subsequent two years. Part of this volatility has been driven by sharp fluctuations in the wholesale cost of oil and gas.

The £4.7 billion dip in tax receipts since 2011/12 is equivalent to a significant slice of Scotland's education or health budget. In 2011/12 (the latest year for which data is available), £11.1 billion was spent in Scotland on health, while £7.7 billion was spent on education and training. £4.7 billion represents 42% and 61% of these totals respectively.

However whether or not Scotland would be forced to absorb volatility of this magnitude in its tax receipts from oil and gas in the event that it did opt for independence is more of a moot point.

The comparison made by Downing Street uses the total UK revenues from oil and gas, but as we have seen in the past how these receipts would be divided in the case of Scotland separating from the Union remains a contested subject. However even if the geographical basis for apportioning oil and gas revenues favoured by the Scottish Government did prevail, Westminster would still be entitled to a share of the tax receipts generated by the oil and gas industry. The size of the swings Scotland would have to absorb would therefore be proportionate to the share of the revenues it eventually received in any post-referendum settlement.

Scottish First Minister Alex Salmond has also disputed the idea that the size of the swings in oil and gas tax receipts was crucial to an independent Scotland's financial future, arguing that the country could establish a reserve fund to smooth out the volatility in the market.