Will a cut in fuel duty create 180,000 jobs?

"Cut duty on fuel..create 180,000 jobs"

The Sun, 29 February 2012

As the 2012 Budget draws ever closer, the clamour from lobbying groups to target specific duties for cuts or areas for spending grows ever louder.

The issue of petrol costs has recently taken up column inches across several national newspapers as the group FairFuelUK campaigns for a reversal in the fuel duty, claiming that a cut will create 180,000 jobs, nine times more than the country's largest private sector employer has recently pledged to provide.

But is there enough evidence to support such a claim?

Analysis

The headline figure comes from a Centre for Economics and Business Research report (CEBR) commissioned by FairFuelUK to "investigate whether an economic case could be made to support its view that a cut in fuel duty could generate more tax revenues from across the wider economy".

The CEBR report uses the Office for National Statistics's most recent set of Supply-and-Use Tables data from the 2009 national accounts, plus several assumptions in modelling the data. These include:

- UK Treasury assumptions of how fuel price changes affect consumer behaviour used in last year's Budget costings paper

- Several further assumptions about the knock-on effects of a reduction in fuel duty across other industry sectors

- That the UK consumed 51.5 billion litres of fuel in 2000

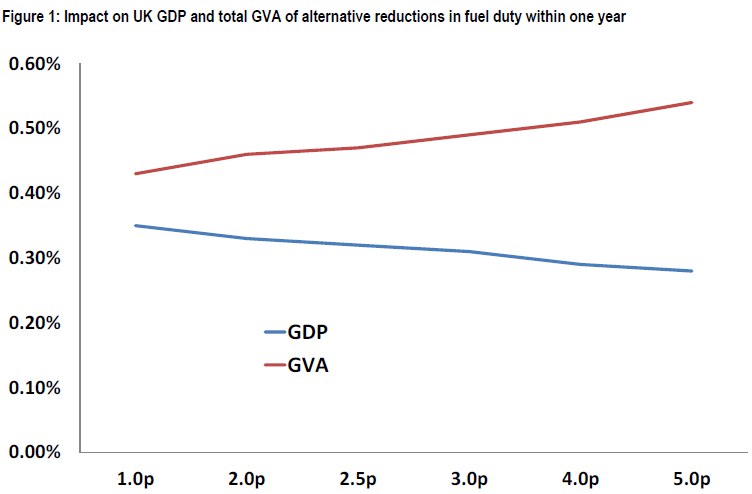

If we take these as given, a one pence relief in fuel duty is expected to add 0.35 per cent to GDP after only a year. The relevant graph from the report is shown below:

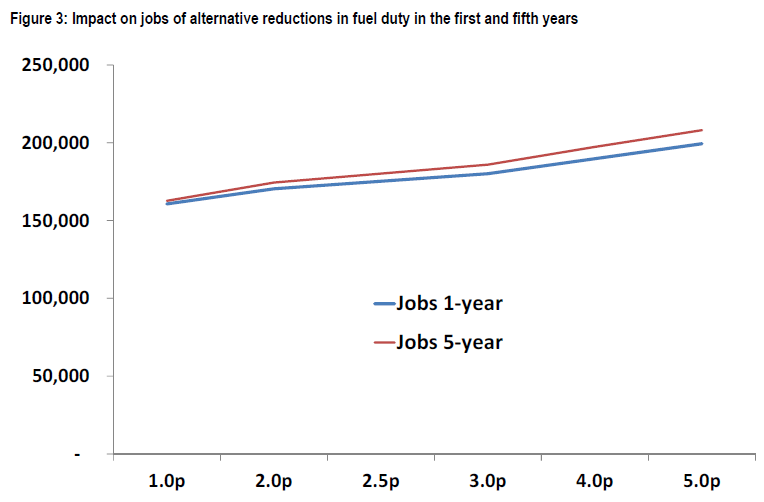

The report then goes on to apply this to jobs. The following graph illustrates the expected result of the extra economic growth on employment. The 180,000 figure is the result of a two-and-a-half pence fall in the fuel duty over five years.

However, although the report depicts a positive relationship between Gross Value Added [GVA] - described as having a truer impact on fuel duty reductions on economic activity than GDP - and employment, one has to bear in mind the assumptions made will hold for any reductions in fuel duty to achieve their optimum effect.

When Full Fact contacted CEBR's economists, we were told that any anticipated job creation from added GVA economic growth was a likely estimate of what could happen if that value gained was invested mainly in hiring extra workers.

In other words, there would be 180,000 more jobs created if all beneficiary firms of the fuel duty cut used their extra profits to augment their workforces.

It was also admitted that businesses benefiting from the fuel duty cut were just as likely not to invest the proceeds from added economic growth in employment. Entrepreneurs could use the income for any number of other reasons, from increasing salaries to repaying loans.

Conclusion

The CEBR report is a complex analysis that requires the reader to make a host of assumptions on the impact of petrol duty before arriving at its conclusions.

While the figures reported by the Sun and used by FairFuelUK are consistent with the CEBR analysis if these assumptions were to be borne out in practice, it is by no means certain that they would, and this distinction is perhaps unclear from the Sun's headline.

UPDATE (7/03/2012)

The CEBR contacted Full Fact again to raise issues with how we explained their data. As they confirmed, the Supply-and-Use tables from the ONS are the most recent available data of that type and do not represent headline national accounts data which are more recently available.

In addition, while we previously commented that the report made the relationship between job estimates and GDP 'unclear', this was imprecise. The report did state that the pattern of GVA increases closely followed that of job increases. However, the derivation of the job figures remains dependent on accepting the assumptions CEBR pointed out to us when we contacted them initially.