What was claimed

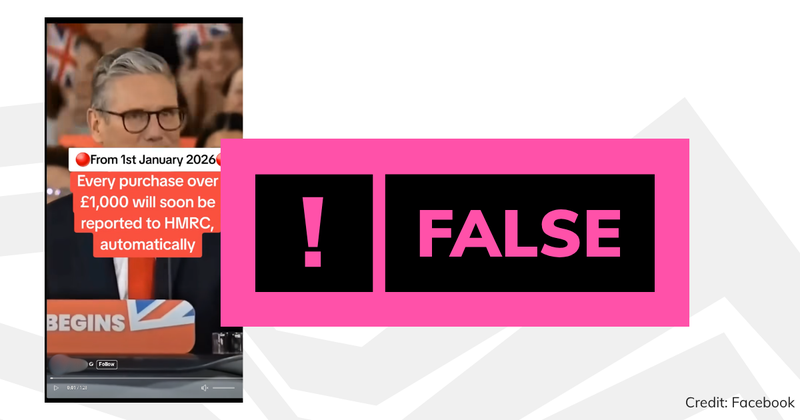

From 1 January 2026 every purchase over £1,000 will be automatically reported to HMRC to crack down on money laundering, benefit fraud and undeclared income.

Our verdict

False. HMRC has confirmed this isn’t true.

What was claimed

From 1 January 2026 every purchase over £1,000 will be automatically reported to HMRC to crack down on money laundering, benefit fraud and undeclared income.

Our verdict

False. HMRC has confirmed this isn’t true.

Social media posts claiming that from January 2026 purchases over £1,000 will be automatically reported to HM Revenue and Customs (HMRC) have been shared thousands of times. But these claims aren’t true.

One Facebook post shares a video which claims this is part of a “crackdown on money laundering, benefit fraud and undeclared income” and will require “all major retailers, online platforms and even small businesses” to report the details of any transaction above £1,000 “straight to the tax authorities”.

The video says that the new system will force retailers to send the purchaser’s name, the amount spent, the payment method and the seller’s details to HMRC, and that this information will be “linked to your National Insurance number through a secure digital reporting system overseen by HMRC and the Department for Business and Trade”.

It claims that people receiving universal credit or tax relief “could face immediate benefit suspensions if their purchases don't align with their reported finances” and that “even cash transactions will be tracked via identity verification at checkout”.

Join 72,953 people who trust us to check the facts

Sign up to get weekly updates on politics, immigration, health and more.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.

A spokesperson for HMRC told us the video’s claim about every purchase over £1,000 being reported to HMRC was untrue and said it could “cause undue alarm and fear”. They added: “Anyone wanting information on rules around taxation should go to GOV.UK or seek advice from a tax professional.”

We also contacted the Department for Business and Trade about the claims, but did not receive a response.

The oldest version of the video making these claims we could find was posted by a TikTok account that also shared a video claiming that government is introducing a new system called “enhanced customs monitoring” on 4 August to “track UK residents who leave the country more than three times within a 12 month period” to check they are living within their means. We debunked this claim in July, and explained that no such system exists.

Another clue this video isn’t from a trustworthy source is that despite being shared on TikTok in July 2025, it claims the home secretary is James Cleverly. Mr Cleverly, who is a Conservative MP, was the home secretary from November 2023 until July 2024, when the Labour party won the general election. He is currently the Shadow Secretary of State for Housing, Communities and Local Government, while the Labour MP Yvette Cooper is the current home secretary.

Another video we’ve seen which appears to make a similar claim begins by stating that “Keir Starmer is now pushing for all UK residents’ bank accounts to be accessible by the government”, and then adds: “He’s decided that anyone who spends, withdraws over £1,000 from their bank account, the banks now have to or will have to notify HMRC of this so the government can track your payments and decide whether they are appropriate or not.”

While we’ve seen no evidence to support the claim that all purchases over £1,000 will be automatically reported to HMRC, civil liberties groups and some politicians have raised concerns over the new Public Authorities (Fraud, Error and Recovery) Bill which aims to reduce the amount of money lost to benefit fraud and error. It would give the Department for Work and Pensions (DWP) powers to check and recover money directly from benefit claimants' bank accounts.

This video then goes on to claim that "anyone wanting to withdraw upwards of £3,000 from their bank account, they are now subject to written information about what they want this money for”. While it’s not quite clear what that means, we previously fact checked false claims in May that people have to give HMRC advance notice of withdrawing over £3,000 in cash. While some banks require advance notice, ID and more information for large cash withdrawals, there is no requirement to notify HMRC.

Another post sharing this claim also states that “if you sell your old clothes or items on the likes of eBay, depop etc you will be taxed if you earn over £1,000”. However, as we have explained before, whether people selling personal items on platforms like these may have to declare this to HMRC and pay tax on earnings over £1,000 depends on whether they are considered a ‘trader’.

HMRC says you are “probably trading” if you buy goods to sell them on, or make them yourself with the intention of selling them for a profit, rather than selling your own personal items, such as used clothes, an old TV, or unwanted furniture, which you don’t have to pay income tax on.

Before sharing content like this that you see on social media, first consider whether it comes from a trustworthy and verifiable source. Our toolkit gives you advice on how to navigate bad information online.

Update 22 August 2025

We’ve updated the section in this article outlining the response we had from HMRC and our attempt to contact the Department for Business and Trade.

Update 22 August 2025

We’ve further updated this article with more information about videos making this claim and to mention the Public Authorities (Fraud, Error and Recovery) Bill.

Full Fact fights for good, reliable information in the media, online, and in politics.

Bad information ruins lives. It promotes hate, damages people’s health, and hurts democracy. You deserve better.

Subscribe to weekly email newsletters from Full Fact for updates on politics, immigration, health and more. Our fact checks are free to read but not to produce, so you will also get occasional emails about fundraising and other ways you can help. You can unsubscribe at any time. For more information about how we use your data see our Privacy Policy.