The welfare budget

- There is no single definition for the 'welfare budget'; some claims just cover benefits payments, others add in admin costs and social services.

- Benefit payouts (including the state pension) by the Department for Work and Pensions are expected to come to about £171 billion in 2015/16.

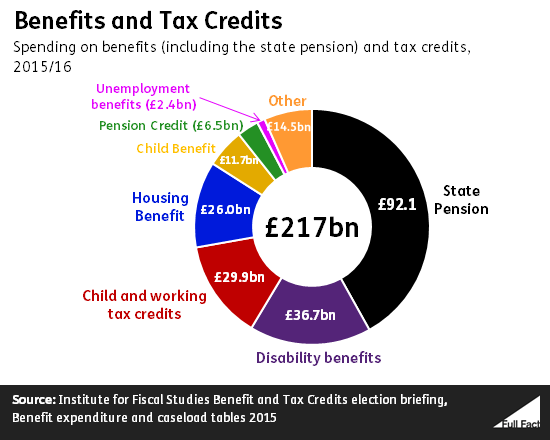

- Total spending on benefits and tax credits is expected to come to about £217 billion in 2015/16. This is about 11.7% of GDP and about 29.2% of total public spending.

- Social protection spending amounted to £231 billion in 2015/16, about 35% of all public spending. This doesn't just include benefits and tax credits; personal social services like child protection are included in this figure, as well as pensions paid to former public sector employees.

- The government introduced a cap on government welfare spending in 2014, covering some but not all types of payment. The cap on benefits received by a household includes a different set of benefits.

Department for Work and Pensions benefits spending

'Welfare spending' can mean different things to different people.

Spending on benefits administered by the Department for Work and Pensions (DWP) is expected to be about £171 billion in 2015/16 (23% of public spending), of which about £90 billion is expected to be paid out in the State Pension.

This doesn't include the costs of administering the benefits (such as staff and IT costs): these are included in wider definitions, explained later.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

'Welfare' spending on benefits and pensions across government

The DWP doesn't manage everything people might count as 'social benefits'. Child Benefit and Guardian's Allowance account for £11 billion a year and are managed by HM Revenue and Customs (HMRC).

War pensions—which cost about £900 million in 2013/14—are managed by the Service Personnel and Veterans Agency, which is part of the Ministry of Defence.

Tax credits are also paid out by HMRC to eligible people on low incomes and some people who have children.

HMRC is forecast to pay out about £30 billion in tax credits this year. Including them alongside benefits and pensions payouts gives a total of £217 billion, 29% of public spending.

'Social protection' spending: all of the above, and more

The amounts above all refer to what's actually paid out in benefits, pensions and tax credits to the people who claim them. What's not included is the cost of administering the benefits centrally and locally—these are recorded separately by the departments concerned.

HM Treasury's figures on public spending—which are also used in each Budget—use a much broader category: 'social protection' spending, which captures payouts and admin costs combined.

It also includes the significant amounts spent on personal social services. This can include daily social care for the elderly, the provision of shelter for vulnerable people and children's social services. This cost the government about £29 billion in 2015/16.

Total social protection spending came to about £231 billion in 2013/14: about 35% of public spending.

The welfare cap

In the 2014 Budget the government introduced a 'cap' on spending in the welfare budget. In includes most disability and sickness payments, as well as tax credits and most Housing Benefit, but it doesn't include Jobseekers Allowance or the State Pension (among others).

Of the £217 billion spending on benefits, pensions and tax credits (as above) the payments involved account for about 56% of the total.

If forecasts suggest the cap will or has been breached, the government has to either propose measures to reduce spending, seek parliamentary approval for the cap to be raised, or justify the breach, according to the Charter for Budget Responsibility.

Sources and more information

Department for Work and Pensions benefits expenditure and caseload tables - annual figures for spending by benefit, including pensions. Tax credits and Child Benefit spending also now shown separately in this release.

HM Treasury public spending statistics—quarterly release showing social protection spending breakdowns (July releases have more information).

HM Treasury Public Expenditure Statistical Analyses—annual release detailing public spending by department and function.

United Nations classifications of the functions of government—how to make sense of the Treasury's social protection definition.

Office for Budget Responsibility economic and fiscal outlook—breakdown of 'social security' budget, includes DWP benefits and pensions, Child Benefit and Northern Ireland social benefits, excludes tax credits, social services and admin costs.

Department for Work and Pensions Annual Report and Accounts.

HM Revenue and Customs Annual Report and Accounts.

The piece originally said that expenditure on Child Benefit, One Parent Benefit and Guardian's Allowance totalled £11 billion. One Parent Benefit was discontinued and rolled into Child Benefit in 1997, so there is no current expenditure on this benefit.