Budget 2012 Survival Guide: What is a big number?

How do you know whether to be impressed by a budget announcement? It isn't as hard as it seems. Simply asking whether a number is really that 'big' can help us understand how impressive a budget announcement really is.

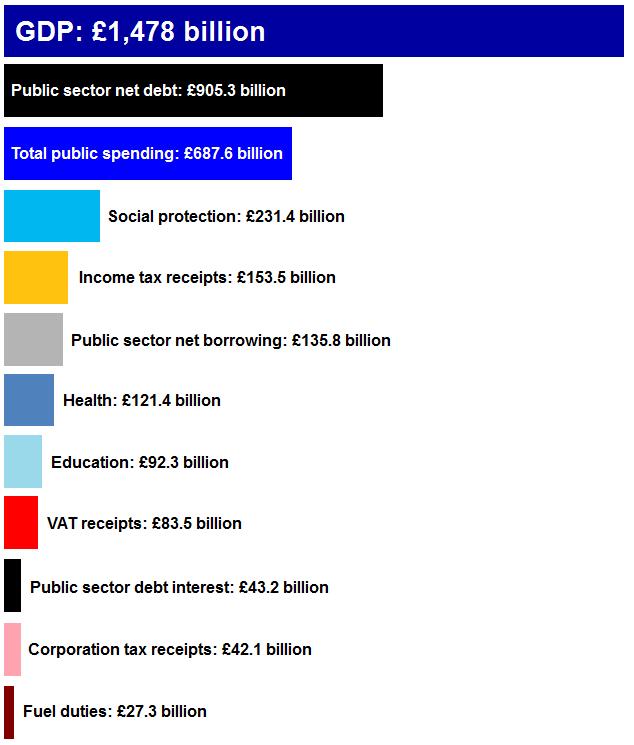

There are two ways of doing a quick check: first, how does the number compare to government spending overall? Second, how much money is it per person? Here are the numbers to help provide that sense of scale, or scroll down to use our calculator tool.

A drop in the ocean?

Last year, for instance, the Government pledged £2 billion extra funding for a Green Investment Bank, and £100 million for pothole repair. But let's see how these kinds of projects compare to the Government's more hefty price tags:

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

* Approximate figures for 2010/11 from the Treasury, Office for National Statistics (ONS) and HM Revenue and Customs (HMRC). (Public sector net debt and borrowing exclude temporary financial interventions such as establishing public ownership of UK banks. Including these takes UK public debt to £2,250 billion, or 150 per cent of GDP. It also takes borrowing up to £109.5 billion.)

Budgets are often filled with changes in tax duties for fuel, beer, tobacco, wines and spirits. Last year, fuel duty was reduced by one pence per litre and wine, beer, spirits and tobacco rose by two per cent above inflation.

In the grand scheme of things, however, these deal with small numbers compared to the public purse. Fuel duties bring in the most money out of these at £27.3 billion, but that is less than two thirds of the money spent on repaying interest on public debt.

Numbers on a human scale

The team behind Radio 4's More or Less programme on statistical abuses likes to ask how much a sum of money means for each of the people actually affected.

Michael Blastland and Andrew Dilnot, creator and first presenter of the show, tell in their book of how they investigated a decision by the Labour government in 1997 to spend £300 million over five years to create a million new child care places. That, they calculated, was £300 per place, £60 per place per year, or £1.15 per child per week—not a lot of money for child care.

So how can we apply their technique to other claims?

- First and foremost, there are 62.3 million people in the UK - that's the starting point for something that affects us all

- We live in 26.3 million different households - so divide any amount affecting everyone by this for the household impact

- There are 12 million married couples - any changes to marriage tax need to account for these. 4.5 million of these have dependent children.

- Any changes to state pensions would affect the 12.6 million people who are currently in receipt - a figure likely to grow in the coming years as the population continues to age.

- As for taxpayers, there were around 30.6 million in the 2010/11 financial year.

- 890,000 companies pay corporation tax too.

We'll be tweeting during the budget to put some of the figures into perspective so follow @FullFact to stay on top of the news.

Try our calculator tool to do these sums for you. Plug in your number and see what it means per head: