Will 9 out of 10 working households be better off this month? You'll have to ask the Treasury...

*The title of this piece is updated to include 'working'

April is set to be the 'all change' month of this year, at least as far as taxes and benefits are concerned. Yesterday saw reductions in Housing Benefit for certain properties with spare rooms and a change in the way crisis loans and community grants are funded. A series of further changes will come into force over the rest of the month.

The Chancellor's speech today outlines some of the changes, including the rollout of Universal Credit to replace a series of benefits, Personal Independence Payment (PIP) replacing Disability Living Allowance, a cap on the increase and total benefits working-age people are entitled to, and an increase in the income tax personal allowance from £8,105 to £9,440.

The key message from the speech, picked up by most national news outlets was clear:

"This month, 9 out of 10 working households will be better off as a result of the changes we are making... And the average working household will be better off by over £300 a year."

It might sound unusual to read that the vast majority of people are going to be better off this month in the context of the Government's work in reducing the national deficit, but as the Institute for Fiscal Studies (IFS) explained on today's World at One programme, the personal allowance increase will account for much of the good news in spite of some benefits restrictions.

But where do the Government's numbers actually come from?

The Treasury haven't published anything other than the speech itself on their website, and after Full Fact enquired as to where this figure was from, the department was unable to provide any detail of any sort. The Office for Budget Responsibility (OBR) - who are tasked with scrutinising the Treasury's costing of budget measures - were unavailable to enquiries.

It's likely - as the IFS informed us - that the Treasury's estimate comes from some form of 'micro-simulation model' which isolates the tax and benefit changes coming into effect this April for working-age households alone.

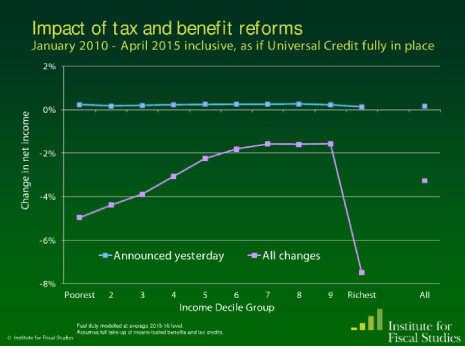

Given that the figures only concern this month, this has given rise to criticism from Labour and others that this is only a partial picture in the grand scheme of things. The IFS's own post-budget briefing last month gives some illustration of this:

However, given that the Treasury would not provide any information, source or detail, this means that readers are effectively being asked to trust the Chancellor's claim with no clarification of what the actual numbers are and no way of checking the facts for themselves.

Update (3 April 2013)

The Treasury have today provided Full Fact with more information about the claim. It gives away more specifics on the Chancellor's speech yeaterday, but still leaves us none the wiser as to how it's all been calculated:

"around nine out of ten working households (around 14 million households) will be better off by on average almost £300 a year

"a typical working couple with two children will be over £400 a year better off (this is based on one person earning 27.8k full-time and the other 13.7 part-time, which is typical for this type of household)

"a typical family with a single earner and two children will be around £90 a year better off (this is based on one person earning 26.4k full-time, which is typical for this type of household)- a couple on the minimum wage with two children will be around £360 better off (this is based on each person earning 12.9k full-time)

"an out of work couple without children will lose about £150 a year."