Does the UK have the highest fuel duty in Europe?

"Britain charges the highest rate of fuel tax in the EU."

The Sun, 21 August 2012; also reported in other media outlets

On the 1 January 2013 motorists will have more than just the frivolities of the previous night to give them a sore head as the New Year will see fuel duty rise by 3.02 pence per litre.

This move (originally planned for August 2012 but subsequently postponed) has received widespread criticism; with motoring groups and the media outlets pointing out that the UK already has the highest rate of fuel tax in the EU.

Full Fact decided to have at a look at the figures to make sure that the claim stood up to scrutiny.

Analysis

The most recent data on fuel prices was released by the EU earlier this month and makes for some interesting reading.

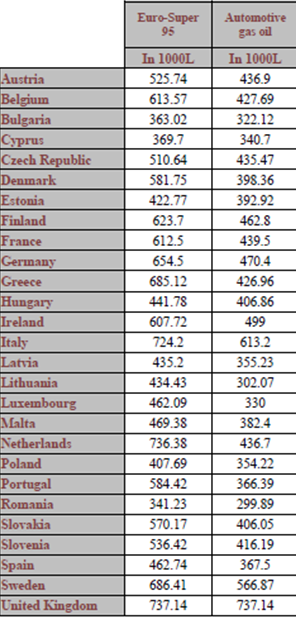

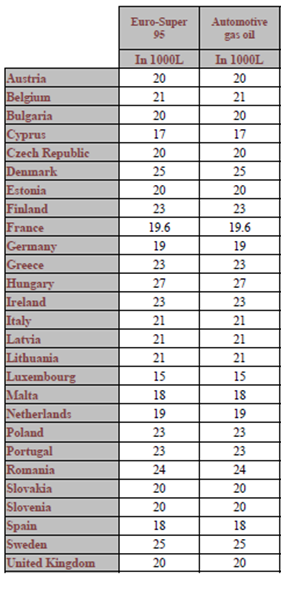

The tables below present the relevant data for the 27 countries of the EU (as of 13 August 2012) with all prices converted into euros. Euro-Super 95 is each member state's equivalent of standard unleaded petrol and automotive gas oil is the equivalent of diesel:

Comparing the EU states

We can see that the UK had the highest indirect fuel duty for both petrol and diesel of all EU members and thus can be said to have the highest rate of fuel tax in the EU.

It is interesting to note that the market price of fuel in the UK is considerably less than the EU's weighted average and thus the high price of both major transportation fuels can largely be attributed to the duty paid by motorists; especially as the UK has a fairly normal level of VAT for fuel by EU standards.

It is, however, also worth noting that this has not always been the case.

The House of Commons library presents similar data for 20 February 2012 (also taken from the EU but this time converted into sterling) and we can see that, in the case of petrol, both Italy and the Netherlands had higher fuel duty rates than did the UK:

So going on the most recent EU figures, it is seemingly indisputable that the UK has the highest fuel duty for both petrol and diesel.

However we can't make a full assessment about the relative 'affordability' of fuel across the EU without accounting for different income levels across EU states. So although a British motorist pays 0.74 euros per litre fuel duty and a Portugese counterpart pays only 0.58 euros per litre, 0.58 euros could buy more in Portugal than it would in the UK.

So a more comprehensive assessment taking into account economic tools such as purchasing power parity would be required before more complex international comparissons could be made.

Conclusion

The UK does indeed have the highest fuel duties in Europe, although that doesn't necessarily translate into the highest costs at the pump due to the relatively cheap market price and an average level of VAT.

However actually determining the relative affordability of fuel at the pump as a proportion of incomes is another matter, and not explained by examining fuel pump prices alone.

---

Image courtesy of TaxFix.co.uk