BBC Question Time, factchecked

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

“The point about the changes is that actually, you have to have taxable profits at over £32,000 before you'll be paying more tax."

Karen Bradley MP, 10 March 2017

“It's £16,000 according to the IFS today.”

Fraser Nelson, 10 March 2017

“No, no, the overall picture, you have to look at the budget in the whole. It's over £32,000 so actually we are protecting the lower and middle incomes.”

Karen Bradley MP, 10 March 2017

Karen Bradley and Fraser Nelson are talking about different things.

Fraser Nelson is referring to the impact of changes to National Insurance Contributions (NICs) for self-employed people. It’s a bit uncertain how much you have to be earning to lose out from the changes by the time they come in, but £16,000 is likely to be about right.

Karen Bradley seems to be talking about the effect of every tax and benefit change combined together. We don’t know what analysis she’s referring to and we’ve asked her for the source.

NICs tax changes

Two changes are happening to self-employed NICs taxes.

- The flat-rate Class 2 NICs tax is still being abolished. This was announced last year.

- The Class 4 NICs tax is being raised. It’s charged as a percentage of profits and the rate will increase from 9% next year to 10% in April 2018 and 11% in April 2019.

Self-employed people who had annual profits of more than £15,570 would have lost out this year if both reforms been put in straight away.

The Treasury has suggested that anyone who earns over £16,250 will have to pay more tax in 2019/20, by the time the reforms are actually put in place.

It’s likely that it’s suggesting a higher figure because it assumes the threshold for paying Class 4 NICs will go up by 2019/20.

The threshold has been raised most years in the past, although there’s no guarantee how much the Chancellor will put it up over the next two years.

Either way you look at it, there will still be tax advantages to being self-employed.

We've looked into the question of whether the announced change to National Insurance Contributions represents a broken manifesto promise here.

Tax and benefit changes overall

The highest earning half of households will see their incomes fall slightly and the poorest half will gain slightly from policy changes since the Autumn, according to Treasury analysis.

Karen Bradley might have meant to refer to a self-employed household with one adult and one child on a pre-tax income of £32,000... If you knew nothing else about that household you’d expect them to lose out overall from policy measures since the Autumn, according to the Treasury.

We’ve asked her office what she was referring to.

Tax and benefit reforms across the whole of this parliament have tended to lower the post-tax income of poorer households, according to the Institute for Fiscal studies.

“For there to be no money for the NHS is extraordinary. We have been through six years where never before since the NHS was founded in 1948 has it ever had such a low settlement.”

Polly Toynbee, 9 March 2017

This is in the right ballpark, although there are a lot of ways of calculating and comparing changes in NHS funding over time.

It’s difficult to get a single, primary source for health spending over such a long period, so we’ve brought together some of the calculations that experts have come up with.

Experts at the Health Foundation charity say that there’s been an “unprecedented slowdown in funding for the NHS—now halfway through the most austere decade of funding growth since records began in 1948”.

This refers to healthcare spending for the whole of the UK. It grew by an average of 3.7% a year between 1949/50 and 2013/14 on Health Foundation calculations, taking inflation into account. By contrast, spending is set to have risen by around 1% a year in the decade up to 2020.

That’s slower than any previous decade: the annual growth rate was around 2% in the 1980s, according to the charity.

Ms Toynbee referred us to similar figures in a blog by the then chief economist of health think tank The King's Fund. He wrote that “the decade since the 2010 Spending Review will be the toughest financially since the inception of the NHS”.

If you just look at the NHS in England, the average funding increase over the five years to 2014/15 was smaller than any time since the 1970s, according to the House of Commons Library. There aren’t fully comparable figures for England going back to 1948.

Slower real-terms increases in funding than in the past are still increases. The NHS has more money than ever before. But experts, however they slice and dice the numbers, consistently warn that it’s not enough to keep up with demand for healthcare.

