28 January's BBC Question Time, factchecked

On the Question Time panel last night were Transport Secretary Patrick McLoughlin, Labour’s Jess Phillips MP, Westminster SNP Leader Angus Robertson, Yasmin Alibhai-Brown of the Independent, and M&C Saatchi CEO Moray MacLennan.

We factchecked their claims on Google, taxes, refugees, the railways, and what the polls tell us about the EU referendum.

Honesty in public debate matters

You can help us take action – and get our regular free email

Taxes

“At the moment we have absolutely no idea what rate of tax Google is paying because it seems to be shrouded in some sort of secrecy, and when the Ministers were asked again and again [what rate of tax Google is paying] they said no we don’t know”—Jess Phillips MP

This is effectively what we concluded in Is Google paying 3% tax?. Technically, the argument isn’t about what tax rate they are paying, it is about which part of the multi-national company’s activity is taxable in the UK at all. But we don’t know where that line was drawn.

A Minister told MPs that: “without fully understanding the whereabouts of a company’s assets and activities, no one is in a position to make a judgment about how much tax it should pay. HMRC is able to do that,” which does seem to imply that Ministers aren’t.

That’s not the same as not knowing the tax rate. Another Minister confirmed in the House of Lords that Google will be paying “the full amount of UK taxable profits at the statutory corporation rate.”

HMRC is not permitted to reveal details without Google’s consent. As their guidance puts it: HMRC staff have a duty of confidentiality under section 18 of the Commissioners for Revenue and Customs Act 2005.

Rather than being “some sort of secrecy” the Minister argued that: “The principle of taxpayer confidentiality is not new. It has existed for as long as we have had a tax system.”

“Peter Mandelson—do you remember?—saying, ‘we are intensely relaxed about the filthy rich’.”—Yasmin Alibhai-Brown

This is a famous partial quote.

Lord Mandelson, as he now is, has been keen to emphasise that “I always added ‘as long as people pay their taxes’”, as the FT, his political opponent Vince Cable MP, and even the Institute for Fiscal Studies have all recorded.

“We need to recognise that the UK has amongst the most complicated tax laws in the world.”—Angus Robertson MP

Laws aren’t easy to compare between different countries but it’s not controversial to say that the UK’s tax system is very complicated and too complicated.

The previous Coalition government set up the Office of Tax Simplification for exactly that reason, which was welcomed by other parties. Before that the Tax Law Rewrite Project spent years rewriting existing law “to make it clearer and easier to use.” The history goes back for decades.

Thankfully, the Office of Tax Simplification has concluded that “though there are over 17,000 pages in Tolley’s tax handbooks, the real figure for effective, unduplicated primary legislation was 6,102 pages in 2012.”

At one page per minute, that’s four days of uninterrupted reading.

“The National Audit Office can do an investigation, can do an audit… This happened in the last Parliament and it found that every single action of HMRC was legal”—Patrick McLoughlin MP

Mr McLoughlin referred specifically to the review of five big tax disputes by a retired judge.

What he said was half the story: “The National Audit Office has concluded, on the basis of an examination by former High Court tax judge Sir Andrew Park of five large tax settlements, that all five settlements were reasonable and the overall outcome for the Exchequer was good.”

The other half is: “However, the spending watchdog has expressed concerns about the processes by which the settlements were reached and over poor internal communication of the reasons for settlement.”

So large tax disputes and their behind-closed-doors settlements were a concern for the National Audit Office but it reported that things got better.

“HMRC improved the transparency and accountability around how it settles large tax disputes in response to our recommendations,” it said.

That includes clearer guidance; a Tax Assurance Commissioner who does an annual report on major disputes; and “more independent challenge” by separating people working on a dispute from those who sign off on a deal.

Refugees

“The UK has taken in far, far less [refugees] than our European neighbours”—Angus Robertson

This is correct overall—in countries like Germany, far more refugees have either arrived or been brought over from the Middle East. The UK is focusing on proactively resettling refugees from the region, in smaller numbers, and the government’s claim that it’s doing better than others on that particular front seems reasonable.

About 14,600 people were granted asylum in the UK in the year up to September 2015. Five EU member states accepted more asylum seekers; Germany was at the top of the list with 83,000 applications accepted. This is initial decisions, so it doesn’t include people accepted after an appeal. That means the total numbers will be a little higher in both countries.

Another 800 refugees were ‘resettled’ here—that is, flown over from the Middle East—through separate government schemes. We don’t have figures on how many were resettled to other EU countries through their own schemes in the same period.

