Is Britain's banking system "in crisis"?

Labour leader Ed Miliband this morning made a keenly-anticipated speech on his proposals for Britain's banking system, which he described as being "in crisis". Does the evidence support the flaws identified by Mr Miliband?

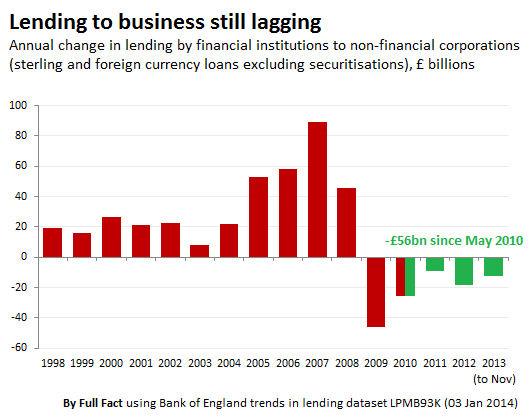

Lack of lending to businesses?

One claim this morning's media expected to see in Ed Miliband's speech (it wasn't actually referenced when the Labour leader did eventually take to the stage, although the Labour party on Twitter did publish it) is that there's been a £56 billion fall in lending to businesses since the election.

It comes from the Bank of England and corresponds to the total drop in lending from financial institutions such as banks to UK businesses since May 2010 (although missing out a massive £46 billion fall in 2009 alone). Lending is still yet to recover to pre-2009 levels and is still falling year-on-year.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

Too few banks, too much power?

One statistic that did make it into the final draft of Mr Miliband's speech was this claim about the concentration of banking power into just a handful of banks. He said:

"Britain has one of the most concentrated banking systems in the world. Just 4 banks control 85% of small business lending."

This, the Labour leader claimed, was a "decades long problem in British banking" and evidence that too much power over lending was held by this select group of banks.

The source of the statistic appears to be the Independent Commission on Banking, which made recommendations for reform of the banking system last year. It found that:

"In 2010, the four biggest banks had a market share of 85% between them."

However when it came to deciding whether not this was exceptional by international standards, the Commission was more circumspect. It found that:

"the UK appears to be similar to many other developed countries, such as the Netherlands, Sweden, Australia and Canada, in having a concentrated retail banking market. However, they have smaller populations, which is relevant if there are scale economies. In general, it is difficult to compare across countries as their histories and competitive dynamics differ (for example, in some countries regional banks are the norm), and there are few comparators with similarly sized markets that also have national bank networks."

More millionnaire bankers than the rest of the EU?

In advance of Mr Miliband's speech, Guardian columnist Polly Toynbee outlined what she saw as the "abominations of banking", drawing readers' attention to bankers' pay and bonuses in particular, asking:

"How can there be more bankers earning in excess of £800,000 in Britain than in the entire EU?"

The source Ms Toynbee links to for this claim is a blog by her Guardian colleague Andrew Sparrow, who in turn is quoting Labour's Shadow Chief Secretary to the Treasury Chris Leslie, who told a Commons debate on the topic on Wednesday that:

"The number of UK bankers who earn more than £800,000 rose by 11% to 2,714 last year, which is more than in the rest of Europe combined."

While Mr Leslie doesn't tell MPs where his figure comes from, with a little digging it can be traced back to the European Banking Authority (EBA), whose duty it is to keep tabs on the number of people working in financial services who earn €1 million (just over £800,000) or more.

The Authority did indeed identify 2,714 Euro millionaires working in the UK, while the total for the rest of the EU nations was 816, meaning that the UK accounted for about 77% of all the high-earners in financial services.

The claim is therefore accurate, but whether or not it is surprising is another matter. According to one investigation by the Financial Times, London accounts for between 20% and over 40% of the various global markets, much more than any other European financial centre.

The EBA data also shows that the average high-earner in London receives around €1.95 million per year. While this is towards the upper end of the spectrum, it isn't the highest, with Spain and Cyprus's high-flyers taking home more on average.

So while the claim is accurate, it could owe more to the large number of people working in financial services in this country rather than any peculiar generosity of British banks.