It’s true that the basic state pension rose by 75p per week in one year of the last Labour government (between 1999 and 2000). But the natural comparison isn’t with the total annual rise under seven years of Conservative-led government. In fact, pensions rose by more under Labour, on average, once you take inflation into account.

In simple cash terms, the full basic state pension rose by £141 a year on average under Labour compared to £183 a year under the Coalition and Conservative governments.

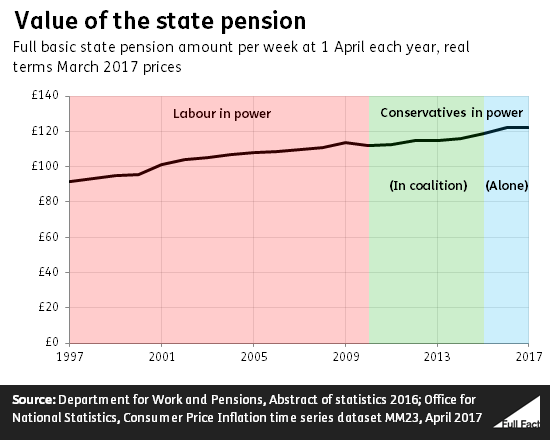

But as we’ve noted when assessing Ms May’s headline figure in isolation, this takes no account of price inflation. When taking the natural rise in prices (as measured by the Consumer Prices Index) into account, we see a different story.

In real terms, the full basic state pension went from roughly £4,800 a year in April 1997 to £5,800 a year in April 2010. So, on average, every year of the Labour government saw an increase of £82 in real terms. The real value of that pension under the Conservatives went from £5,800 to £6,400—an average annual rise of £75 a year.

The Conservatives’ record is slightly better than Labour’s if you don’t count the latest year—the real terms increase between 2010 and 2016 was £85 a year on average.

None of this is relevant to anyone retiring after 6 April 2016, as the basic state pension we’ve been discussing has been replaced with a new state pension scheme for more recent retirees. And we’ve been looking at the full amount of the basic state pension, which not everybody will be entitled to.