Things will have changed since September. The UK has resettled 750 more refugees through its Syrian Vulnerable Person Resettlement Programme, according to the government. The European Commission recently told us that other EU members had collectively resettled a similar number since June under an EU plan, although not all countries have reported back. Countries may also be resettling people under their own programmes, and these people might not be counted by the Commission—it’s all a bit unclear.

But the UK has promised more resettlement places overall than most of its neighbours, according to the United Nations.

The EU also has separate plans to relocate 160,000 asylum seekers in two years from the member countries most affected by the current crisis: Greece and Italy. The UK isn't part of that scheme.

Progress towards this goal has been “unsatisfactory” so far, according to the EU itself. To date around 400 asylum seekers have been relocated from Greece and Italy as part of the scheme.

Public opinion on the EU referendum

“Today is the first time that the average of polls in the UK is 50/50”—Angus Robertson MP

That’s what the poll of polls shows, but polling peculiarities mean public opinion may not be anything like that close.

Last month, a 50/50 poll made headlines, but as we said at the time, that was an online survey, while telephone polls have been finding a clear lead for remaining in.

We don’t know whether either of the online or telephone polls are right.

We do know that the poll of polls summarises the last six published polls, and at the moment they are all online polls.

So while it’s showing a 50/50 split at the moment, it would not be surprising if remain took the lead again the next time a telephone poll is published.

The last telephone poll it included was from Ipsos MORI in mid-December, which found 58% wanted to remain, 32% to leave, and 10% didn’t know. That was based on a relatively small group of 529 people.

On the other hand, the latest pollsters, ICM point out that “Four consecutive polls, each revealing a lower Remain In number than the last, may constitute a trend.”

“Scotland will leave the United Kingdom. Is that what you want? … I think that Scots are very pro-European”—Yasmin Alibhai-Brown

“It has long appeared to be the case that Scotland is somewhat more Europhile than the rest of the UK”, says Professor John Curtice at NatCen’s What UK Thinks.

Regular polls are usually too small to provide reliable information about different parts of the UK, but the larger British Election Study found:

- In England 45% said remain in the EU, and 35% said leave

- In Wales 50% wanted to remain, 33% to leave

- In Scotland, 58% wanted to remain, and only 28% wanted to leave

Professor Curtice concluded:

“Should the UK as a whole vote narrowly to leave the EU, it seems highly likely that Scotland and perhaps Wales will have voted at least narrowly in the opposite direction, thereby potentially creating new debates about the future of the United Kingdom.”

Railways

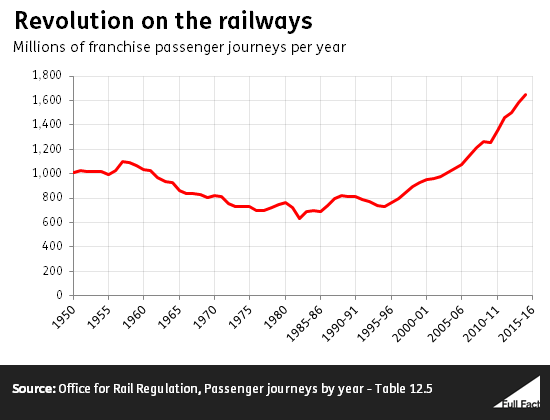

“We’ve seen the revolution in this country on the railways, 20 years ago there were 750 million people using the railways, last year it was 1.6 billion. It’s growing each year at four per cent.”—Patrick McLoughlin MP

It’s always surprising to hear of 1.6 billion people doing anything in the UK, since that’s about 25 times the size of the population. These are the correct figures for passenger journeys.

We made 1.65 billion journeys by national rail in 2014/15, up from 735 million in 1994/95.

Last year that grew by 4%, and by even more in recent years.

According to the Department for Transport, the way journeys were counted changed after privatisation in 1994 “with possible double counting” when people change trains, so there is “an element of inflation” in the figures.

We spoke to statisticians at both the Department for Transport and the Office of Rail and Road to confirm that it is reasonable to compare them.

A similar set of passenger statistics published yesterday counts journeys with changes differently. The overall numbers are slightly lower, but the growth is also more than double twenty years ago.

Update: We orginally referred to the Office of Rail and Road as the "Office for Rail Regulation". Its name changed last year, in April 2015.

Round up posts like this—and those we publish for PMQs and major speeches by politicians—don’t go into as much depth as our usual articles or cover every claim made in the show. Often they are done under a much shorter deadline, so we prioritise a clear conclusion above all else. As always we welcome feedback: please email the team on team@fullfact.org