Non-doms and tax: what we know

The recent spate of claims about 'non-doms' started with a speech by Ed Miliband, where he called on the Prime Minister to abolish an "arcane, 200 year-old loophole" that he claimed cost the UK "at least hundreds of millions of pounds".

Ed Miliband was talking about how UK taxpayers are taxed on foreign income. It's usually a simple case of determining whether someone is resident in the UK. If they are, they normally pay tax on all their income, whether from the UK or abroad. If they're not a UK resident, they usually only pay tax on their UK income.

But the idea of non-domiciles adds an extra complication.

What it means

The concept of domicile determines a person's permanent residence, not just where they happen to live now. Instead of your permanent residence being the country in which you live and work, 'domicile' can mean that you reside in one country but consider your permanent home as being in another.

When it's relevant

Domicile becomes relevant in a number of situations including marriage, divorce and tax. If you reside in the UK but are not domiciled here, you might not be liable to pay taxes on your foreign income, so long as you don't bring it into the UK.

How domicile is established

That's the complicated part. The general rule is that you inherit your father's domicile: the country he considered his permanent home at the time you were born. There are also exceptions under which you inherit your mother's domicile.

After reaching the age of 16, you can change your domicile by proving that you have an intention to permanently and indefinitely reside in the country you consider your new domicile.

Non-doms and numbers

Ed Miliband has promised to reduce the number of people who can use non-dom status to avoid paying tax in the UK, a situation which he said isn't fair or just.

George Osborne reportedly responded by saying that Labour's plans were simply "tinkering around the edges" of the rules for non-doms. The Liberal Democrats responded with the following claim, also repeated by the Guardian earlier this year.

"Non-dom numbers exploded under Tony Blair and Gordon Brown"—Danny Alexander, Liberal Democrat Chief Secretary to the Treasury, 8 April 2015

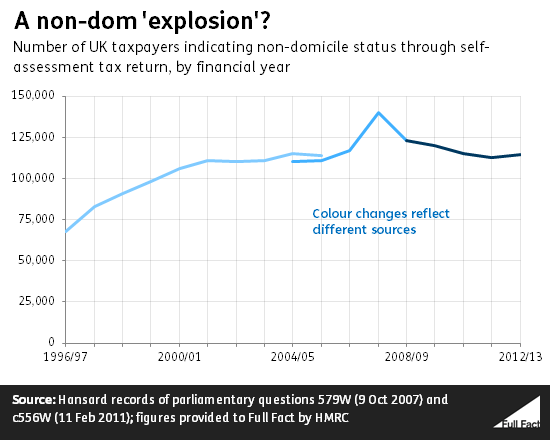

This depends on your interpretation of the figures, and of the claim. The number of UK taxpayers indicating non-domicile status roughly doubled under Tony Blair's premiership, provided you compare the last year under the Conservative government (1996/97)—with almost 70,000 reported non-doms—with the year that Mr Blair left (2007/08) with an estimated 140,000.

But 2007/08 was the year that the number of non-doms peaked, and by the end of Labour's time in office in 2010, the figure had fallen back to 115,000, as far as the published figures indicate.

This doesn't count all non-doms though. The graph shows only those non-doms who actually declare their status for tax purposes. If someone with non-dom status gets less than £2,000 per year in foreign income or gains, it's likely they won't need to register using a self-assessment tax return, so won't be included in these figures.

HMRC has previously been quoted as saying there are a "significant number" of non-doms who don't show up in the figures.

So the true number of non-doms will be higher than shown here. But for the purposes of claims about non-doms and taxation, these figures give us a good idea of the scale.

We do know a little about what these non-doms pay in tax (at least those who declare on a Self-Assessment form). In 2011/12, the government collected £8.5 billion in tax from non-doms in the UK, according to figures given to us by HMRC, based on a previously published freedom of information request. That's about £76,000 per person in that year.

Will it cost or save money?

The Institute for Fiscal Studies (IFS) has investigated the potential financial costs and benefits of Labour's policy, as far as the details currently available allow. A lot depends on how non-doms ultimately respond to the reform. The IFS says the proposed change could cost the Exchequer revenue if a lot of people leave the country altogether. On the flipside, if there's less response of this kind additional revenue of £1 billion or more "may be achievable". In summary it says:

"Whether it would raise much, if any, revenue is uncertain: we do not know full details of the policy, full details of non-doms' overseas income and assets, or how non-doms would respond to the reform."