What was claimed

Tax credits originally cost £1.1bn. Now they've reached £30bn.

Our verdict

This figure only covers half a year, when the first tax credits were introduced in 1999. They cost over £4bn in their first full year compared to £28bn today.

"The original Tax Credit system cost £1.1 billion in its first year. This year, that cost has reached £30 billion."—George Osborne, Chancellor of the Exchequer, Summer 2015 Budget

"It can't be right that a tax credits system Gordon Brown said would cost just over £1bn in its first year ended up costing £30bn, with payments being made to nine in every 10 families with children."—George Osborne, 19 July 2015

The Chancellor's recent statements on tax credits need clarification. The figures he cites for the initial cost of tax credits are confusing at best, wrong at worst and not useful in any case as they don't take into account price inflation over the course of 16 years. We've asked the Treasury to explain his statements and are waiting to hear back.

George Osborne's claim about families is about right if he meant to talk about eligible families, but not if he's talking about all families—as the claim happens to read. There are over 3 million estimated families eligible for tax credits but almost 11 million families with children in the UK.

On the money, the actual cost of the first full year of the tax credits was much higher than £1.1 billion. The predictions at the time were closer to £1 billion.

£1.1 billion yes, but for half a year

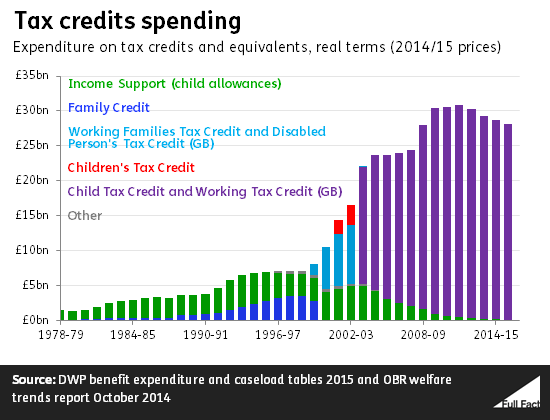

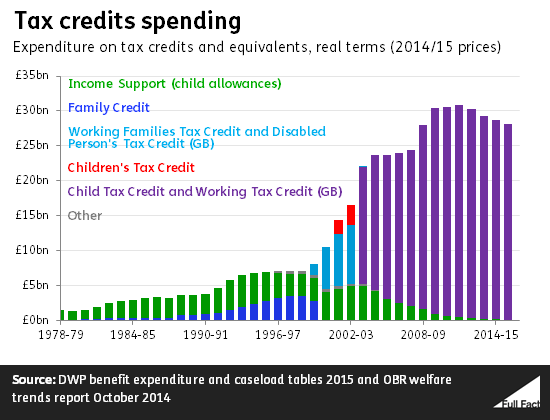

George Osborne's figure of £1.1 billion is what tax credits cost the government in 1999/2000—the year in which they were first introduced as the Working Families Tax Credit and Disabled Person's Tax Credit. He's probably comparing that to the equivalents today: Child Tax Credit and Working Tax Credit, which are estimated to cost £28.4 billion this year.

But he's not comparing like with like, because the old tax credits were brought in half way through the 1999/2000 tax year—in October 1999. So the starting figure of £1.1 billion only covers half a year and represents the initial start-up period for the credits.

The best comparable figure is the first full year of the tax credits which saw a cost of £4.3 billion.

Still quite a rise, but not on the same scale.

The Treasury initially thought the tax credits would cost less

The latest claim from the Chancellor confuses matters, as he's now apparently referring to what the then Chancellor Gordon Brown said the credits would cost.

And initial estimates of what things cost can get things wrong.

Back in 1998 the Treasury projected the new system would cost £425 million in the first six months and £1.4 billion in 2000/01—so much lower than actually happened. So we're close to £1 billion again, for the first full year.

Meaningless unless prices are taken into account

Whether the 'starting figure' we're interested in is about £1 billion or closer to £4 billion, neither of these numbers is useful for comparing tax credit spending over time, because of inflation. Prices are almost always rising over time.

It's better to compare the £28 billion bill today with what the tax credits would have been worth in today's prices.

That puts the tax credits bill at about £6 billion in their first full year in 2000/01. Compared to £28 billion today, it's still a considerable rise.

*This graph has been updated from a previous version to include the cost of Children's Tax Credit.

Nine out of ten eligible families with children claiming

The Chancellor's claim as it reads is wrong, but he's probably referring to something different.

The figures the Chancellor is using closely match the 'take-up' rates for certain tax credits—that is, the proportion of eligible families who are actually claiming the benefits.

In 2012/13 (the latest year we have figures for) 88% of eligible families were estimated to be claiming Child Tax Credit. 84% of eligible families with children were claiming either Child or Working Tax Credit. That's about 2.6 million in-work families with children out of just over three million eligible families.

So he's unlikely to be referring to the 10.7 million families with children in the UK overall, even though that's how the claim reads.

Update (24 July 2015)

Michael O'Connor, who blogs at strongerinnumbers.com has pointed out that it's possible the Chancellor was referring to the number of families claiming tax credits at the peak of the number of people claiming them, as a proportion of families with dependent children. He points out this would still be a flawed comparison. We took a look at the figures and came to the same conclusion.

Combining Census 2011 figures for England and Wales, Scotland and Northern Ireland gets us to about 7.6 million families with dependent children in the UK.

Meanwhile the number of families (whether in work or out of work) claiming at least one tax credit peaked in 2010/11 at about 6.3 million.

That means about 83% of families with dependent children were claiming tax credits at their peak in 2011. This is still some way off the 9 in 10 claim.

Of course this isn't a reasonable calculation either because it includes families without children which only claim Working Tax Credit—about 550,000 at the 2011 peak. That sends us back down to about 76%.