Labour's VAT poster: untangling the confusion

Last week Labour released a new poster ahead of this month's European and local elections, which accused the Coalition government of adding £450 to shopping bills by raising VAT from 17.5% to 20% in 2011.

The poster has come in for criticism from some quarters, and Shadow Foreign Secretary Douglas Alexander was forced to defend the campaign when he appeared on the Sunday Politics Show at the weekend. However the discussion did little to clarify the facts and fictions behind the poster.

Which goods are subject to VAT?

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

One question asked by interviewer Andrew Neil was which of the goods portrayed on the poster were actually subject to VAT. While Douglas Alexander conceded that the poster was "representative of a weekly shop" rather than a basket of VATable goods, the question was never fully answered.

According to HMRC, "food and drink for human consumption is, in general, zero-rated" when it comes to VAT, meaning that consumers won't pay any money to the taxman when buying these goods.

However this only applies to food considered to be essential. Alcohol, fizzy drinks and confectionery, all of which feature on the poster, are charged VAT at the standard rate of 20%.

Where the £450 bill comes from

A more keenly contested point of contention was whether or not Labour's £450 figure was realistic.

Andrew Neil claimed:

"For an average family to pay £450 a year extra in VAT, they'd have to spend £21,600 a year on VATable products at 20%. The average take-home pay is only £21,000."

In response, Douglas Alexander disputed that the £450 was an "annualised figure", claiming instead that the Coalition "increased VAT early in this Parliament and there's a figure that's calculated over the course of [the remaining four years of] this Parliament."

In fact this isn't correct. We looked at the figure when Labour first made the claim back in 2011, and found that it used Treasury estimates of the impact of a 1% increase to the VAT rate to the amount paid by an average couple with children.

This data suggested that a 1% rise in the rate of VAT would cost such a family £180 extra per year, from which Labour extrapolated that a 2.5% rise would cost £450 per year.

The effect on consumer spending

Mr Neil calculates that consumers would need to spend £21,600 per year on VATable goods to be incurring a £450 rise from 2011's 2.5% hike.

If you pay £120 for every VATable good, £100 of that will have been the base price and £20 will have been VAT (at 20% VAT rate). If VAT goes up by 1%, you pay £1 more per product than you used to (you're now adding £21 on to the base price).

Working backwards, then, if you're supposedly paying an extra £180 a year when there's a 1% increase in VAT, you'd need to times that figure by 120 to get the total amount you've been spending on VATable goods. In this case, that's £21,600 in total spending.

So how can this be when average take home pay is, according to Mr Neil, just £21,000?

While we can't trace the £21,000 quoted, the most recent available figures from HMRC (for the tax year 2011/12) suggest that Mr Neil is in the right ballpark: median post-tax pay was approximately £18,000, while mean post-tax income was just under £24,000.

The effect on couples with children

Importantly however, these figures are for individuals, while Labour's VAT claim refers to another group: couples with children. In effect therefore, we're talking about the spending patterns of two adults and any costs associated with purchasing VATable goods for children.

It's difficult to identify take-home pay for these families alone. The ONS does record that average household disposable income is around £30,000, rising to over £34,000 if we look only at non-retired households.

However not all of this money is spent on VATable goods and services, or indeed at all. The latest published estimates from the ONS (for 2009/10) found that the average household spends £23,614 each year, of which £13,177 is VATable.

So why is this figure so different from the one put forward by Andrew Neil?

Firstly, there may be some problems associated with extrapolating an annual spend on VATable goods from the Treasury's estimates of the impact of a 1% rise. Doing so assumes that consumers spend the same amount on these products regardless of the rate of VAT, which is unlikely to hold true in practice.

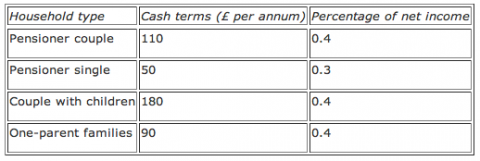

However even leaving this aside, there is some evidence that couples with children might spend more than other household types. While we don't have access to the Treasury's methodology so can't comment on how the estimates that underpin Labour's figure were arrived at, it is worth noting that a number of different household types were modeled with very different results.

According to the Treasury's model, single pensioner households, which account for 14% of all households, would see their VAT bill rise by £50 in the case of a 1% rise (which implies annual VATable expenditure of £6,000 using Mr Neil's method).

Single-parent households, which account for a further 11% of households, would see their's rise by £90 (giving an implied spending of £10,800 per year on VATable products).

This suggests that the level of spending implied by the Treasury estimates might not be entirely out of line with the recorded average household expenditure on VATable goods of just over £13,000.

However Labour has chosen the most extreme case modelled by the Treasury: couples with children, who account for around a quarter of all households. The poster Labour has publicised doesn't make this clear, saying only that £450 will be added to "your bill". If you are a typical single pensioner, this is unlikely to be accurate.