Does the government subsidise airlines by £10 billion?

"Aviation is actually subsidised in this country to the tune of £10 billion every single year, because aviation doesn't pay tax on fuel for example, it doesn't pay VAT on its tickets."

Caroline Lucas, Question Time, 19 January 2012

On Question Time on Thursday, Green Party Leader Caroline Lucas alleged that the aviation industry in the UK is being subsidised in the form of fuel tax and VAT exemptions by some £10 billion. What is the evidence for this figure?

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

Analysis

The claim appears in a Green Party report and briefing in 2003. Both documents cite a 2003 report entitled "The Hidden Cost of Flying" by Brendon Sewill, an environmental campaigner.

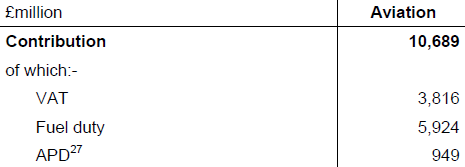

In the report, Mr Sewill calculates that implementing fuel tax at the same rate as private fuel tax would cost the aviation industry £5.7 billion, adding VAT to the cost of tickets would add £4.0 billion to the cost, and the abolition of duty free would cost £0.4 billion. Deducting the contribution that air passenger duty (APD, worth £0.9 billion, which would no longer be necessary) makes to the Treasury, he calculates that the eocnomy could potentially be missing out on a contribution of £9.2 billion per year.

In a later report in 2005, Mr Sewill notes that the 2003 Volterra report for BAA appeared to confirm his calculations. Volterra's calculations appear below:

Since both reports were produced, the aviation industry has expanded significantly and VAT has risen to 20 per cent. Both could have had an impact upon the figures.

However, Volterra calculates the average cost of a ticket to be £136, with 182 million passengers according to the Civil Aviation Authority. At a VAT rate of 20 per cent added to the cost of the ticket and assuming the same number of passengers, this would raise £4.95 billion. Added to the older figure for fuel tax, this amounts to a tax exemption of £10.65 billion.

It is worth noting however that these analyses assume that the addition of new taxes to airline tickets would not have an impact upon the demand to fly. Whether or not this is the case in reality might depend upon the extent to which airlines passed on these new costs to the customers, however the Institute for Fiscal Studies has noted in the past that changes to VAT do have an impact upon levels of cunsumer demand.

Problems

When we got in touch with Caroline Lucas's office we were told that the £10 billion figure was a "Government figure" - although the link they provided us with was to a letter in the Guardian. This stated:

"The Treasury in 2008 estimated part of this tax subsidy received by aviation: "Were the UK to charge a fuel duty and VAT on tickets, this could result in revenues of around £10 bn [per year].""

However that the figure has been used by government is seemingly confirmed by a Department for Transport response to the 2007 consultation on the Aviation Emissions Cost Assessment.

The value of this estimate was however questioned by the Transport Committee in 2010, who noted that:

"it ought be relatively straightforward to provide a factual account. We asked for this, but did not receive one. It would be helpful if the Government clarified this issue with a statement of the revenues raised, the extent of any tax exemptions and how these compare to the social and environmental costs of aviation. As part of this clarification, the Government needs to explain the basis for its earlier statement that an additional £10 billion might be raised if VAT and fuel duty were applied to aviation."

The Transport Committee report also highlights some difficulties associated with describing these examptions as subsidies (and indeed it notes that, unlike rail and bus travel, "airports and airlines receive virtually no subsidy."). In fact these perks are better described as tax breaks (i.e. money that isn't collected by HMRC, rather than public funds made available to the industry).

To complicate matters further, there are a number of historical and legal precedents for the aviation industry's tax exemptions. For example, the 1947 Convention on International Civil Aviation specifies that aeroplanes should be exempt from fuel duties, while in the UK all forms of passenger transport are zero-rated for VAT.

Conclusion

So while the £10 billion figure has been widely used - both in government and by others - to describe the savings that the aviation industry enjoys as a result of its VAT and fuel duty exemption, questions have been raised about the details.

Government itself hasn't provided the specifics behind itsz use of the estimate, while the breakdowns we have seen from Volterra and Brendon Sewill are now slightly dated.

Update: 26 January 2012

Brendon Sewill has been in touch with us to point out that the Treasury responded to the Select Committee's request for more information. According to their response, the figure of £10 billion is rounded and calculated from a 2008 Office for National Statistics figure on the amount spent on air travel (£13 billion), combined with Department of Energy and Climate Change figures on air fuel consumption (16 billion litres of fuel). They give rounded figures for the potential tax of £2 billion (VAT) and £8.5 billion (fuel duty) respectively.

Full Fact has found updated DECC figures for fuel usage which state that during 2010, 11.2 million tonnes of fuel were used in the aviation industry. Jet A fuel has a density of roughly 0.82kg/l, suggesting that 13.62 billion litres were used. The figure is likely to be lower than in 2008 due to the effects of the economic downturn and improvements in aircraft efficiency. If fuel duty were applied in the same way as for unleaded petrol (currently 0.5795 £/litre, although due to be raised to 0.6097 £/litre in August) this would raise £7.89 billion.

The ONS has also released updated figures for consumer spending, showing that in 2010 £12.4 billion was spent on air travel. Applying the current VAT rate of 20 per cent, this would raise £2.48 billion. Added together, if VAT and fuel duty were applied to the aviation industry, this would raise £10.37 billion.

Further data for the financial year 2010/11 shows that £2.16 billion was raised by Air Passenger Duty, resulting in a net figure of £8.21 billion.

-----

Image on homepage © Crown copyright 2012