“But ‘as strong as we are now’ means that we impose 50% tariffs on rice, maize and other cereals [on African countries]. Over 300% tariffs on processed sugar.”

Sarah Smith, Today Programme, 28 August 2018

“And yet time and again we [in Nigeria] are hit by EU tariffs on products such as sugar cane and rice… Rice, maize and other cereals face tariffs of more than 50 per cent.”

Atiku Abubakar, 26 August 2018

The EU does charge tariffs on imports of all these goods, but most African countries aren’t subject to them. This is because the EU has special schemes in place with the majority of African countries that mean that they can import almost all of their goods into the EU tariff-free.

Following a number of complaints the Today Programme aired a discussion the following morning, looking in more depth about the trading relationship between the EU and Africa.

Honesty in public debate matters

You can help us take action – and get our regular free email

The EU does have tariffs on rice, maize, cereals and sugar

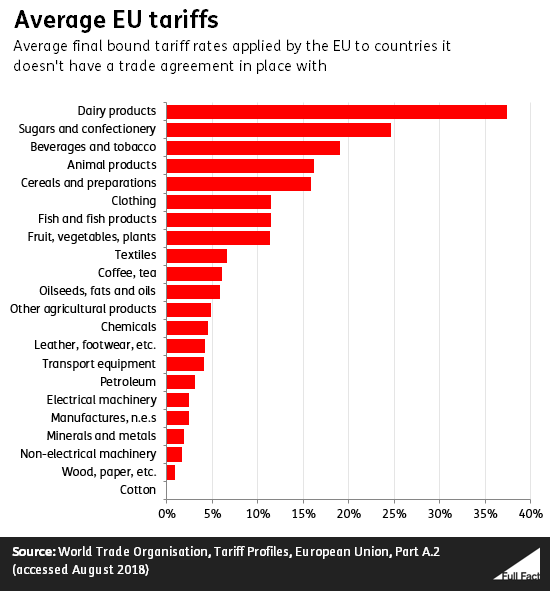

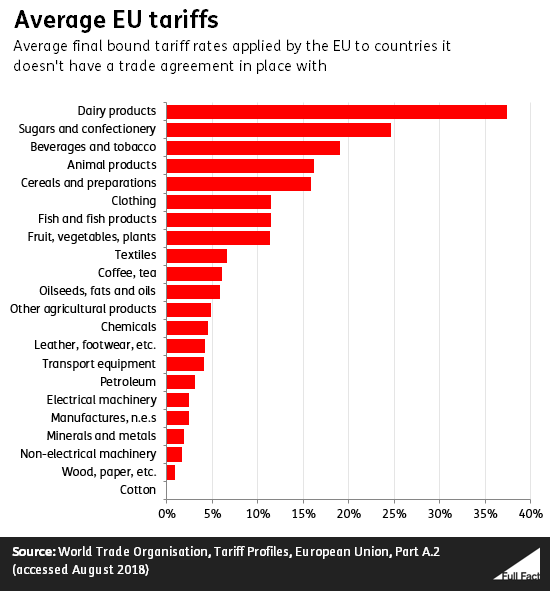

The UK is part of the EU customs union: this means that the EU as a whole decides what taxes—or tariffs—to charge on goods coming into the EU customs union area. These tariffs are all agreed with the World Trade Organisation (WTO), the body that regulates international trade.

The EU’s average tariffs look like this:

These categories are for average tariffs. In reality, goods are classified into more detailed categories. So, for example, there isn’t one tariff for “sugars and confectionary”, but a number of different tariffs depending on things like how the sugar has been processed.

Some tariffs are charged as a percentage of the value of a product (“ad valorem” is the technical term for this).

Other tariffs are charged as a set value per unit (these are called “specific” duties). This means that the value of specific duties will vary depending on the price the exporter charges: if they halve their price, the tariff will double as a percentage of the product’s value.

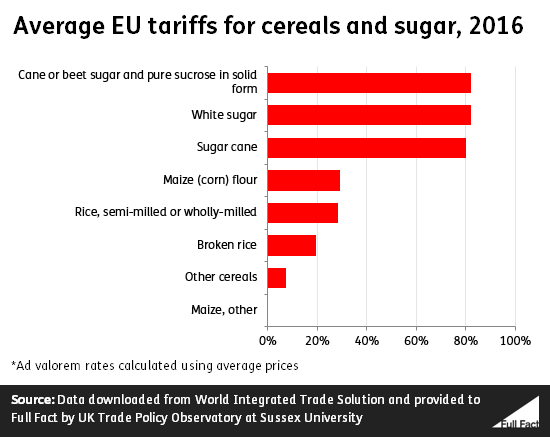

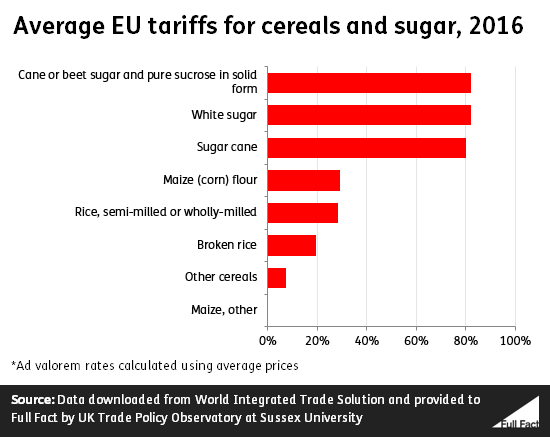

The EU’s tariffs for the products in the claim, expressed as percentages, are as follows:

All of these tariffs are lower than those in the original claim. However, these rates are calculated using average prices. This means that if the price of a good was lower than the world average in a particular country, this country’s exporters would experience the tariff as a higher percentage of the product’s value.

So if, for example, Nigeria’s sugar price dropped to a quarter of the world average, it would face a tariff of over 300%. So that's unlikely to be a typical rate.

Most African countries have better trading relationships with the EU than this

However, in reality, the majority of African countries aren’t subject to these tariffs. This is because these tariffs are the highest that the EU can charge: countries can negotiate reductions to these tariffs, so long as they do so following the rules set by the WTO.

The EU has a number of schemes in place that reduce the tariffs that apply to different African countries. These include:

Generalised Scheme of Preferences (GSP) and Generalized Scheme of Preferences Plus (GSP+)

These schemes enable the EU to offer preferential treatment, including tariff reductions, to products originating in developing countries. Together, the standard GSP and GSP+ cover seven African countries: Cabo Verde, the Republic of the Congo, Cote d’Ivoire, Ghana, Kenya, Nigeria and Swaziland. These reductions only apply to imports from developing countries, and not the other way round.

Everything But Arms

This is a particular form of GSP scheme provides tariff free access to the EU customs union for products from places that the UN judges to be the “Least Developed Countries”, including 34 in Africa (not including Nigeria). As the name suggests, it applies to everything but weapons, so rice, maize, cereals and sugar are all covered. Again, this is a unilateral scheme: meaning that the EU drops these tariffs without asking these countries to do the same in return.

The UK government has pledged to continue this scheme after Brexit.

Economic Partnership Agreements

These are agreements between the EU and African, Caribbean and Pacific countries. Similarly, they provide for tariff free access to the EU for everything apart from arms. The EU has EPAs with a number of groups of African countries: the Southern African Development Community, Central Africa, West Africa, Eastern and Southern Africa.

Generally, they provide immediate tariff-free access for non-EU countries to EU markets, whilst the EU gets phased access—increasing over time—in return. They also aim to reduce non-tariff barriers, such as the difficulties African producers face in meeting EU product standards.

These agreements are not all in force: the EU provided an update on their status in June 2018.

African economies are growing fast, but from a low base

Ms Smith also said that:

“Six of the world’s ten fastest growing economies are in Africa which means there may be significant economic opportunities there for the UK as we seek to expand our trade relationships outside the European Union”

This is roughly right, as far as available estimates can show. Claims like these are always based on estimates, so it is hard to say for certain if they are correct or not. But data from the International Monetary Fund (IMF) has five of the ten fastest growing economies in 2018 in Africa. These countries are Libya, Ethiopia, Côte d’Ivoire, Rwanda and Senegal.

