Was the rise in Child Tax Credit the biggest ever?

"There is going to be a £255 increase this year, which is the largest ever increase in Child Tax Credits, and there will be a further £135 increase next year, at an increase of 5.2 per cent".

David Cameron, Prime Ministers Questions, 30 November 2011.

The announcement accompanying this week's Autumn Statement that Child Tax Credits would not be increased at a higher rate than inflation came as a blow to many families hoping for a greater increase to their family budget.

Mr Cameron asserted the change still offered a fair increase, and represented the largest increase to child tax credits since the system began in 2003.

Is this an accurate claim?

Analysis

The Autumn Statement announced the child element of the Child Tax Credit (CTC) would be uprated in line with the Consumer Prices Index measure of inflation in 2012-13, rising by £135 per year in 2012-13.

The 2012-13 CTC was due to have an above inflation increase of £110, which has now been scrapped.

So, is £255 the largest ever increase to Child Tax Credits?

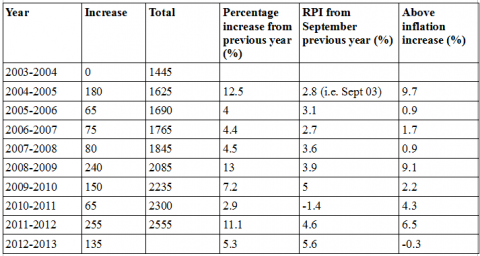

First one needs to consider the annual changes to Tax Credit rates from 2003 to 2012 which can be found on the Revenue Benefits website (a partnership between the Low Incomes Tax Reform Group and the rightsnet website).

Secondly, to offer a real-term analysis of the annual increase it is important to compare these increases to the changes in inflation each year.

Tax credits and benefits tend to be uprated in April each year based on the rate of inflation from September the previous year. Until this year, inflation was measured on the Retail Prices Index and the Rossi Index. This April it was announced that benefits and tax credits would be uprated using the Consumer Prices Index measure of inflation in September.

This decision sparked a number of debates over the merits of each inflation measurement, and an Institute for Fiscal Studies report published in 2010 offers further analysis of this.

It is also worth noting that until the coalition Government, changes to the child element of Child Tax Credit were uprated each April according to the growth in average earnings over the months of May to July the previous year.

To assess the real-term increase of Child Tax Credits, Full Fact will be looking at the increase of the child element above RPI.

The ONS provides statistics for the rates of RPI since 1948.

Using these figures, we have compiled the following table.

Based on a comparison of RPI increases in September each year to increases in the Child Tax Credit, the greatest above inflation increase appears to have been in 2004-05. Using this approach, the above-inflation increase this year is the third largest increase, the second being in 2008 to 2009.

Evidently the increase to CTC is one of a number of Tax Credits, and therefore the impact on family budgets must be judged in comparison to rises and falls in other Tax Credits. Furthermore, the value of the changes will differ depending on family income and will affect each family differently.

Conclusion

The cash increase to Child Tax Credits this year is the largest cash increase ever to Child Tax Credits, so in this sense Mr Cameron is correct.

Nevertheless, the above inflation increase this year according to RPI only represents the third largest increase since the system began in 2003.