Which countries are in double-dip recession like the UK?

"Britain has gone from a tepid recovery to being deep in a double-dip recession — the only G20 country apart from Italy to be in this much trouble"

The Guardian, 26 July 2012

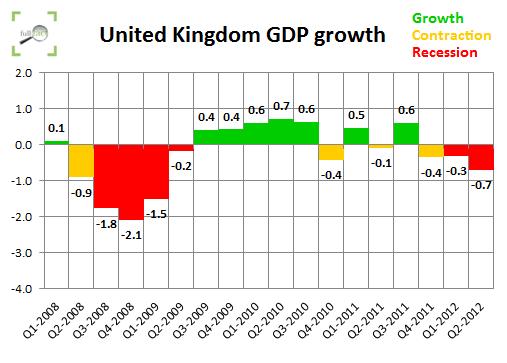

Bleak economic statistics were released this week by the Office for National Statistics (ONS), showing UK Gross Domestic Product (GDP) fell by 0.7 per cent in the second quarter of 2012 compared to the previous three months.

It continues what has been dubbed the UK's 'double-dip' recession following the long period of economic contraction experienced by the UK in 2008 and 2009.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

The Guardian's claim this morning that only the UK and Italy are suffering the from a second stint in recession echoes a claim circulated by the Labour party last month, highlighting how badly the UK is doing compared to other large economies.

So is it true?

Analysis

There is actually no official definition of recession, although it has come to be understood as occuring when a country experiences two successive periods of shrinking economic output. In the UK, this means two consecutive quarters (three-month periods) of negative GDP.

The Organisation for Economic Cooperation and Development (OECD) helpfully compile and make available a database detailing changes in GDP across the developed economies.

From this we can look at GDP figures since the start 2008 for all 20 members of the G20 (Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, South Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the UK, the USA, and the European Union).

If we take the commonly-used definition of recession, every G20 country bar Australia, China, India, Indonesia and South Korea entered recession at the end of 2008 or the start of 2009. By the third quarter of 2009, each of these countries had left recession and returned to positive growth.

Looking to the present day, it's indeed the case that only the UK and Italy are in recession again, although Japan also experienced a 'double-dip' last year:

Is this useful?

There are obvious drawbacks to simply defining recessions like this as it doesn't take into account the size of the slumps in output. Russia, for example, experienced a much more severe economic contraction than the UK (experiencing quarterly shrinkage as high as 4.7 per cent compared to the UK's trough of 2.1 per cent) back in 2008/9, yet Russia hasn't fallen back into the red since.

Also, a sustained period of negative growth could be interrupted by just one quarter of positive or zero growth which would break the recession into 'two' dips, while some would prefer to see this as part of the same recession period.

Iceland, for instance, experienced almost ten successive quarters of contraction from 2008 to 2010, broken by only one quarter showing faint growth at the end of 2008. While this might suggest a 'double dip' recession, the brief period of expansion could easily be an anomoly caused by exceptional circumstances.

Another method is to look at each G20 country who experienced a recession to see how well they have recovered since the start of 2008 when most began to enter negative growth - similar to the method employed by the National Institute of Economic and Social Research (NIESR) in their analysis of the UK's recessions and recoveries:

{"dataSourceUrl":"//docs.google.com/spreadsheet/tq?key=0AhY6F-ytSPsXdE05UC1NZHZBN2Q2YzM4WldMSndUeHc&transpose=1&headers=1&range=A2%3AS17&gid=0&pub=1","options":{"titleTextStyle":{"bold":true,"color":"#274e13","fontSize":"14"},"vAxes":[{"title":"Indexed growth","useFormatFromData":true,"minValue":85,"viewWindowMode":"pretty","viewWindow":{"min":85,"max":null},"maxValue":null},{"useFormatFromData":true,"viewWindowMode":"pretty","viewWindow":{}}],"curveType":"","title":"Indexed economic growth, 2008-present","booleanRole":"certainty","animation":{"duration":0},"domainAxis":{"direction":1},"legend":"right","lineWidth":2,"hAxis":{"title":"","useFormatFromData":true,"viewWindowMode":"pretty","viewWindow":{}},"width":705,"height":466},"state":{},"chartType":"LineChart","chartName":"Chart 1"}

[Chart designed by Full Fact]

It's also worth looking beyond the G20 for more context. While the UK and Italy are the only G20 countries to be in a second period of recession, they're joined by Spain, Portugal, Hungary and the Czech Republic when we consider all OECD countries (data on Greece isn't recently available in a quarterly format, although what information we have also shows annual falls in output).

Similarly, if we look at those countries that have been through a 'double dip' recession but have since returned to growth, seven more countries can be added to the list: Denmark, Iceland, Japan, Luxembourg, Netherlands, New Zealand and Slovenia.

Conclusion

The UK and Italy are indeed the only G20 countries currently experiencing a double-dip recession, however other countries beyond this group are suffering from similar economic woes. A wider look at OECD countries shows that five more are currently in double-dips of their own, while seven further countries have also double-dipped since 2008 but since returned to growth.

However a potentially more useful measure is to analyse how each country is faring compared to its 'peak' GDP before the financial crisis struck. On this measure, the UK and Italy are also faring worse than their G20 counterparts.