Is Ed Miliband right about extortionate pension fees?

"I think there are real issues in the pension industry, because in parts of the industry people can see half the money they have paid in being taken in fees and charges and all of that."

"What you find in some parts of the [pensions] industry - not all parts, clearly - is that people are facing not 0.5%, which is the benchmark administration fee that we put forward in the government scheme when we were in government, but 4% or 5%."

Ed Miliband, 13 July 2012

Last week, during a Westminster lunch with journalists, Labour Leader Ed Miliband hinted that the 'next chapter' of scandals in the financial services sector would focus on overcharging by pension companies on schemes offered to employers and employees.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

As part of his case, he accused some parts of the pensions industry of charging 4 or 5 per cent annual administration fees on those enroled in schemes.

Not so, according to the Association of British Insurers (ABI) who claimed that Mr Miliband was "absolutely wrong" to imply that such rates were common in the industry.

Analysis

Readers who haven't yet experienced paying for pensions first-hand probably aren't familiar with what 'normal' administration fees levied by pensions providers actually are.

A good starting point is to look at the National Employment Savings Trust (NEST), a system set up by the Pensions Act 2008 to help low- and medium-income earners obtain low-cost pension provision.

When NEST becomes operational in October it will charge its customers on two fronts: there is an Annual Management Charge (AMC) and a contribution charge. The AMC takes away 0.3 per cent of the total pension pot accrued by the customer each year, and so grows nominally over time. The contribution charge takes away 1.8 per cent of the employee's own contribution to the pot each year.

Contribution charges are not ordinary in the pensions industry, with the NEST only using it to pay back the Government's large investment in the scheme. Most companies surveyed by the RSA think tank reported only levying an AMC and other administrative charges. The RSA points out that they nevertheless fail to disclose other costs, such as subcontracted services employed by the pension companies.

NEST's charges, for now, are the equivalent of a 0.5 per cent AMC. Ed Miliband's point on Friday was that some providers are charging 4 or 5 per cent in AMCs - obviously a much larger amount, but is it "enormous"?

How much is 5 per cent?

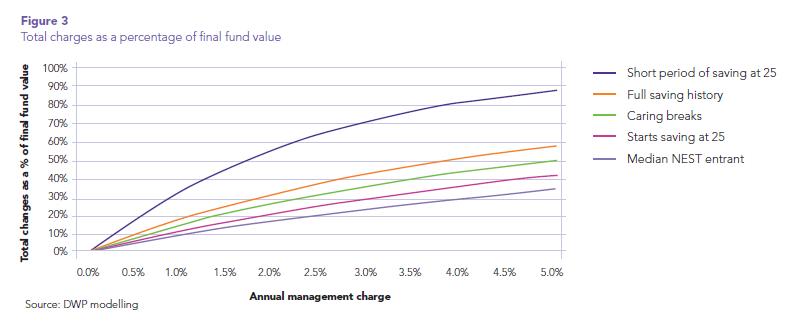

To define precisely what consitutes an 'enormous amount' requires a look at modelling done by the Department for Work and Pensions (DWP). As in the RSA's research, they calculate the estimated tangible effect that AMCs can have on the value of a final pension fund.

The table above demonstrates what proportion of a pension's final fund value can be siphoned off after certain AMCs are applied. There is obviously some variation depending on the point at which saving for a pensions actually starts, however most circumstances estimate between 30 and 60 per cent of a fund could be wiped out if costs were levied at 5 per cent.

This assumes no other charges are present, which means that the actual costs could be higher in some cases.

In any case, the potential costs of high administrative fees are certainly non-trivial. But how widespread are 5 per cent charges?

Is 5 per cent normal?

As the Times pointed out this morning and confirmed to Full Fact, one of Ed Miliband's 'extreme' examples used during the Westminster lunch was the 'Neptune Mid Cap fund', who were found by Which? in 2011 to have a total investment cost of 3.96 per cent.