When assessing how important trade with African countries could be for the UK after it leaves the EU, though, it’s worth putting these figures in context. The IMF has estimated that in 2018, the EU’s GDP (minus the UK) was $16.7 trillion compared to $2.4 trillion for Africa. France, Germany and the UK all individually have a larger economies than Africa as a whole.

The African economy may be growing much faster than the EU’s, but it started from a much lower base.

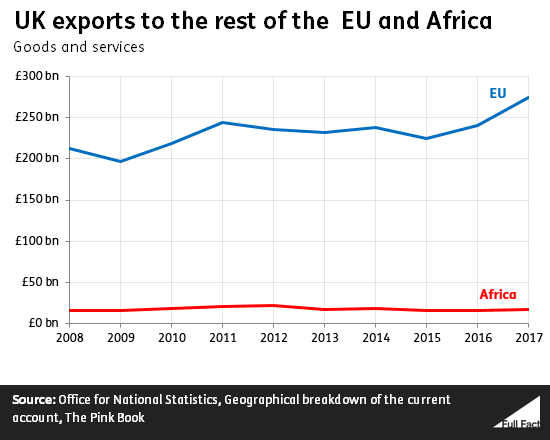

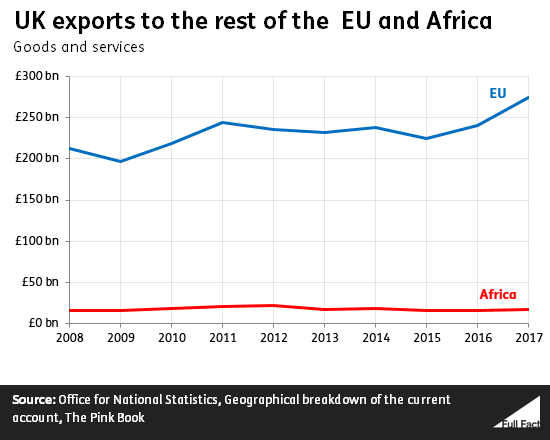

UK trade relationships are usually stronger with neighbouring countries, as well as countries with large economies. This is reflected in current levels of UK exports to Africa, compared to those to the rest of the EU:

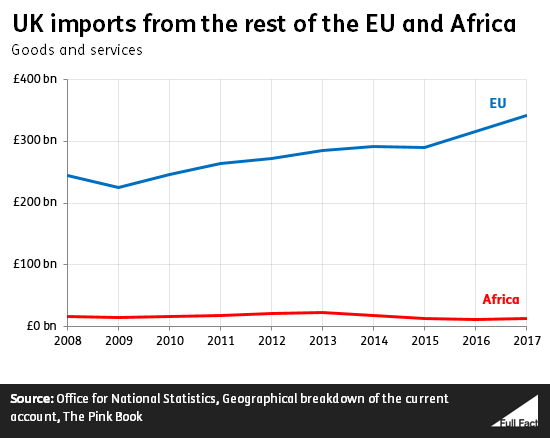

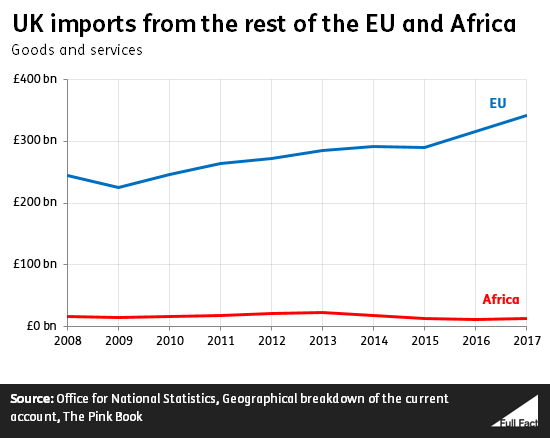

Imports are important too: they give consumers greater choice, and can reduce prices paid by shoppers and businesses for products.

Despite the fact that most African countries have zero tariffs on exports to the UK, trade between the UK and Africa is a lot less than trade between the UK and the EU. Tariffs are of course only part of the picture, and it could be that different regulatory regimes between the EU and African countries inhibit this trade. But it looks unlikely that the volume of trade between the UK and Africa will be similar to that between the UK and the EU anytime soon.