How much do pensioners' benefits cost?

"Spending on universal benefits for the elderly (the Winter Fuel Allowance, free prescriptions, free bus travel and free TV licenses for the over 75s) reached roughly £4 billion in 2010/11."

Nick Boles MP, Speech to Resolution Foundation, 10 July 2012

"[Benefits for pensioners] are estimated to cost £5bn a year."

Independent, 10 July 2012

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

"The winter fuel allowance costs between £2bn and £3bn a year, typically (it depends on the weather), while TV licenses for those over 75 cost around £550 million. Once you add free bus passes and the like, the total cost comes to around £5 billion."

The Telegraph, 7 June 2012

Conservative MP and close ally of David Cameron Nick Boles received considerable media coverage yesterday after he proposed to means-test benefits for pensioners, which would see the richest lose out on certain perks.

The suggestion is seen as controversial because the Coalition Agreement explicitly stated: "We will protect key benefits for older people such as the winter fuel allowance, free TV licences, free bus travel, and free eye tests and prescriptions."

Mr Boles argued that in a time of economic difficulty, this should be reviewed. But are these benefits placing a £4 or £5 billion burden on taxpayers every year?

Analysis

Costing only those measures mentioned by Mr Boles - Winter Fuel Allowance (WFA), free prescriptions, free bus travel, and free TV licenses - proves simple in some places but quite difficult in others.

The Department for Work and Pensions (DWP) make life simple, providing figures showing annual expenditure on the WFA and free TV licenses. They tell us that the WFA cost the Government about £2.15 billion in 2011/12, with free TV licenses setting the DWP back £578 million.

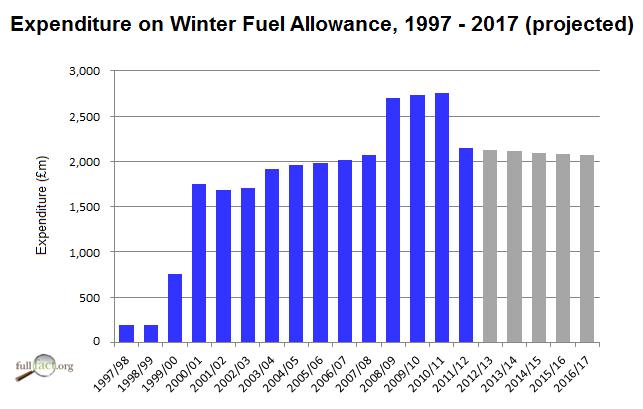

It's worth bearing in mind that Winter Fuel Allowance costs have varied greatly since their inception in 1997. Presently households where the oldest person in under 80 receive £200, or £300 if that person is older than 80, whereas before 2000 only up to £50 was available.

From 2008 to 2011, the WFA cost the government as much as £2.7 billion due to additional one-off payments available of up to £100 - hence total costs have occasionally approached the £3 billion mark:

The cost of free bus passes, however, has to be sourced from the Department for Transport (DfT). They don't regularly publish costings as the DWP do, but a parliamentary answer from Transport Minister Norman Baker confirms the DfT estimates concessionary travel cost just under £1.1 billion in 2011/12 (although this figure includes travel for older and disabled passengers).

The cost of free prescriptions doesn't seem to be available, however, as confirmed by Pensions Minister Steve Webb last year.

In spite of this, the total cost of free bus passes, free TV licenses and the WFA comes to £3.8 billion. Prospectively, the costs of free eye tests and prescriptions will take this cost considerably higher.

What can be saved?

Nick Boles's suggestions yesterday are not new. The Environment, Food and Rural Affairs Committee proposed in 2009 that the WFA should be removed from over 200,000 higher-rate taxpayers, and for WFA to be taxed for basic-rate taxpayers. The Government estimated that this combined effect would save around £250 million a year.

More recently, last year the Institute for Fiscal Studies (IFS) proposed removing the WFA to all pensioners except those receiving the Pension Credit benefit.

The DWP statistics confirm that there were 12.65 million recepients of WFA in 2011/12 and 2.6 million recepients of Pension Credit. If all those receiving Pension Credit took the same rate of WFA as those not on the benefit, this amounts to a saving of £1.7 billion. The IFS estimate this saving slightly lower, at £1.4 billion, which could well employ a more detailed analysis.

Conclusion

While not all of the figures are readily available, the statistics on Winter Fuel Allowance, free TV licenses and free bus passes support a costing of at least £4 billion.

The amount that could be saved by restricting these benefits obviously depends on the policy. A Winter Fuel Allowance tax introduction for basic-rate payers and abolition for high-rate taxpayers is estimated to save £250 million alone. Meanwhile restricting the benefit to only those on Pension Credit, as suggested by the IFS, could save in excess of £1.4 billion.

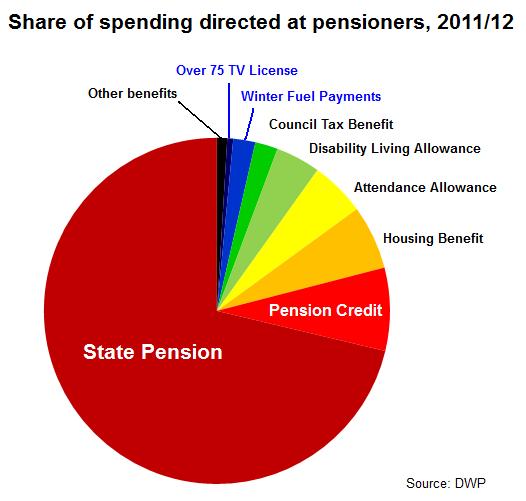

In context, of course, the amount spent by the government on winter fuel payments is dwarfed by other benefits measured by the DWP, even if pensions are excluded.