Would average earners have to see their wages more than double to afford their first home?

This article has been corrected.

"Average earners in England would need to see their wage more than DOUBLE to afford their first home, shock research has found." The Mirror, 11th February 2014

Rising house prices and the difficulty faced by many in getting onto the housing ladder, particularly in the capital, is a topic which repeatedly catches the headlines.

Tuesday was no different as the Guardian, the Independent and the Telegraph reported that wages would need to double to 'keep up' with house prices, based on a new report published by Shelter into house prices since 1997.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

The Mirror went further, reporting that average earners would need at least double their wages to buy their first home.

Rising house prices and doubling wages

The Mirror cited the Shelter report in support of its headline, although the report actually focuses on something quite different: the change in the house price to earnings ratio over time.

It found that in 1997 the average house cost five times the average wage, at £75,562 to £16,500.

By 2012, that difference had risen to ten times, with the average house costing £253,816 compared to average wages of £25,932.

The data comes from the Annual Survey of Hours and Earnings, which shows the average weekly wage for all employee jobs, and official Land Registry figures on mean house prices.

The earnings data is based on a 1% sample of employee jobs (excluding the self-employed), while the Land Registry index excludes new builds. The latter is a significant omission since new builds are required by law to include some affordable housing, and are therefore a common option for first-time buyers.

Based on these figures therefore, the gap between wages and house prices has doubled compared to 1997, and it's fair to report that wages are not keeping up with house prices.

What does this tell us about affordability over time?

While the earnings-to-house-price ratio is often used as a yardstick for the affordability of housing, it isn't a perfect measure of how easy or difficult it is for first time buyers to purchase a home.

We often buy homes together with a partner; first time buyers probably don't buy 'average' houses; while the willingness of banks to lend can also inhibit or encourage the first-time buyer market. The Mirror's headline misses out these nuances.

So can we account for this? There are a variety of ways of measuring affordability of home ownership.

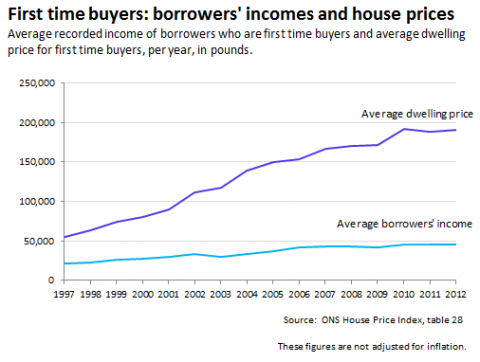

The ONS House Price Index charts the average total declared income of borrowers and therefore takes account the joint purchasing power of people who buy property together. It also reflects the average earnings of people who are actually managing to buy a house, rather than that of the total population.

It offers figures for all property purchases, but also focuses specifically on first-time buyers, which allows us to look more closely at the Mirror's wider point.

In 2012, borrowers who were first time buyers had, on average, an income of £46,000. They were paying four times that for their home. That compares to two and a half times in 1997.

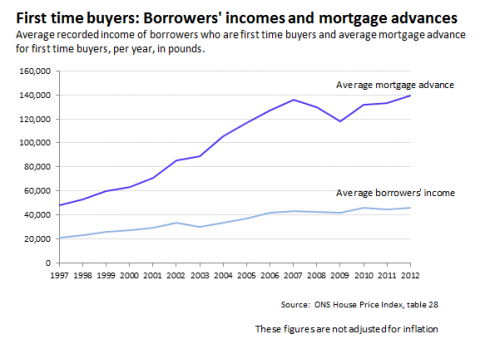

Another key factor determining affordability is the size of the mortgage that first-time buyers are able to secure. The data from the ONS shows us that first time buyers are now borrowing about three times their income to make their first purchase.

This also suggests that borrowers are now getting a larger mortgage for their salary - but what we don't know is how much deposit was needed to secure the mortgages and whether this has increased over time.

Clearly, variations in lending from mortgage brokers has a huge impact on the value of the deposit buyers need to secure mortgages, and their ability to buy a home.

Government schemes such as Help to Buy, introduced in April 2013, seek to ease the burden on people who are struggling to gather a large enough deposit to secure a mortgage. We won't know the full impact that this is having on the likelihood of potential first time buyers being able to buy their own place for a few years.

Conclusion

Shelter's research does not justify the Mirror's claim that the average earner needs their salary to double in order to buy their first home: an increase in the gap between wages and house prices is not the same as the shortfall that any individual prospective buyer would need to bridge. The numbers do however show a growing gap between wages and house prices, and other figures also show that buying property has become harder over the past fifteen years.

Originally the article mistakenly referred to the average mortgage advance as the average deposit - this has now been corrected.