Who will bear the brunt of the benefits freeze?

As MPs prepare to vote over the Government's plans to cap rises to certain working age benefits and tax credits, newspapers and commentators have been circulating figures on who will be hit hardest as a result of the changes.

Starting from this year, benefits will no longer be pinned to the CPI. Instead, the majority of these benefits and tax credits will be increased at a flat rate of 1% for the next three years if Parliament votes in favour of the Welfare Benefits Uprating Bill.

So who loses out?

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

The cap in increases will affect Jobseeker's Allowance (JSA) and Employment and Support Allowance (ESA), as well as other benefits including Statutory Sick Pay and Statutory Maternity Pay. However disability and carer premiums payable with means-tested benefits and the ESA Support Component will rise by the full CPI (2.2% from next April).

The Government has estimated that around 30 per cent of all households will be affected.

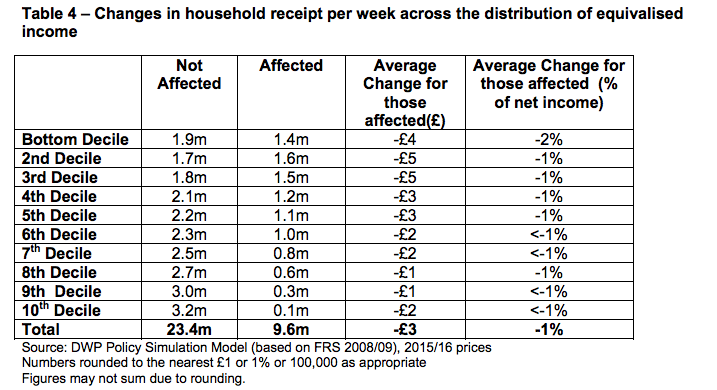

The Department for Work and Pensions (DWP) released an Impact Assessment today, which revealed that the average change for poorer households - those in lower income deciles - is larger than it is for those in richer ones. This is to be expected, given that households in lower deciles are more likely to receive state benefits.

Which type of families will be affected the most?

Workless Households

Using figures from the 2010-11 Family Resources Survey, the IFS has also estimated that out of a total of 2.8 million workless households of working age, 2.5 million (or 90%) will be affected by the Welfare Benefits Uprating Bill. They will see their entitlements reduced by an average of about £215 per year by 2015 —16.

Working Households

Of 14.1 million working-age households with someone in work, around half (7 million) will see their entitlements reduced, by an average of about £165 per year. This figure includes three million families who lose only from the cuts to child benefit, at an average of about £75 per year. (Source: IFS)

Mothers

In general, families with children are more likely to be affected than families without children. Given that only 10 percent of single parents are men, women are more likely to be affected by the cap than men. In fact 33% of all women are affected, compared to 29% of men. The Government has estimated that on average around 340,000 women each year receive Maternity Allowance and Statutory Maternity Pay. (Source: DWP Impact Assessment)

Conclusion

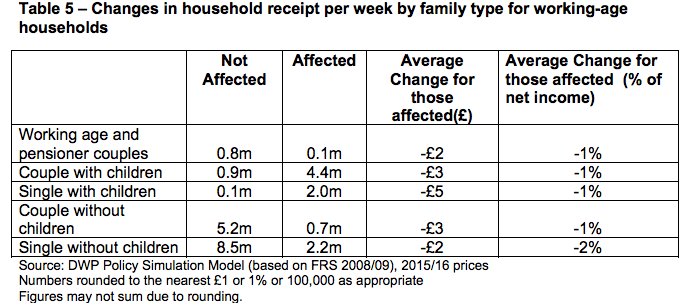

From the DWP Impact Assessment and the IFS's analysis, it has become clear that poorer households will be the most affected. As the table below shows, single parents will see the greatest change in their average weekly income, but single people without children will experience a greater loss as a percentage of their weekly income.

Update (11 March 2013) - Children

The incoming Archbishop of Cantebury, Justin Welby, yesterday endorsed a letter to the Sunday Telegraph in which 43 Bishops criticised the Welfare Benefits Up-rating Bill for its "disproportionate" impact on children. The letter claimed:

"A third of all households will be affected by the Bill, but nearly nine out of 10 families with children will be hit."

On Twitter yesterday, the Sunday Times economics editor David Smith was unimpressed with this 90% figure. Later he clarified that the figure referred to 85% of children affected as calculated in the DWP's impact assessment, but that its effect was roughly only £1 a week.

The source he cited is correct. The impact assessment confirms (via the table shown above) that 6.4 million families with children will be affected by the cap, compared to 1 million families with children who aren't forecast to be affected - so roughly 86% are affected in some way.

So via some rounding, almost nine in ten families (couples or singles) with children are affected. However this isn't the same as children, as some families will have more than one child.

From the latest Child Benefit caseload statistics from HM Revenue and Customs, 7.9 million families and 13.8 million children are in receipt of Child Benefit. However, because of the Government's reforms to means-test the receipt of Child Benefit, the numbers of families receiving the benefit in full is set to fall by over 1 million. The Children's Society estimate that this will leave 11.6 million children affected by the 1% cap.

Out of just over 13 million dependent children living in families in the UK, the proportion of children affected is similar to the proportion of families affected - around 87%. So it's entirely fair to claim that almost nine in ten children will be impacted by the 1% uprating cap, although the amount they lose will vary.

---

Flickr image courtesy of Regional Cabinet