Do pensioners lose 29% of their income in tax?

On Friday, the Daily Mail and the Daily Express reported that, on average, a third of the income of a retired household is being sucked away by the taxman. Overall, they claim, Government coffers are bolstered by nearly £42 billion from the contribution of older taxpayers.

What is more, the poorest are the worst hit, with over 40% of the lower income hoovered up by the Treasury, according to the stories.

These figures can be traced to an analysis by MetLife, a large insurance provider, whose latest analysis bolsters the claims in both articles stating clearly:

"Tax takes a 29 percent bite worth nearly £42 billion out of pensioner income. And the bill rises to 42% for the less well-off."

But what is the context of these figures? And what do they mean?

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

MetLife's statistics come from an analysis of the latest Wealth and Assets Survey, released by the Office for National Statistics (ONS) earlier this month. The figures can be found in "the effects of taxes and benefits on household income 2010/2011", a statistical bulletin comparing the loss of income for both retired and non-retired households through taxes.

Using the survey, we can provide a breakdown of the income and tax loss for the average retired household.

Retired household income and taxes

The income of an average retired household comes through two main channels: original income and cash benefits. On average, a household will receive £10,153 of original income a year, composed of any private pension and annuities or investments the household may have.

On top of this, an average retired household would receive £9,977 worth of "cash benefits" provided by the state. The majority of this chunk of money (£7,682 of it) will be from the state pension, with the remaining £2,295 composed of various smaller benefits such as winter fuel payments and widow's benefits.

Overall, therefore, the average retired household has a gross income of £20,130 per year pre-tax.

Direct tax includes income and council tax, which on average claims 12.2% of a retired household's income, or £2,456 a year.

The amount of indirect tax a household pays depends on their expenditure rather than on their income, as it is taken out of the cost of consumer goods and services. These can include duties on alcohol and tobacco, VAT, motor vehicle duties and TV licenses, and on average, a retired household will lose 16.8% of its income through these means, totalling £3,408 a year.

Overall, therefore, the average retired household will live on a post-tax income of £14,266, which is indeed the result of a 29 per cent bite out of their gross income pre-tax.

The total amount of indirect and direct taxes lost per average household can be multiplied by the number of retired households (7.15 million) to give a total figure for the sums taken in tax, which, as MetLife and the two articles report it, totals £41.9 billion.

Non-retired income and taxes

To give some perspective on these figures, it will be useful to compare what the average retired household paid in taxes compared to the average non-retired household.

The average non-retired household (which nominally consists of 2 adults and seven tenths of a child) had a gross-income pot of £44,330. From this, £9,322 was taken in direct taxation and an extra £5,939 was lost from indirect taxes. This means, between 2010 and 2011, the average non-retired household lost 21% of their gross income in direct taxes and 13.4% in indirect taxes.

As we can see, a retired household will lose a greater chunk of their gross income to indirect taxes compared to a non-retired household, although far less via direct taxation.

Inequality of income and tax distribution

To further expand on this, we can consider how the poorest of the retired households are hit by taxation.

MetLife's statistics are correct: retired households with an income in the bottom decile on average receive £8,259 a year and lose a total of £3,598 of this in indirect and direct tax. The poorest households therefore lose 44 per cent of their gross income in this way.

However, as we saw above, a retired household shells out much less in direct taxes and the ONS survey points out the significant redistributive effect direct tax and cash benefits have on the income of retired households.

Even though the poorest households seem to lose a large proportion of their income through taxes, overall, the addition and subtraction of cash benefits and direct taxes equalises the income of retired households more effectively than in unretired households.

It is the high price of the indirect taxes which means that the poorest retired households contribute a greater share of their income to thr Treasury than the richest retired households.

Indirect taxation over the years

The Daily Express and Daily Mail point to recent phenomena such as rises in VAT and fuel prices, as reasons for why the indirect taxation burden on older households is particularly heavy at the moment.

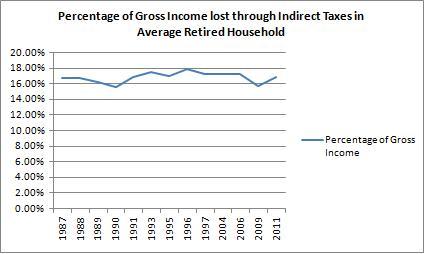

But is this contribution unusually high by historical standards? The graph below shows the results for every Office for National Statistics publication on this topic since 1987:

As we can see, although the period 2010 to 2011 showed a sharp increase in the impact of indirect taxation on a retired household's gross income, it is by no means the highest rate in recent years lower than the amounts typically taken out of their budgets during the 1990s and 2000s.

Unsung benefits

There is however another side to the ledger in the benefits-in-kind received by pensioners, unmentioned by the newspaper articles or MetLife. After both indirect and direct taxes are taken off the rolling total of pensioner household income, the ONS Survey calculates the significant benefits retired households receive from the NHS.

Estimating the monetary value of this service per annum (which is very similar across the income range), the ONS estimates that the average retired household received NHS services worth £5,598 between 2010 and 2011. If we factored this into the equation therefore, then pensioners might not be getting such a raw deal from the taxman.

Conclusion

The Daily Mail and Daily Express have correctly reported the analysis of an ONS survey done by insurer MetLife.

The average retired household will lose 29% of their income on indirect and direct taxes, and the poorest decile, will lose 44 percent, with the difference largely due to the impact of indirect taxes such as VAT and fuel duty.

Despite this however, the proportion of the average retired household's income lost to these indirect taxes is still relatively low compared to previous years and if we put a monetary value on the provision of NHS services the net loss to taxation for pensioners doesn't seem so severe.