If a house costs ten times your salary it doesn't necessarily mean you can't afford it

The Telegraph reported this morning that house prices have risen to ten times the average salary, which could make it "almost impossible for first-time buyers without access to the 'bank of mum and dad' to get on to the property ladder".

The comparison is one that's often used as a yardstick for the affordability of housing, but we've said before it's not a perfect measure of how easy or difficult it is for first time buyers to purchase a home.

We often buy homes together with a partner; first time buyers probably don't buy 'average' houses; while the willingness of banks to lend can also inhibit or encourage the first-time buyer market.

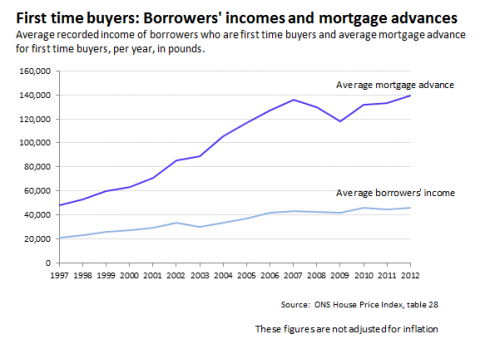

There are a variety of ways of measuring affordability of home ownership. For example, the Office for National Statistics provides data on the average mortgage - showing first time buyers are now borrowing about three times their income to make their first purchase.

What this doesn't tell us is how much of a deposit borrowers have needed to secure their first mortgage, and looking exclusively at income doesn't tell us how much savings people have.