This doesn't quite reach the '5 per cent' level quoted by the Labour Leader, but there are doubts over whether the Neptune example is really relevant.

Neptune's response to Mr Miliband's attack was reported in Money Marketing:

"A statement from the [Neptune] fund manager says the fund is a retail investment fund and not a pension fund, as reportedly described by Miliband."

In addition, Neptune argues that the Which? survey is already out of date, depite being carried out at the end of last year. Neptune claims that lower expense rates are now in place, and that the 4 per cent charge was the total cost to investors in the fund, taking account of the market costs of buying and selling its shares.

In essence, a small retail investment fund is not comparable to a pension fund.

In terms of positive evidence, the Association of British Insurers (ABI) weigh in with their own suggestion: they claim that their members charge, on average, 0.77 per cent in AMCs. Unfortunately, when Full Fact asked the ABI if they would provide the details behind this average, they declined to give us the data.

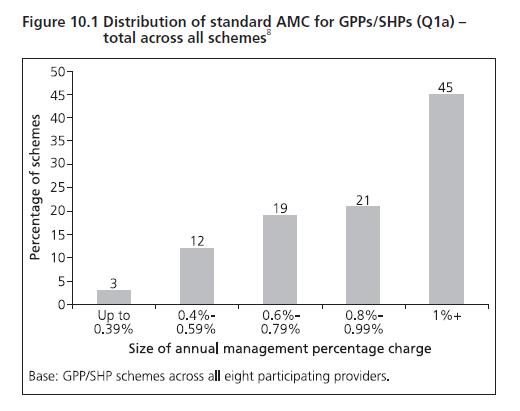

However the Department for Work and Pensions surveyed eight providers of a total 3,513 pension schemes in 2009/10, and was able to establish the normal AMC levied on each of the schemes:

[GPP/SHP refers to Group Personal Pensions and Stakeholder Pensions, the former being those schemes designed for groups of employees or self-employed peoplewho share personal schemes, and the latter referring to schemes required by companies who do not provide their own schemes, and which impose caps on how high the AMCs can get, at 1-1.5 per cent. For this reason, the DWP's estimate is not comprehensive and may be downwardly affected by the Stakeholder Pension data.]

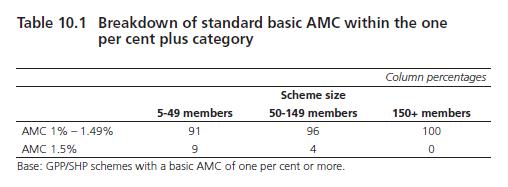

The graph shows that over half of all the schemes sampled had AMCs of less than 1 per cent. As for the 45 per cent in the 'one per cent plus category', the DWP are kind enough to break these down too:

Even in this category, over 90 per cent fell between 1 and 1.5 per cent AMC, while only a small proportion levied at over 1.5 per cent.

While the data is imperfect, it does suggest that pension charges as high as 4 or 5 per cent are extremely rare cases - if they can be found at all. Until we have more information from Ed Miliband, there seems to be little evidence for this.

Conclusion

What may seem at face value to be a fractional difference in pension administration costs can add up to considerable losses for savers over the lifetime of a scheme.

The higher rates quoted by Ed Miliband, which he claims can 'wipe out' pension pot values, are best examined against the modelling from the Department for Work and Pensions. 'Annual Management Costs' of five per cent can take off nearly half the value of a pot by the time a saver reaches retirement.

However the evidence for the existence of schemes that charge such high rates appears to be scant. The example quoted by the Labour Leader does not seem to be a pension fund at all, but a retail investment fund, so different circumstances are likely to apply. In addition, evidence suggests that, even if there are schemes out there charging this much, they are clear anomalies. Most schemes seem to offer administrative costs of beneath one per cent.

However whether this accounts for the 'hidden' charges highlighted by the RSA think tank is another matter. For now, savers would do well to check how much they're paying and ensure their rate is better than the alternatives.