Has the government dropped a £1,600 cost of living 'bombshell'?

Labour party on Facebook

According to Shadow Chancellor Ed Balls, one central fact defies the government's 'boasting' about economic recovery: "for most people in our country living standards are not rising, but falling year on year."

Even before the Chancellor of the Exchequer got to his feet for yesterday's Autumn Statement, the opposition were making traction on social media with their version of a now infamous Conservative attack ad. The message was simple: you're £1,600 a year worse off under this government.

The small print at the bottom clears up one point of confusion: the poster only applies to "you" if you're in work and on an average salary. Labour confirmed to Full Fact they totted up the loss by taking average weekly earnings figures from the Office for National Statistics and matching it with the Retail Price Index of inflation (RPI).

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

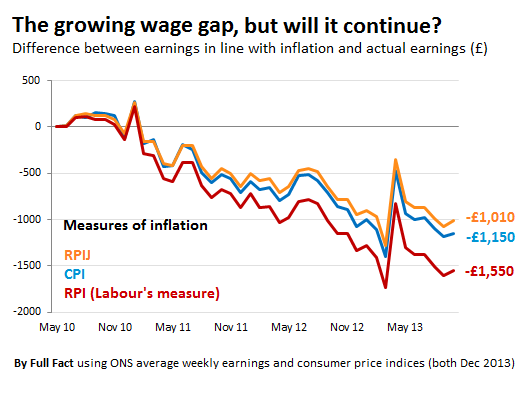

In these terms, Labour's figure is accurate. Average annual wages have gone up 6% from £23,348 a year in May 2010 to £24,700 a year in September 2013. But inflation has gone up faster. Labour's chosen measure (RPI) has risen by almost 13% in the same time.

Had wages risen in line with RPI inflation since the election, average earnings would be £26,312 today: about £1,600 more than is being earned in reality.

But...

What a difference an index makes

There's no one way to measure inflation. The ONS goes about measuring consumer inflation by taking a 'basket' of goods and tracking how the price of the basket changes over time. This is an average that applies to everyone - in reality we all have our own unique level of inflation based on the particular things we choose to buy.

Labour's chosen measure - RPI - is no longer considered robust enough by international standards and so a new version - RPIJ - is currently being piloted. The differences are purely mathematical, but the outcome is that inflation comes out lower under RPIJ than RPI.

The ONS's other common measure of inflation - the Consumer Price index (CPI) - excludes from the basket things like housing costs and takes into account spending by pensioner households, unlike the other measures. The end outcome is again that inflation comes out lower under CPI than RPI.

If Labour had used RPIJ to determine the real change in the average wage, the result would have been that working people would on average be £540 'better off' than appears to be the case with RPI. While this claim is less striking, there is good reason to think that RPIJ offers a more accurate picture than RPI does: The ONS withdrew RPI this year because, in the Financial Times' economics editor's words, "when prices do not change, the RPI will normally show positive inflation."

It's also important not to lose sight of what the numbers don't tell us. Taxes, benefits and public services all have an impact on how 'well off' people are as well as wages, as the ONS demonstrates in its regular household incomes release. Economists at the Institute for Fiscal Studies and elsewhere have built their own models that factor in these extra sources of income, and these might give a more complete picture of what has happened to living standards since 2010.

UPDATE 8 Dec 2013: Originally this article said "Had wages risen in line with RPI inflation since the election, average earnings would be £26,312 a week today." Unfortunately, that's actually the projected figure for average annual earnings.