Do Scots contribute more in taxes than the rest of the UK?

For more articles like this relating to the referendum on Scottish independence on the 18th September, please take a look at Full Fact's Independence Referendum hub page.

--

In the build up to what could be a messy divorce, there's already talk about who has contributed more to the shared bank account.

The referendum on Scottish independence might be almost a year and a half away but that isn't stopping politicians on both sides of the divide arguing that they've paid more into (and spent less of) the UK's total revenue.

Last week Scotland's First Minister Alex Salmond proclaimed:

"In every single one of the last 30 years, the amount of tax revenues generated per person in Scotland was greater than for the UK as a whole."

After making this assertion, he cited the following figures:

- in 2011/12 Scotland contributed £56.9 billion in tax revenue, which is equivalent to £10,700 per person, compared to £9,000 per person for the UK as a whole;

- since 1980/81 Scotland has contributed £222 billion more in tax revenues than if it had just matched the per capita contributions of the UK.

This is but one example in the recent history of claim and counter-claim. For instance, we've already looked at the charge that Scotland's households are, conversely, a drain on the Exchequer.

On this occasion, Mr Salmond's numbers do add up - with one important caveat. Amidst all the discussion of separation, there's one asset that both parties are claiming as their own - North Sea oil.

And how you allocate this 'black gold' makes a huge difference to the health of a country's finances. Mr Salmond has based his calculations on the assumption that the Scottish people are 'geographically' entitled to 85-95% of the oil revenues. In 1999 a pair of academics from the University of Aberdeen estimated that "around 90% of the total tax revenue generated in the North Sea since 1980 has occurred in Scottish waters". Their analysis is based on this map of the 'median line', which divides the UK Continental Shelf (UKCS).

Mr Salmond has based his calculations on recent 'experimental' statistics produced by the Scottish government.

The Scottish government has shown that, if you apply the geographical share principle, Mr Salmond's figures are correct.

If we divide Scotland's total tax receipts for each year by its population, we generate a figure for the 'tax receipt per capita' - in other words, how much each person contributes to the Treasury. If we also repeat this calculation for the UK, we can see that Mr Salmond is on the money when he says, "In every single one of the last 30 years, the amount of tax revenues generated per person in Scotland was greater than for the UK as a whole."

As he notes, in 2011/12 the tax receipt was £10,700 per person for Scotland, as opposed to an average of £9000 per person for the UK.

If, continuing to apply the geographical share principle, we look at how Scotland's total tax receipts since 1980 compare with the UK's, we can see that Scotland has contributed - as Mr Salmond notes - a surplus £222 billion in today's prices.

The graph below shows how Scottish per capita contributions have outstripped those of the rest of the UK:

Source: Scottish government data

Crude calculations?

So while there is evidence to support Mr Salmond's claims, what happens if, when calculating tax revenues from oil, we apply an alternative methodology?

If the total revenue is shared equally among the nations of the UK according to their population size, then the same experimental statistics show that Scotland would have been taking out more than it had been putting in, compared to the other countries in the UK.

There's a similar story to be told if we look at budget deficits. As the Institute for Fiscal Studies notes, "Without oil and gas revenues, or, equivalently, assigning them on a population basis, there has been a bigger gap between spending and tax receipts in recent years than in the UK as a whole". [emphasis added]

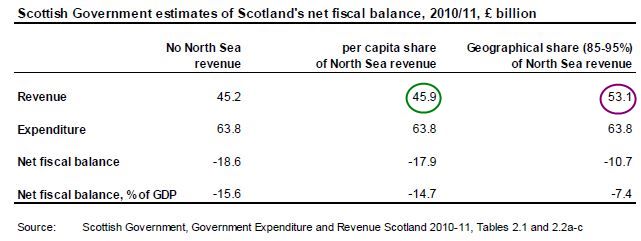

In fact, the Scottish government has itself produced estimates of how Scotland's net fiscal balance varies, depending on how the tax revenue from oil is distributed:

While Mr Salmond's maths adds up, we've seen that Scottish contributions to tax revenues can be viewed as greater or smaller than the UK average, depending upon what assumptions we make about how oil revenues would be allocated between Scotland and the UK in the event of a 'yes' vote.

The population share estimate assumes that Scotland derives no particular advantage from North Sea oil as the resource is equally distributed between all UK nations; the geographical estimate relies upon Scotland claiming all of the tax revenue taken from the taxable activities in its territory. (This in turn is based upon the UK accepting the position of the median line and recognising the existence of 'Scottish' waters.)

Of course it's too early to say whether either of these positions would bear any resemblance to a deal struck on an independent Scotland. If Mr Salmond sits around the negotiating table with a mandate from the Scottish people for independence, it's likely that there will be a range of 'compromise' options under discussion. Until we reach that point, these figures are rooted in speculation.