Thousands of people have shared claims on Facebook that “British old age pensioners” get far less annually in benefits than “illegal immigrants/refugees living in Britain”.

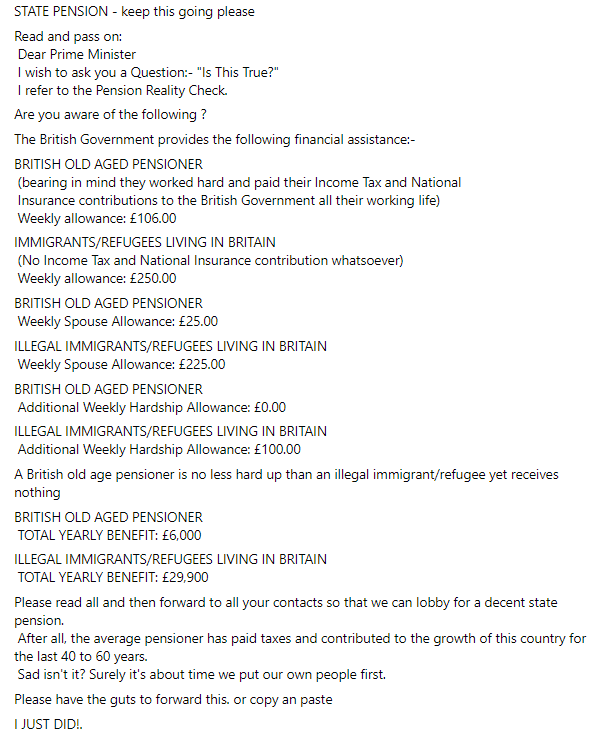

The posts explicitly encourage social media users to share them, claiming that pensioners in Great Britain get a total annual benefit of £6,000 a year, while illegal immigrants and refugees get £29,900.

We wrote about the same claim more than a decade ago, as well as very similar claims using the same headline figures of £6,000 and £29,000 on social media in 2018 and 2019, and found them to be false. The claims made in the post remain untrue—the totals given are inaccurate and some of the “financial assistance” doesn’t even exist in the UK.

Claims juxtaposing the amount of benefits granted to pensioners with financial support for other groups have been circulating worldwide online for many years.

Despite us and others writing about these posts in the UK many times, they have persistently been shared on social media.

What do the posts claim?

The posts are styled as a letter to the Prime Minister. This letter makes a series of financial comparisons, supposedly showing the disparity between assistance given to pensioners and that given to illegal immigrants and refugees.

The House of Commons Library fact checked these figures in a slightly different post in 2015 and said they “bear no relation whatsoever to the situation in the United Kingdom”.

While the financial support pensioners, refugees and asylum seekers receive has changed slightly since 2015, this remains true.

Pensioners are entitled to more than £6,000 a year

In the United Kingdom, men born on or after 6 April 1951 and women born on or after 6 April 1953 are entitled to the ‘new’ state pension, which if paid in full amounts to £185.15 per week (£9,627.80 a year).

Men born before 6 April 1951 and women born before 6 April 1953 are entitled to the ‘basic’ state pension, which if paid in full is £141.85 per week (£7,376.20 a year).

In order to qualify for the full amount of state pension, people need to have 30 qualifying years (or 35 for the new state pension) of National Insurance contributions. The post refers to people who have made tax contributions “all their working life”, which implies this refers to pensioners who are entitled to the full amount. This means that even before additional benefits are considered, the pensioners mentioned in the Facebook post should get significantly more than £6,000 a year.

Some people of state pension age are also entitled to additional benefits, some of which are specific to pensioners. These include pension credit and the winter fuel payment.

While some of these benefits could be described by some as forms of “hardship allowance”, there is not a specific “hardship allowance” available to pensioners. With regards to an additional allowance for married partners, the Department for Work and Pensions ended the “Adult Dependency Increase” in 2020.

Illegal immigrants are not entitled to almost £30,000 a year

There is no legal or broadly accepted definition of an “illegal immigrant”, but the term is commonly used to refer to those who are in the UK without a legal right to be there.

If you don’t have a right to be in the UK, you are not allowed to claim public funds. There is no way in which a person without the right to be in the UK could claim public money in order to remain in the country.

If a person is granted refugee status in the UK then they may be entitled to benefits such as universal credit, pension credit or housing benefits, on the same basis as UK nationals.

The only specific form of government help available to refugees is a refugee integration loan, which can help pay for things such as a rent deposit or rent, household items or education or training for work.

Individuals applying can borrow between £100 and £500, while people applying with their partner can borrow between £100 and £780. These loans are interest-free, but must be repaid in regular instalments.

As we have written before, it is theoretically possible that a refugee could be entitled to more than £29,900, just as a UK national could be. However, this is unlikely as this would only be the case if they were exempt from the benefit cap.

Under the benefit cap, the most that couples or single parents with children can claim is £1,666.67 per month (£20,000 a year) outside Greater London or £1,916.67 per month (£23,000 a year) within Greater London. This amount is lower if the applicant is living as a single adult.

Asylum seekers

Although the post doesn’t specifically mention asylum seekers, it is possible that the post could be referring to some of the support available to that group too. Asylum seekers are people seeking international protection who are applying for refugee status but are awaiting a decision on their application.

Misinformation about the financial support offered to asylum seekers is very common online and we have written about different false claims a number of times in the past.

Asylum seekers are entitled to help with housing if needed, as well as a limited amount of financial support. Cash support usually amounts to £45 a week (£2,340 a year) for each person in a household, to be used on things like food, clothing and toiletries.

If an asylum seeker’s accommodation includes food, each member of the household will be given £9.10 per week instead.

Pregnant mothers or mothers of children under three are also entitled to either £3 or £5 extra per week depending on their situation. Pregnant asylum seekers can also apply for a one-off £300 maternity payment if their baby is due in eight weeks or less, or if their baby is under six weeks old. People who have been refused asylum can also apply for this payment.

People who have been refused asylum are eligible for a place to live and £45 per person on a payment card for food, clothing and toiletries, though no money will be given directly and the payment card will not be given if they do not accept the offer of accommodation.

Image courtesy of Ross Sneddon