Budget 2012 Survival Guide: Who pays what in income tax?

Many newspapers and commentators have been speculating that the upcoming budget will see the reduction in the top rate of income tax, currently at 50 per cent on incomes above £150,000 a year.

That may be the case, but exactly how much money does the Government make overall from income tax, and how much of it comes from the highest paid?

HM Revenue and Customs provide statistics on income tax liabilities and receipts. From these, we can work out where the Government's income tax money comes from.

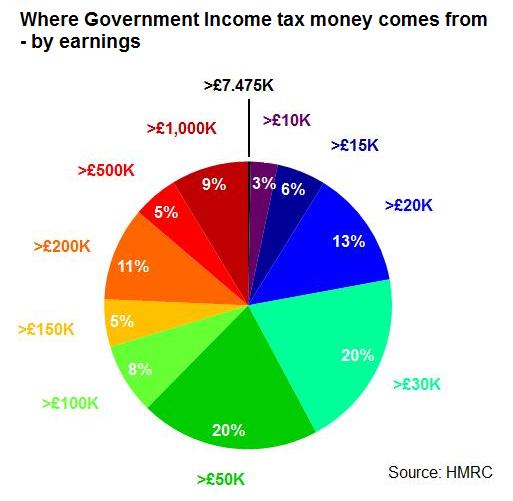

The Government makes around £150 billion a year in income tax. Full Fact put this figure in context on Monday. A full quarter of that revenue comes from taxpayers who earn over £200,000 a year.

About one fifth of the total income comes from taxpayers earning less than £30,000 a year. On Tuesday, Full Fact showed that the 'middle' taxpayer earns £26,200 a year. So the income from the most 'typical' taxpayers contributes a relatively small proportion of Government revenue from income tax.

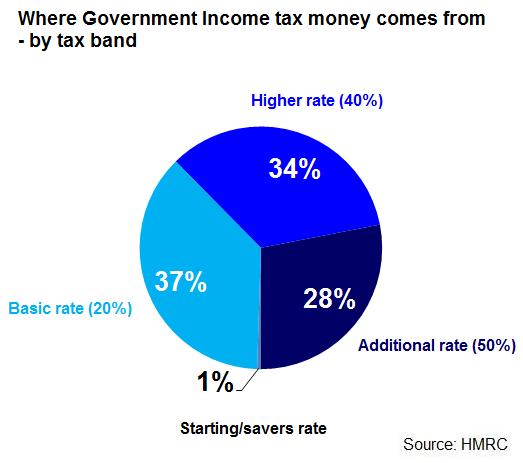

However, looking at the same data by tax band rather than specific earnings, basic rate taxpayers provide the biggest slice of the Government's revenue, adding around £62 billion in total revenue. People paying the additional rate contriubte 28 per cent of all income tax revenues to the public purse.

We will likely see shortly after the budget the expected effects of lowering the 50 per cent rate, if it occurs. In money terms, the Government makes around £47 billion from additional rate taxpayers at present.

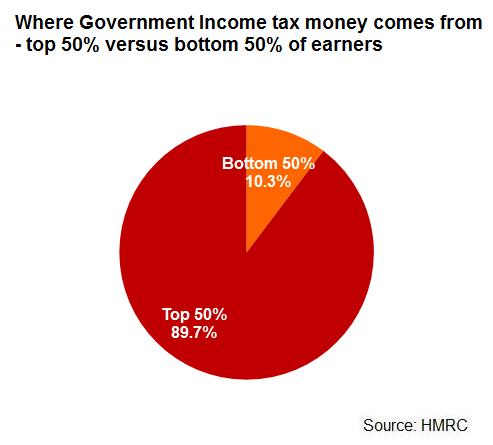

Full Fact also pointed out yesterday how uneven distributions of incomes make measuring averages problematic. By looking at a more simple chart of tax contribution, we can see that the top 50 per cent of earners contribute nearly 90 per cent of the Government's tax revenue.

We will have to see what the 2012 Budget holds for income tax payers in reality. But a breakdown of these figures can help the outside observer to better understand exactly what all the figures really mean.

Try our budget calculator to see how new policy measures affect taxpayers and families - yearly, monthly and weekly.