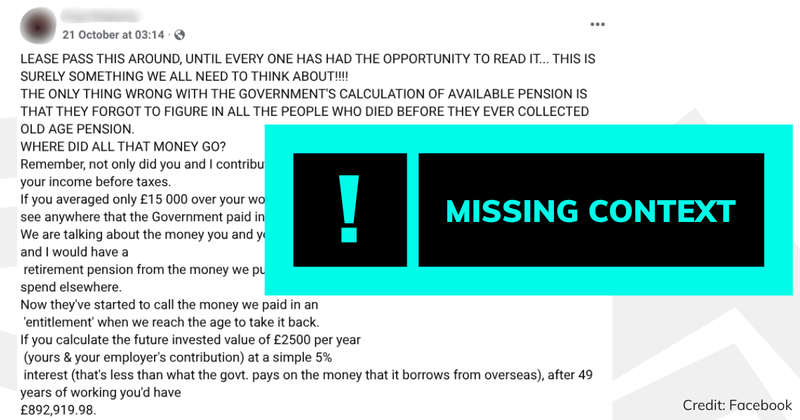

In recent weeks, we have seen dozens of Facebook posts which make a series of misleading claims about pensions and how they work.

But as we have previously explained, the posts misunderstand how the state pension system functions, and even if they worked how the posts claimed, their calculations are wrong.

How state pensions work

One of the central assumptions in the posts is that people who contributed a certain amount per year would see this total sum in future, plus interest, in their own ‘pot’. This is broadly how some private pensions work, but not state pensions.

National Insurance contributions (NICs) don’t only pay for state pensions, but mainly do. This tax, paid by employees, employers and the self-employed, also goes toward paying for other contributory benefits (like contributions-based jobseeker’s allowance and contributory Employment and Support Allowance), and some of the money also goes to the NHS.

NICs are paid into a specific pot called the National Insurance Fund (NIF), rather than being put with the rest of the tax money collected for the Treasury. But even if the fund is in deficit one year, the government will find a way to pay the pensions and benefits it has to, by injecting money into it. And if it’s in surplus, the government may use the money to pay off the national debt.

According to the House of Commons Library: “Currently, the NIF operates on a pay-as-you-go basis: money raised for the NIF in one year is spent on contributory benefits for the same year.

“This means that, although individual taxpayers have an individual national insurance record, the money they pay in NICs does not build up their personal national insurance pot.”

So essentially, today’s National Insurance contributors are paying today’s pensioners, rather than paying forward towards their own future pensions.

The posts suggest that the pension pots accrued over time should then be higher in value than they are, if 5% interest had been applied. But in reality, and as noted, those contributions are effectively spent in the same year they are collected, on pensioners and those receiving contributory benefits at that time.

Some private pensions on the other hand do work something like this, in the sense that generally, you pay into a pot which is invested, so your money has the opportunity to accumulate interest or gain value (although its actual value may decline over time depending on inflation).

But even if state pensions worked as the posts claim, their headline figure would be wrong.

The posts say if you and your employer contributed £2,500 a year for 49 years with 5% interest you should have almost £900,000 by the end. This calculation is incorrect—after 49 years you’d end up with closer to £500,000 at that rate of interest.

You and your employer pay National Insurance

The posts say: “Remember, not only did you and I contribute to our Pension, our employer did, too. It totalled 15% of your income before taxes. If you averaged only £15 000 over your working life, that’s close to £220,500.”

It’s true that mathematically, if you contributed 15% of a £15,000 a year salary into a pot, and your employer did the same, the end total after 49 years without any interest would be £220,500.

But if your salary was £15,000, the amount you and your employer would end up contributing would be much less than this, because there’s a minimum threshold below which you don’t pay National Insurance.

And while it’s true that both employee and employer pay National Insurance on wages, at the time of writing, the rate isn’t 15% for both.

Currently, most employees pay 8% on earnings from £12,570 to £50,270 a year, and 2% on earnings above that, while employers pay 15% on most employees’ earnings over £5,000 a year.

What happens to the state pensions of the deceased?

The posts also claim: “The only thing wrong with the government’s calculation of available pension is that they forgot to figure in all the people who died before they ever collected old age pension. Where did all that money go?”

In certain cases, if someone who has reached state pension age dies, their surviving partner (if they were married or in a civil partnership), depending on the exact circumstances, may expect to inherit some of that pension.

This can be complicated, because there are two types of state pension: the basic state pension for those who reached state pension age before 6 April 2016, and the new state pension, for those who reached state pension age after that date. Under the older system, people could get a state pension based on the NICs of their late partners and could inherit a top-up from the additional state pension.

But under the newer system, pensions are linked to that individual’s NICs and so what exactly a surviving partner can inherit depends on the exact circumstances, such as when they were married or if their partner deferred collecting their state pension.

MP benefits

The posts also claim that MPs get “free healthcare, outrageous retirement packages, 67 days paid holidays, three weeks paid holidays, unlimited paid sick days”.

MPs have the same free access to the NHS as anyone ordinarily resident in the UK. They can’t claim for private medical insurance on their expenses.

MPs do have their own workplace pension scheme, like many workplaces, plus an extra one for ministers. Under this scheme, MPs contribute at least 11.09% of pay, and build up at 1/51st (1.96%) of average salary per year.

MPs don’t have holidays in the traditional sense and how much time they take as actual holiday will vary—as long as they have taken their seats, they get paid a salary even if they don’t attend Parliament. While they don’t have to attend every sitting, it’s likely that they’ll have to attend certain votes that their party needs them to attend, like those with a three line whip. And their work isn’t just in Parliament—it will likely include constituency work, such as surgeries.

So while it’s true that Parliament is in recess for approximately 18 weeks a year, this time isn’t necessarily holiday.

As for sick days, MPs do get paid regardless of how much they attend Parliament, and don’t get any additional sick pay.