UK economic growth within the G7

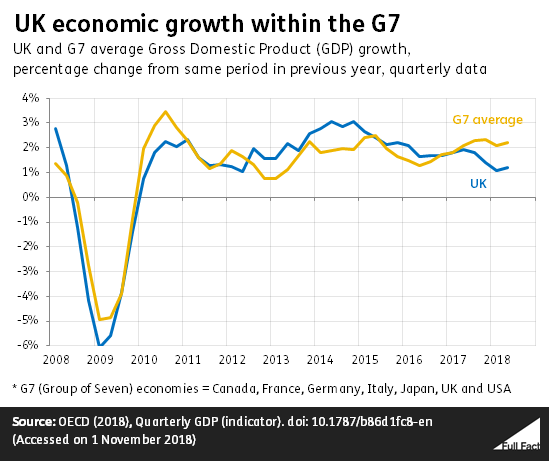

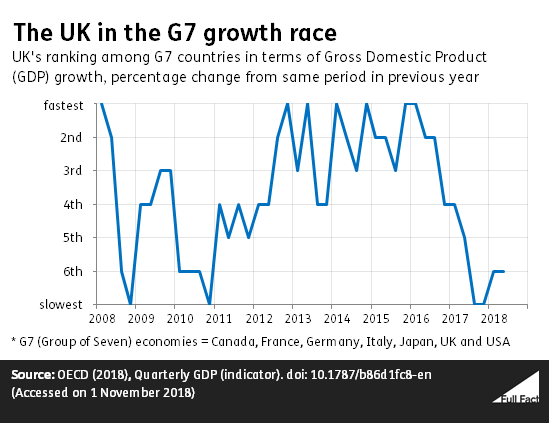

In the first six months of 2018, the UK was one of the slowest growing economies in the G7. This is a group of the largest advanced economies in the world and includes Canada, France, Germany, Italy, Japan and the US, alongside the UK.

This is a significant turnaround since the period from 2013 to 2016, where the UK was one of the fastest growing economies.

Both the government and opposition consistently make references to the UK’s growth compared to other rich countries, depending on what the figures say at any one time.

GDP—‘Gross Domestic Product’—is the main measure of the size of the economy.

Honesty in public debate matters

You can help us take action – and get our regular free email

From among the fastest to among the slowest

The UK economy is almost constantly growing. The last time it actually got smaller over a year was in 2009—which was the time of the recession.

The debate in more recent years has been about whether the UK is growing fast enough, and one measure for that is how it’s doing compared to similar advanced economies.

In April to June 2018, the UK economy was about 1.2% bigger than it was in the same period a year earlier. That’s relatively small, and growth was regularly over 2% in 2014 and 2015.

It’s also relatively small compared to the rest of the G7. Over the same period the US grew 2.9%, ahead of Germany and Canada on 1.9%. Only Italy grew slower at 1.15%.

Why the slowdown?

There’s no single or definitive answer. Broadly speaking, there are explanations for the UK’s poorer performance in 2017 more generally, and we have some ideas about 2018.

Bad weather at the start of the year reduced construction, although it picked up from April. Manufacturing however has fallen in both quarters, driven by a slow-down in exports, especially cars. This is reflected in the fall in business investment, with particularly less investment in transport equipment. The Bank of England says uncertainty over Brexit has affected some business’s investment, but that investment intentions are still broadly positive.

The aftermath of the Brexit vote in June 2016 is one possible factor to explain the slow growth in 2017. Economic growth actually stayed stable throughout 2016—ahead of expectations—but inflation also increased due to falls in the value of the pound after the vote.

In other words, the cost of living went up, so spending by households slumped, slowing down growth in the economy.

Commentators have also cited uncertainty following the EU referendum contributing to a lack of confidence in the economy. The International Monetary Fund says uncertainty is putting some business investment in the UK on hold.

Growth rates need historical context

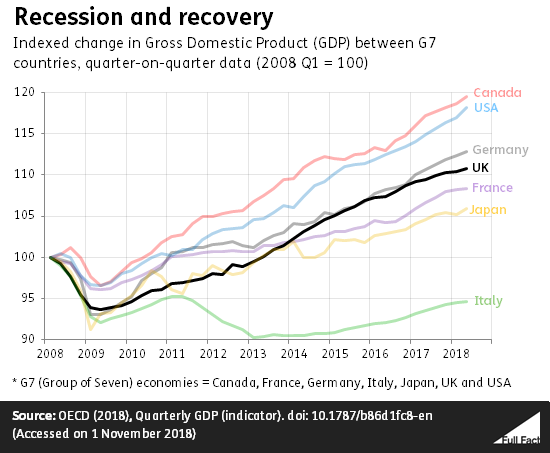

Saying the UK is growing faster or slower than other economies isn’t very illuminating. It’s also relevant to ask where the UK is growing from.

In 2008 and 2009, countries across the world went into recession as part of a global financial crisis. The UK had one of the largest falls in economic output among the G7, and for the first few years recovered slowly.

That partly explains why, from 2013 to 2016, UK growth was among the strongest of the G7, as its path of recovery since the crisis returned to par.

Simply quoting figures on growth won’t tell the full story.