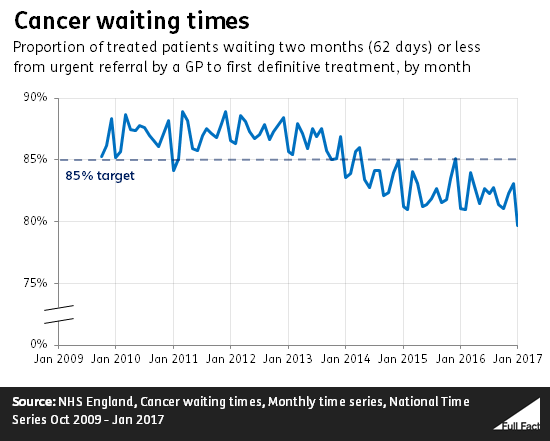

“And today, figures were released, for the first time, showing devastating delays in people waiting for cancer care, the longest delays for most people since the targets were first put there.”

Polly Toynbee, 9 March 2017

There are a number of waiting time targets linked to cancer care in England. The latest figures show that one of these was being missed by a record margin across England in January this year. Ms Toynbee told us this is what she was referring to.

The rest of the NHS cancer waiting time targets were all hit that month.

NHS England says that 85% of cancer patients should wait for no longer than two months between being urgently referred for diagnosis by their GP and receiving their first treatment. This was the target being missed.

Just under 80% of patients were seen within this target time in January, the lowest proportion since 2009. The last time the target was met was in December 2015.

Other waiting times cover parts of this process between being referred by a GP and being treated.

They include 93% of patients waiting no longer than two weeks between referral with suspected cancer and getting their first outpatient appointment. Another is that 96% of patients should wait no more than a month between diagnosis and first definitive treatment.

There is also a 62-day target for patients who aren’t referred by a GP, but are referred by an NHS screening service (90% of patients are to be seen in this time). The aim that no patient should wait more than 62 days between a consultant upgrading the priority of their case and their first treatment has no percentage target.

Specific targets for cancer waiting times were introduced in 2009.

Just under 12,000 people were first treated for cancer in January after being urgently referred by a GP. Around 1,800 were treated after being referred by a screening service and 2,200 after having their priority upgraded by a consultant.

Tasmina Ahmed-Sheikh MP: “We have record levels of attainment in Scotland.”

Kezia Dugdale MSP: “That’s not true.”

Tasmina Ahmed-Sheikh MP: “93.3% of young people are going to into education, training or employment when they leave school.”

Kezia Dugdale MSP: “That's destinations not attainment.”

BBC Question Time, 9 March 2017

Both politicians seem to be talking past each other. They’re correctly referencing different sets of figures, but it’s less clear what Ms Ahmed-Sheikh means by record levels of attainment, since she goes on to talk about where pupils go after they leave school.

Scotland’s performance in international science and reading tests is falling

Labour confirmed Ms Dugdale was talking about Scotland’s recent performance in the PISA international survey of 15 year-olds’ educational performance.

The survey showed Scotland’s performance in science and reading falling between 2012 and 2015. While performance in maths hadn’t changed much in that time, it was still lower than scores back in the mid-2000s.

More pupils going into education, employment or training

Ms Ahmed-Sheikh appeared to be backing up her claim about attainment with statistics about the destination of school leavers, which is different. It’s possible that she was making a separate point on attainment without going into detail, so we’ve asked her office to confirm what her initial claim referred to.

On destinations, she’s correct that, using the available figures, a record proportion of young people are going into education, employment or training.

In 2015/16, 93.3% of school leavers in Scotland went into higher or further education, paid or unpaid work, training and ‘activity agreements’. That’s been rising each year, from 90.1% in 2011/12.

Those figures tell us what’s happening to former pupils three months after leaving. There’s usually a follow-up survey after nine months, which tends to show a small drop in pupils going into education, work or training.

More pupils are leaving school with higher level qualifications

One other measure of attainment paints a more positive picture, in line with Ms Ahmed-Sheikh’s initial claim.

The proportion of school leavers in Scotland attaining one or more Higher qualification has been rising since 2006, from just over 40% to around 60%. At the other end of the spectrum there’s a rising proportion of pupils leaving without any passes at level 3 or better.